Updated: 2023-06-06

Even though T1 EFILE is mandatory, there are cases when you will need to print and file a T1 return on paper:

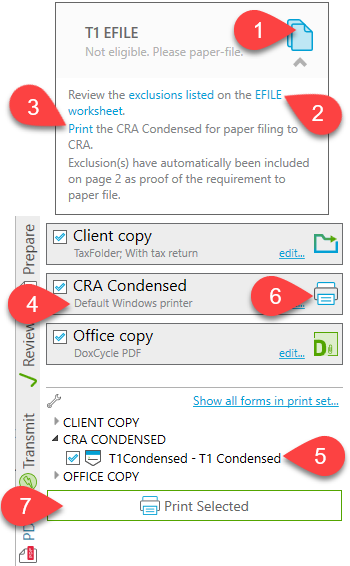

To file a paper return, print and mail the T1 Condensed along with the required slips and receipts. The T1 Condensed is a shortened version of the tax return. It may contain bar codes for the CRA to scan and to facilitate data entry into their system.

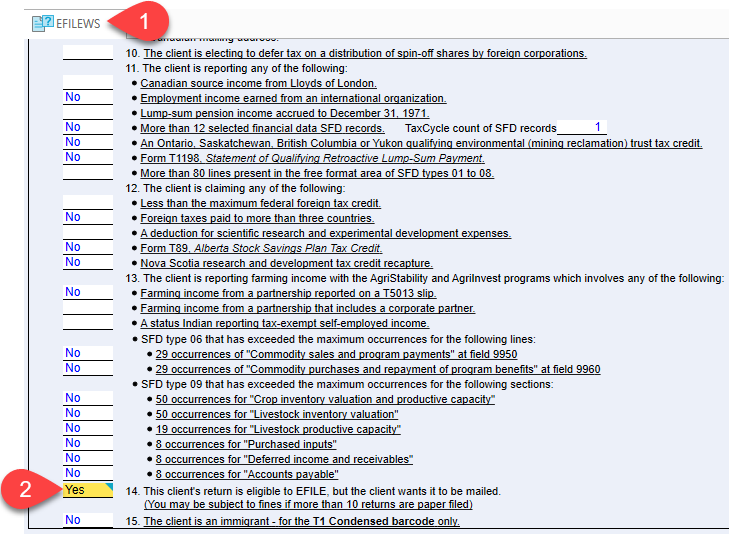

You can elect to paper file up to 10 returns without penalty. To do this in TaxCycle:

Preparers occasionally ask us when they should expect to see a barcode at the bottom of page 1 of the T1 Condensed. Questions about this often arise because there is one circumstance where you can paper file a return and see a barcode on the T1 Condensed.

In general, you can expect the following:

Finally, when it comes to barcodes, what you see on the screen is what will print. If you see a barcode on the T1 Condensed when viewing it in TaxCycle, that is exactly what will print to paper. Learn how to read or copy the contents of a bar code in the Bar Code Contents help topic.