Updated: 2020-07-22

Though regular UCCB payments ended in June 2016, the RC62 and related lines of the return remain for retroactive payments or repayment of benefits made in 2017 and later years.

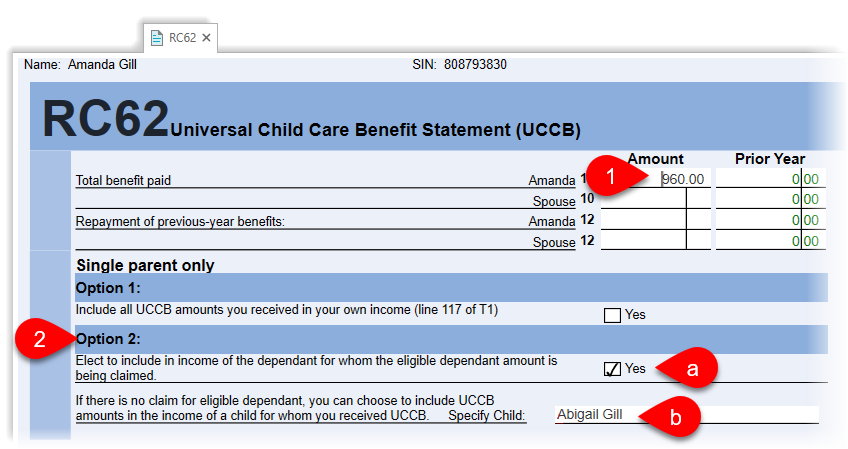

Taxpayers who received the Universal Child Care Benefit (UCCB) in 2016 and prior years, will have received an RC62 slip reporting the amount paid during the tax year. This income is taxable and must be reported on the tax return.