EFILE errors 149-R, 110-B and 960576 are generating questions among TaxCycle preparers this week. Please take note of the details below to help you avoid filing delays.

This error generally occurs when you indicate on the Info worksheet that the client is both filing for the first time and has changed their last name during the year.

In prior years, you were required to answer yes to both questions for first-time filers. Now, you must only answer the first-time filer question and NEVER the name change question.

We will add a review message to check for this issue in the next TaxCycle release.

The Canada Revenue Agency (CRA) now validates the name of a first-time filer against the data they receive from Service Canada.

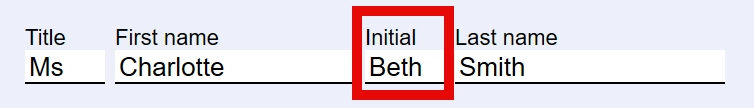

When preparing a return for a first-time filer, you must enter the taxpayer’s name exactly as it appears on their social insurance number (SIN) card.

If this includes a full middle name, enter it in full. The field on the Info worksheet in TaxCycle allows you to enter more than just an initial.

It can happen that a taxpayer has no first name on their SIN card. Starting in 2023, EFILE allows the filing of tax returns for individuals without a first name.

We will add a review message to remind you of this requirement in the next TaxCycle release.

From our reports, this error seems to occur when a married or common-law taxpayer claims the new British Columbia renter’s tax credit on form BC479 but the spouse or partner has no income for the year.

Updated on March 8, 2024: The CRA plans to make a correction on Monday, March 10, 2024.