Updated: 2023-04-25

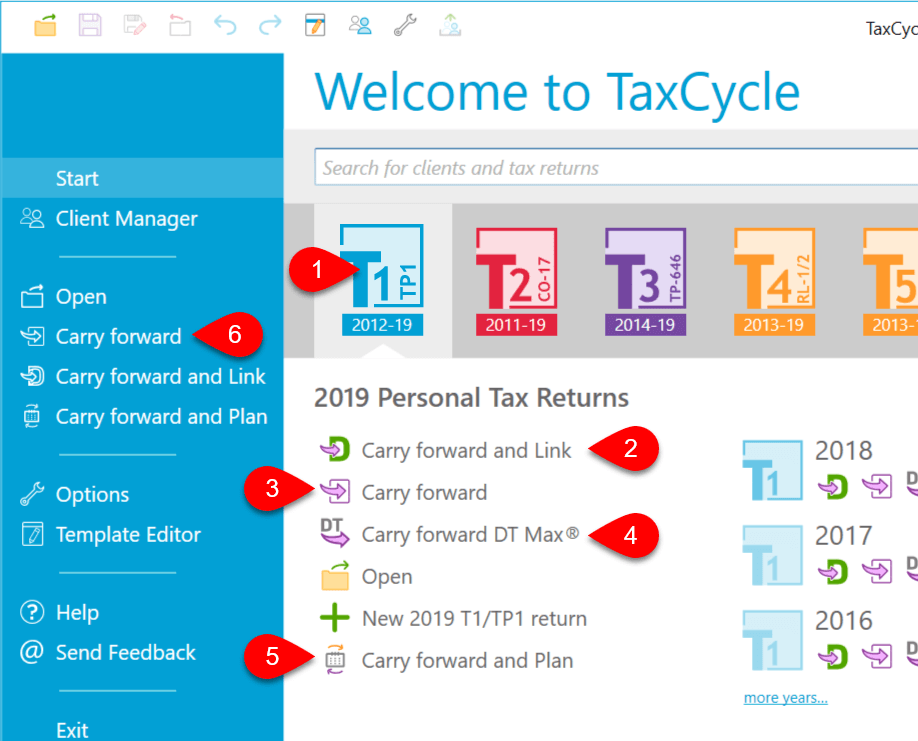

Carryforward takes data from a prior-year tax return and inserts it into the new tax return. This includes identifying information, slip and form usage information, amounts and limits to be used in the following year. (It is not an import or a conversion of same-year files.)

In addition the TaxCycle-to-TaxCycle year-over-year carryforward, TaxCycle offers carry-forward conversions from the following software vendors. Expand the sections below to learn about carrying forward from your old tax software.

When you carry forward family linked returns from ProFile® T1, carry forward the principal taxpayer/spouse file and then each dependant file. This creates a new file for the taxpayer and spouse, and separate files for each of the dependants. Add these dependant files later to the taxpayer/spouse return to create a family return (see the help topic on Family returns).

If you carry forward memos from ProFile® into TaxCycle, the memos will be associated with the original form, but not to a specific field on that form. After carrying forward, you can drag and drop these memos onto fields if you wish. See the instructions in the Memos help topic.

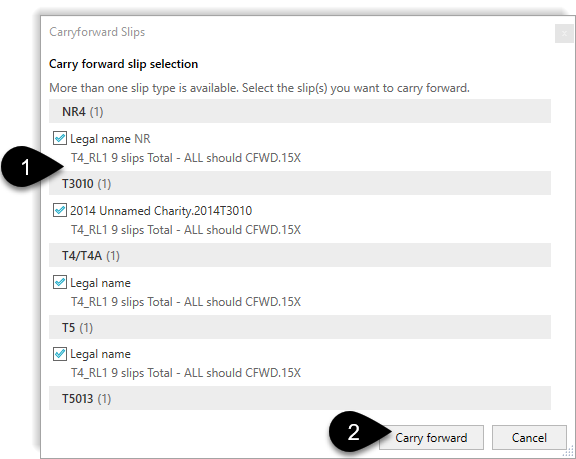

Each ProFile® FX file can contain more than one type of return. For example, T4, T5, T5018, T5013 all in one file. TaxCycle handles each of these types in a separate file. Carry forward ProFile® FX files into TaxCycle in the same way as any other file and TaxCycle will determine what returns to create:

In the dialog box that appears:

It can be beneficial for those using Taxprep® to "recalculate" their returns before carrying them forward. Note: If you don’t want to recalculate returns that have been already filed, we suggest making a copy of those Taxprep® returns into a separate folder first.

Each Taxprep® Forms file can contain more than one type of return. For example, T4, T5, T5018, T5013 all in one file. TaxCycle handles each of these types in a separate file. Carry forward Taxprep® Forms files into TaxCycle in the same way as any other file and TaxCycle will determine what returns to create:

In the dialog box that appears:

Each Cantax® FormMaster file can contain more than one type of return. For example, T4, T5, T5018, T5013 all in one file. TaxCycle handles each of these types in a separate file. Carry forward Cantax® FormMaster files into TaxCycle in the same way as any other file and TaxCycle will determine what returns to create:

In the dialog box that appears:

The DT Max® to TaxCycle carryforward is a little different than the standard TaxCycle carryforward. Due to the way data is stored in DT Max®, TaxCycle cannot index the DT Max® tax returns in the Client Manager. Also, you must first extract returns from DT Max® before carrying them forward. Please read the help topic on DT Max® carryforward for full instructions.

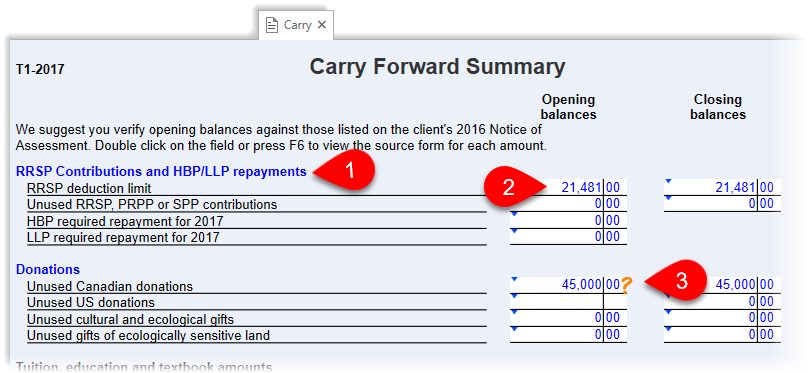

The T1 Carryforward summary (Carry) lists amounts carried forward from the prior year, such as RRSP deduction limit, unused donations and other deductions.