Updated: 2023-03-23

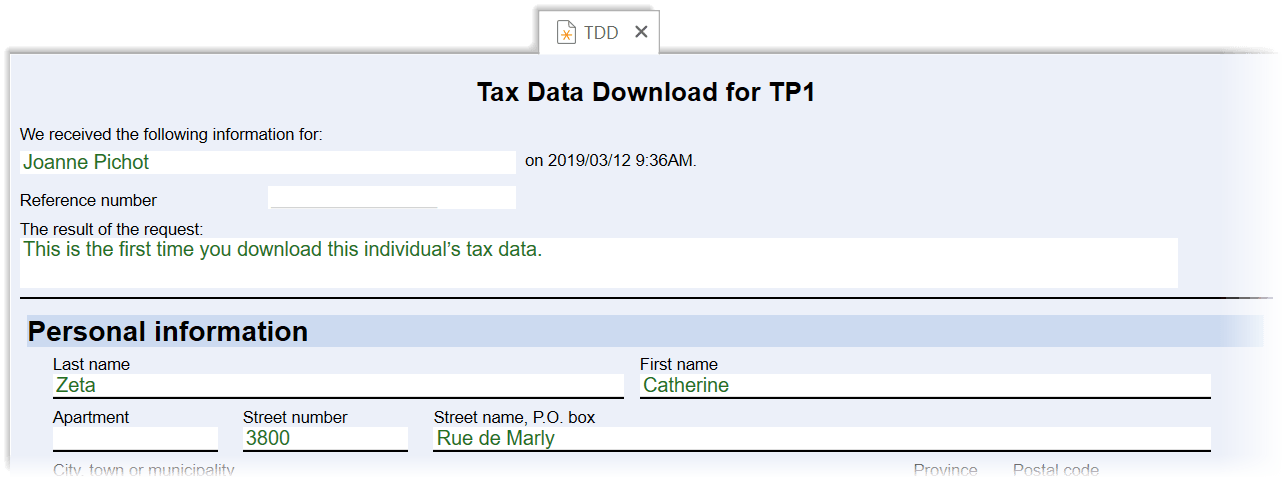

Québec Tax Data Download (TDD) allows you to use TaxCycle to download tax information for individuals directly from Revenu Québec. This includes RL slips that have been filed with Revenu Québec and other data.

