Updated: 2020-06-11

About once a year, we release a new T2 module. The timing of the new module usually coincides with the June/July major certification by the CRA.

Each TaxCycle T2 module supports more than one calendar year to allow for the corporation years that overlap the calendar year end. The file extension reflects the year the module was released, not the year ends it supports. See the T2 File Name Extensions help topic for more information.

When we release a new TaxCycle T2 module, you may notice a message when you open an in-progress T2 return. This notifies you that you can upgrade the file to the new module. See the T2 File Conversion Help topic.

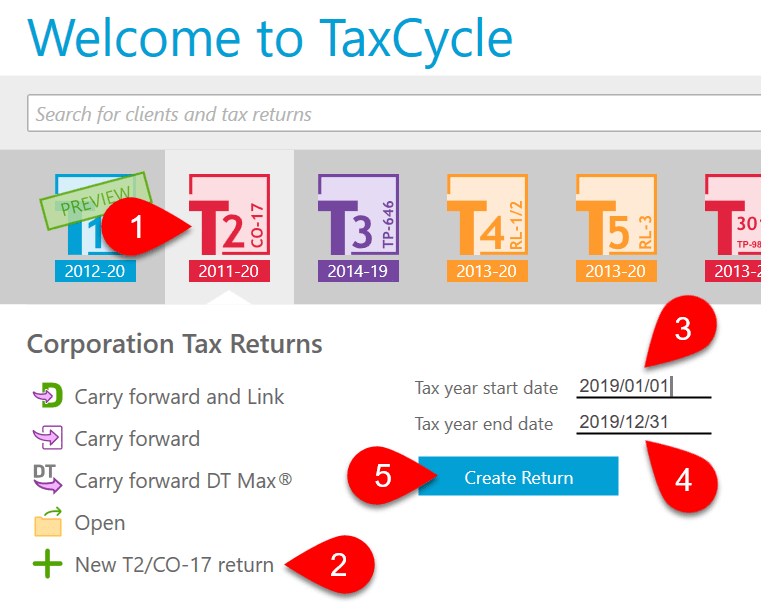

When you create a new T2 return, TaxCycle automatically chooses the appropriate module for the corporation's tax year. When you carry forward a return, TaxCycle also chooses the best module to use. Regardless, if it is possible to prepare the return in more than one module, it will use the most recent one.

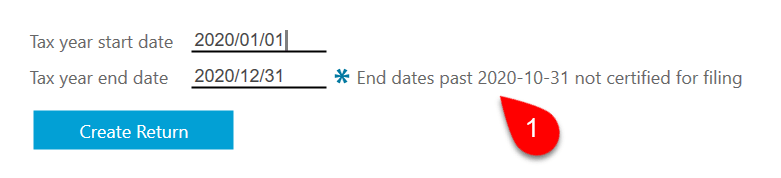

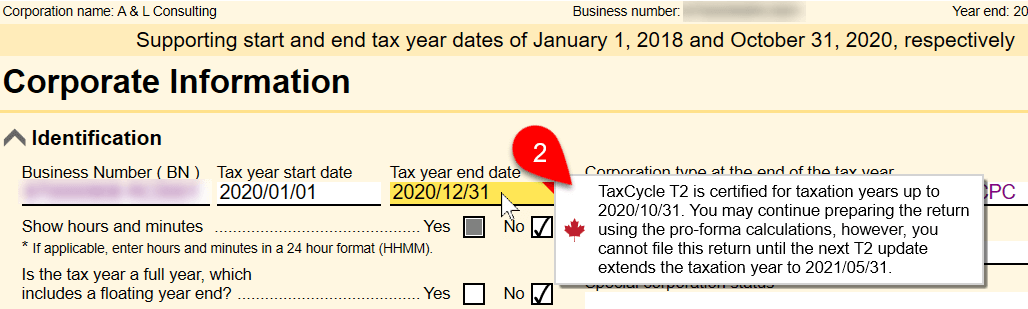

The following messages appear when the corporate tax year falls outside of the dates for which TaxCycle T2 is certified to file returns with the Canada Revenue Agency (CRA) and other provincial authorities.

It is most common to see these messages when there is a gap between the certification period and an updated version of TaxCycle T2 software. TaxCycle usually receives T2 certification around November/December and in June/July. You're more likely to see warning messages as those dates grow nearer.

Most likely not. Your TaxCycle license period is based on a completely different date. During your license period, you get free updates to TaxCycle T2. This includes updates that extend the T2 certification.

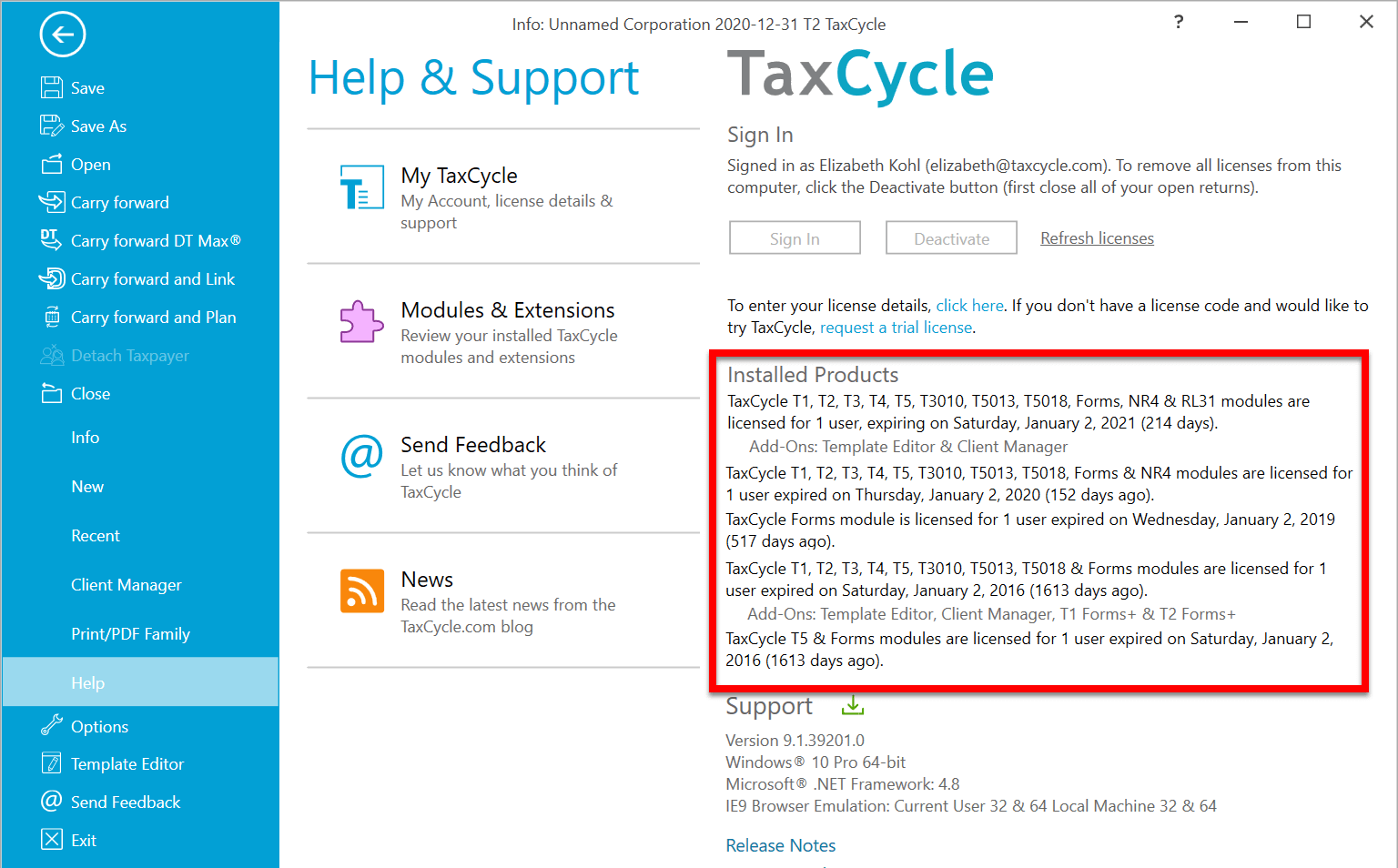

You can check to see when your license expires by going to the File menu and then clicking on Help. The date appears in the list of installed products.