Updated: 2024-01-09

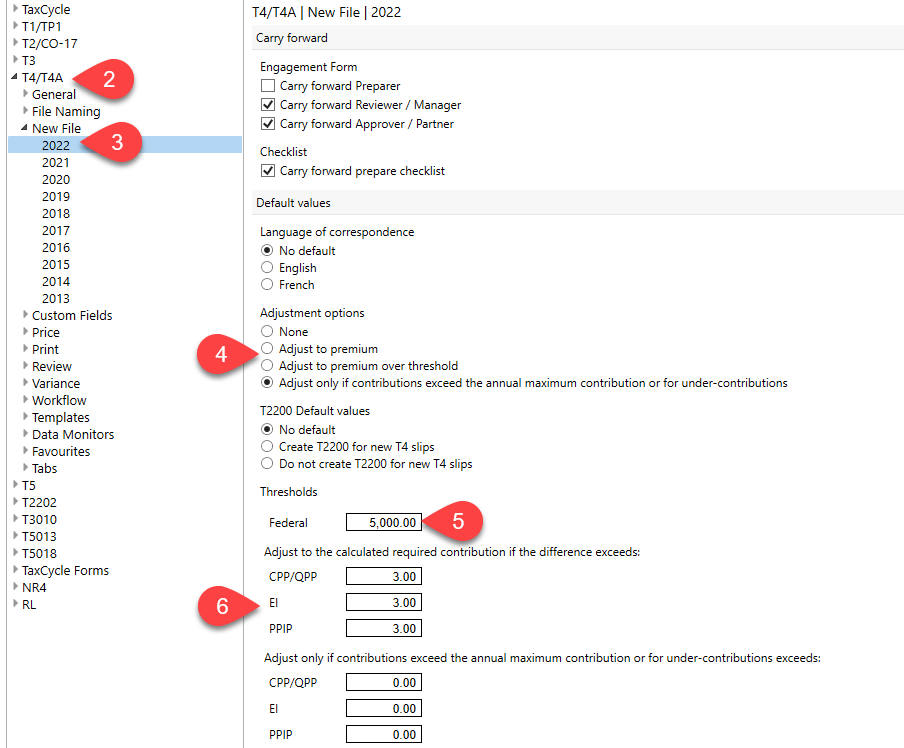

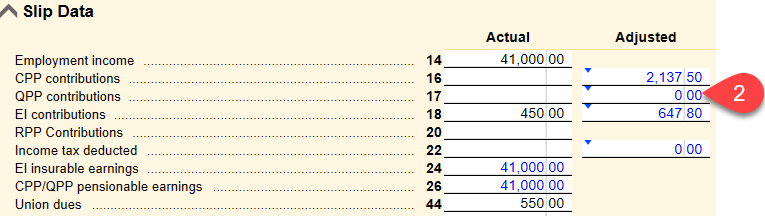

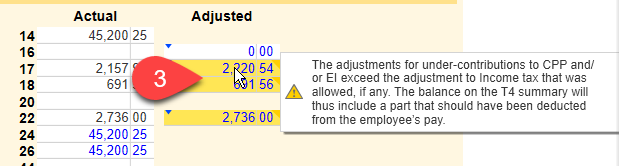

TaxCycle can automatically adjust CPP, EI and PPIP contributions on T4 slips to the required premium contribution amount. It then includes these adjusted amounts in the T4 Summary.

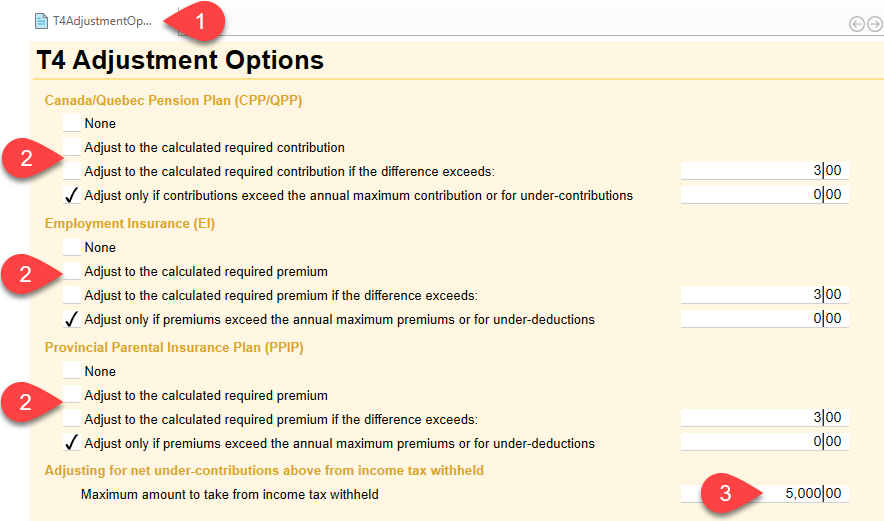

Configure the thresholds for T4 adjustments on the T4AdjustmentOptions worksheet.

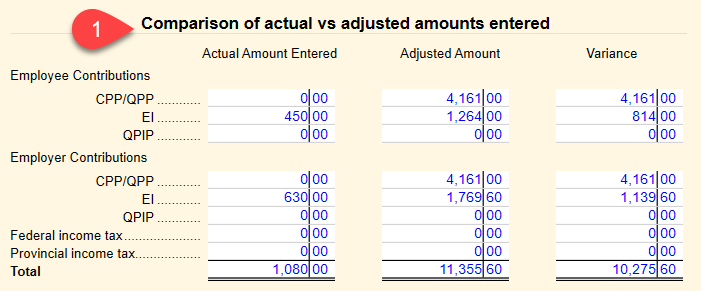

You can configure the defaults on the T4AdjustmentOptions so they are entered in every new file you create or carry forward.