Updated: 2023-02-27

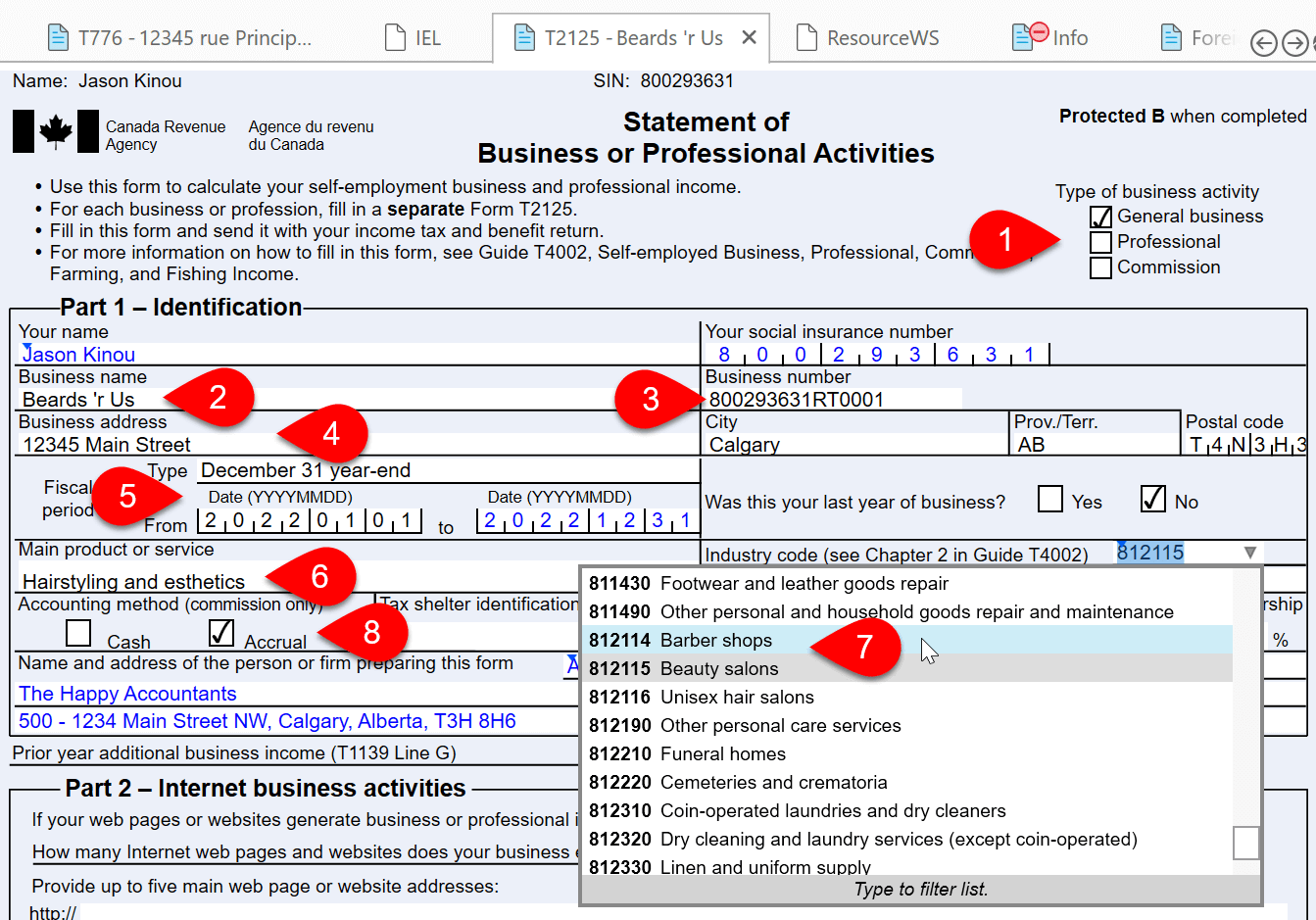

This topic covers completing the T2125 Statement of Business and Professional Income. Many of the concepts used to complete this form also apply to other T1 income statements and expense claims. We suggest starting with this topic to familiarize yourself with these tasks.

The general requirement is to report self-employment income on a calendar year basis. However, it is possible to elect to use an alternate year end. When the individual elects for an alternate year end, the calculation of net income occurs on form T1139 Reconciliation of Business Income for Tax Purposes.

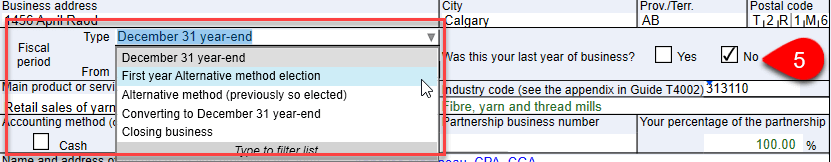

To claim an alternate year end and complete the T1139, first choose an option in the Fiscal Period Type drop-down:

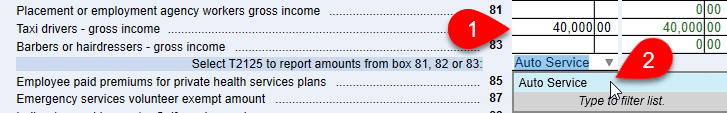

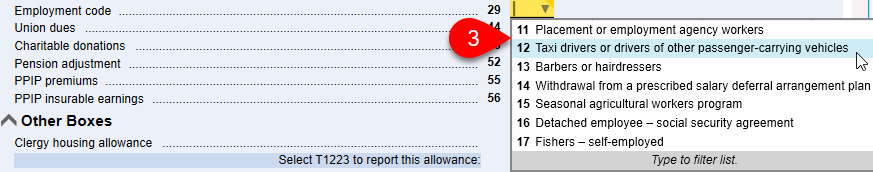

In some cases—for taxi drivers, barbers, or hairdressers—business income is reported on a T4 slip. You can set up TaxCycle to transfer the income automatically from the T4 slip to the related T2125.

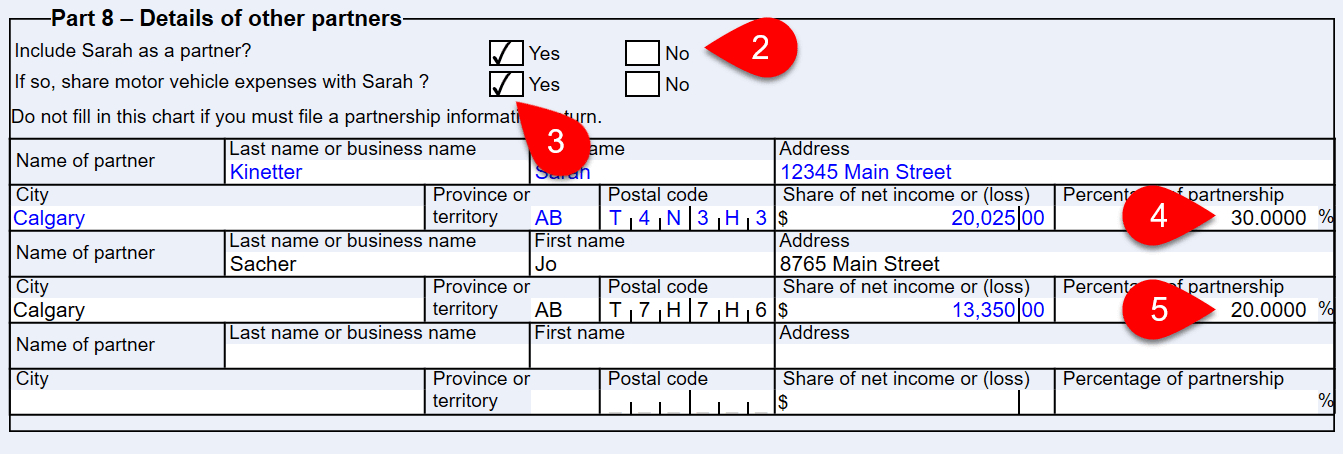

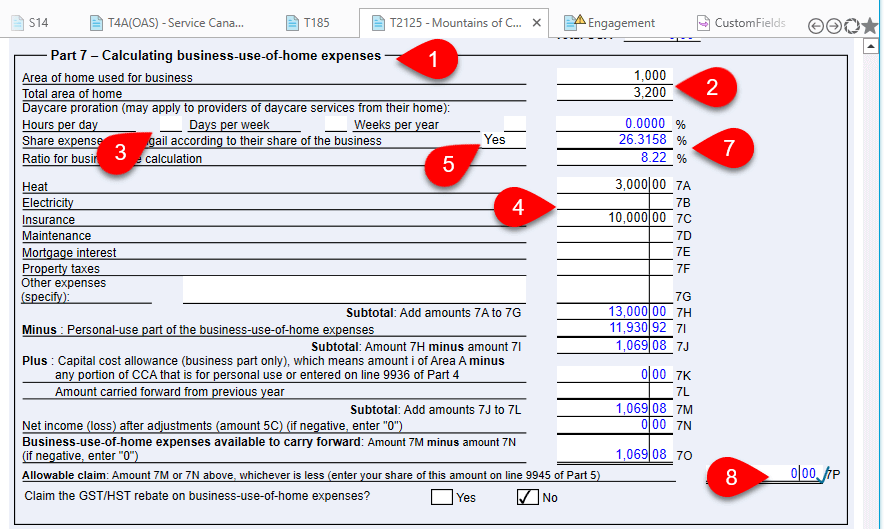

You can share income with a spouse or with a partner. TaxCycle will automatically calculate the portion of net income each partner.