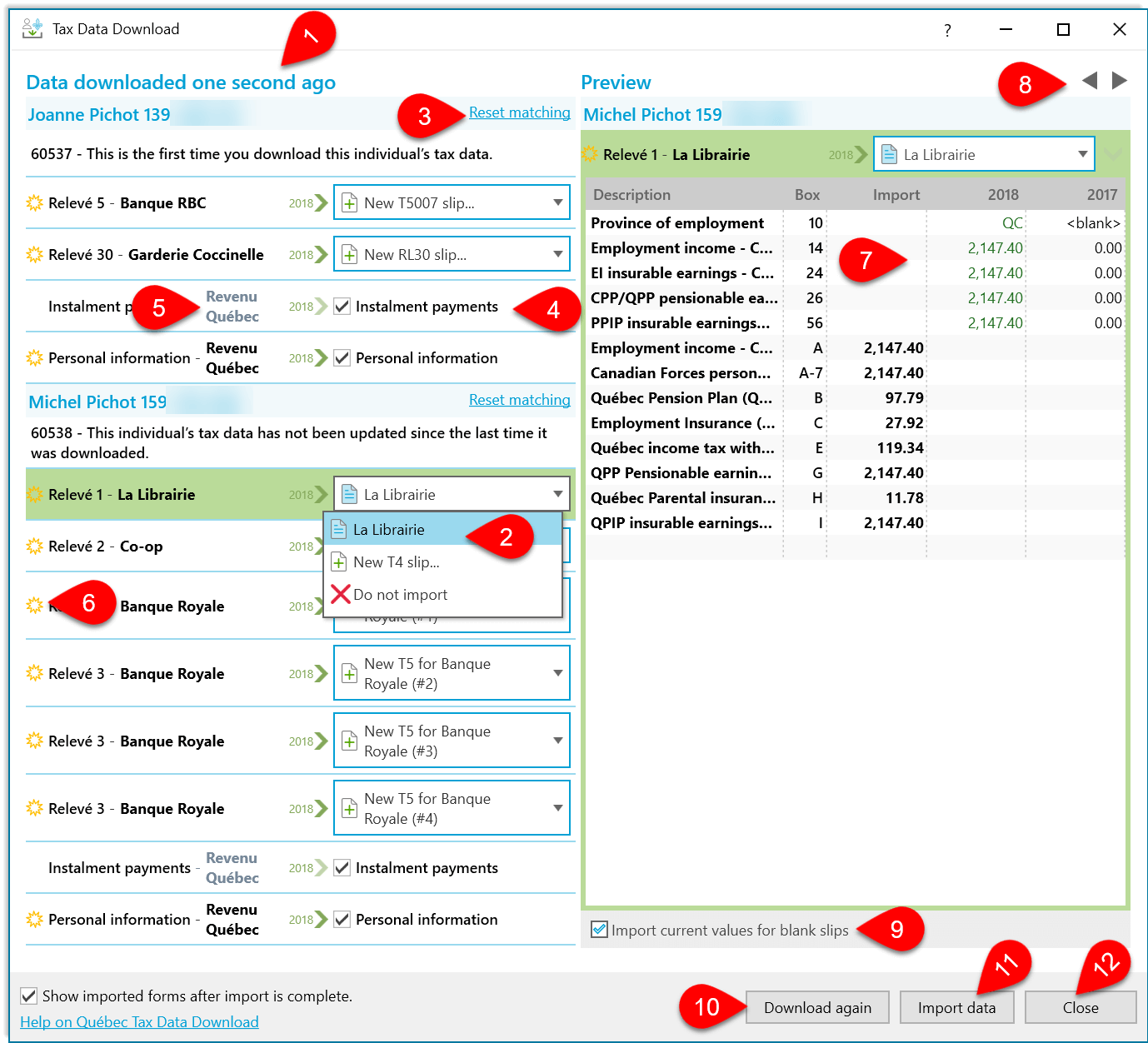

This download process is similar to that for the Canada Revenue Agency's Auto-fill my return (AFR), and you can use both of them together. We suggest reviewing the Auto-fill my return (AFR) help topic to familiarize yourself with all the functions of the download and matching window. The information below covers areas where the two processes differ.

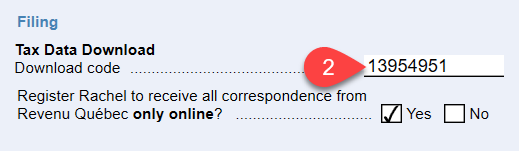

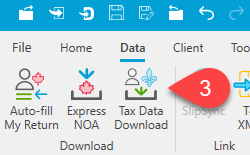

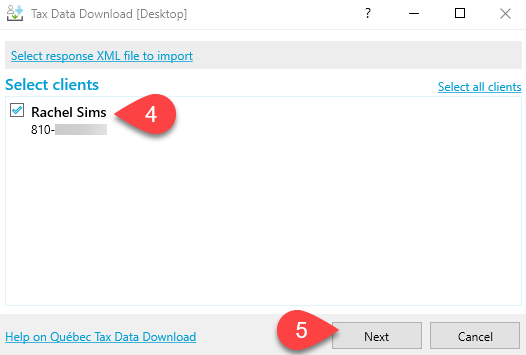

To download tax information for a client, you must:

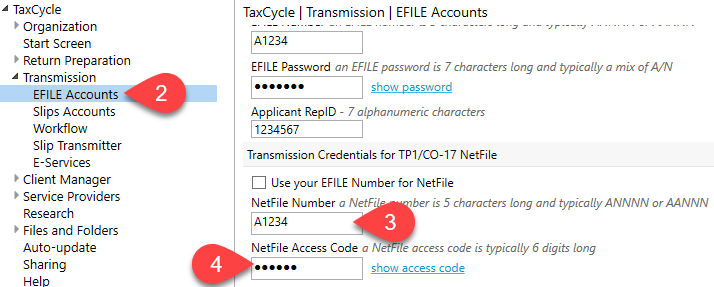

Before you can download data, you must enter your NetFile credentials in TaxCycle Options:

The Tax Data Download (TDD) worksheet summarizes information downloaded from Revenu Québec that does not match to a particular slip.