Updated: 2021-10-18

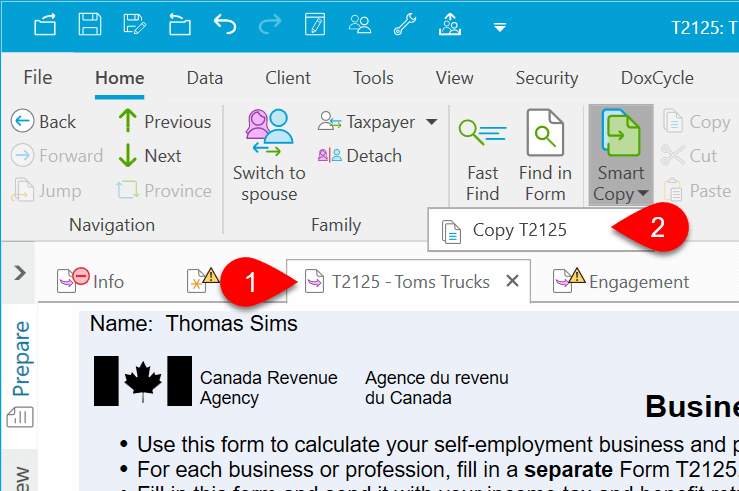

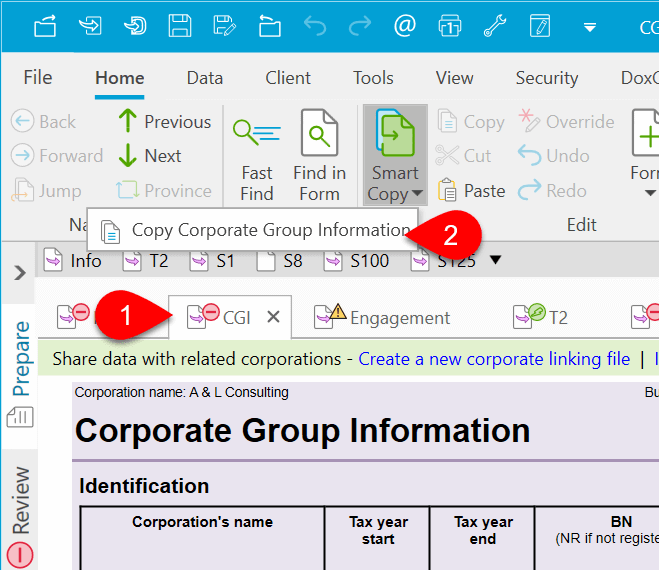

Use Smart Copy/Paste to share information on a form between two files. For example, copy the T2125 business statement from one person's T1 return to a different file for the business partner, or copy the T2 Corporate Group Information (CGI) worksheet from one corporation's file to the files of the associated/related corporations.

This is a one-time copy/paste and does not create a link between the two files. For a live link between two associated/related corporations, see the Corporate Linking help topic.

Smart Copy/Paste is available for the following forms: