All the great features you're used to in other TaxCycle tax modules, paired with trust-specific worksheets and calculations.

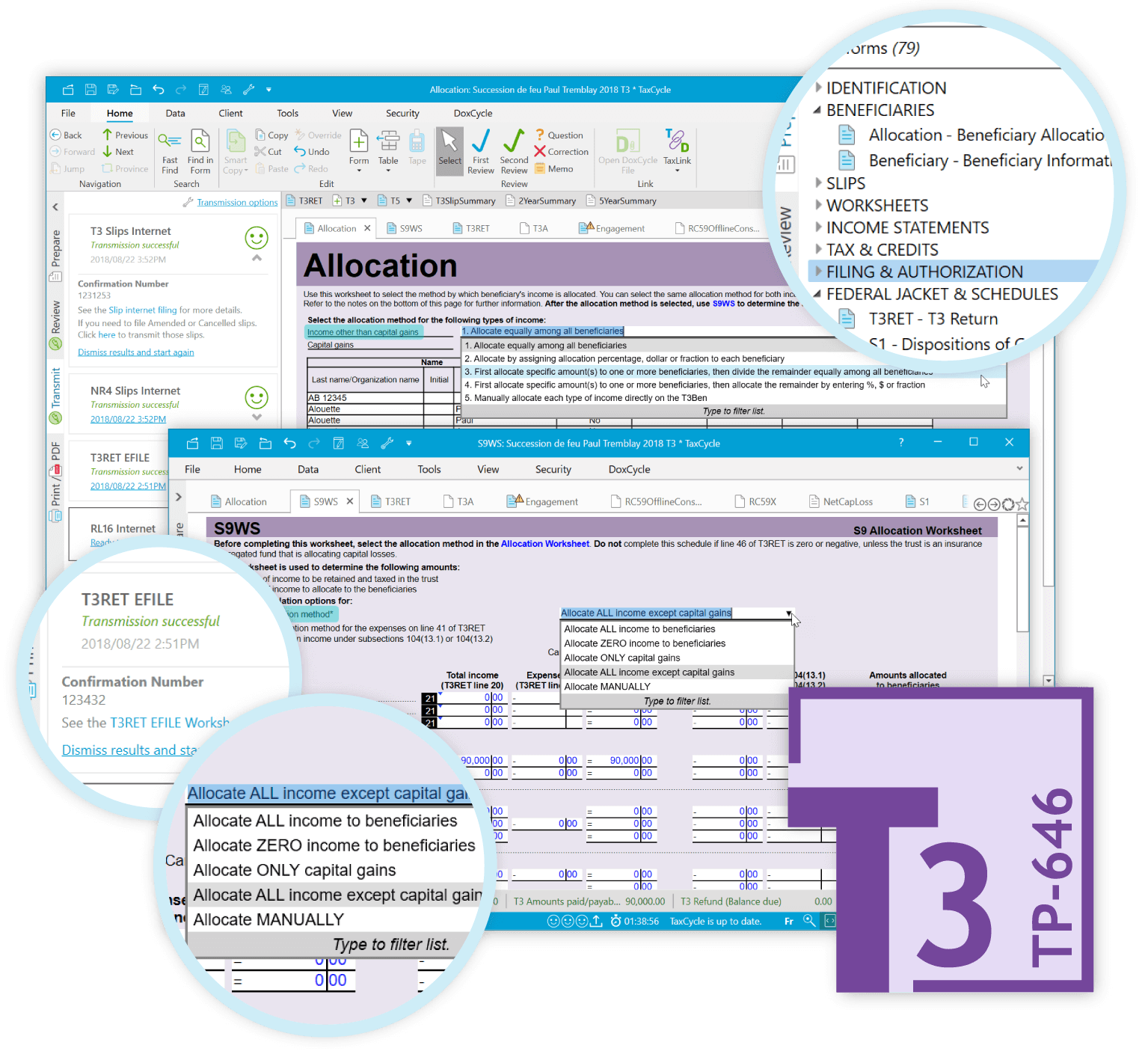

Prepare and electronically file unlimited federal T3 return and slips and NR4 slips for non-resident trust beneficiaries (code 11) with the Canada Revenue Agency (CRA). Also includes Québec TP-646 returns and RL-16 relevés.

TaxCycle T3 is included in the Complete Paperless Tax Suite and is also available as a standalone module.

Enter beneficiaries on T3 slips, the Beneficiary worksheet, or the Allocation worksheet. Then, distribute income on the S9 worksheet.

Effortlessly transfer taxpayer data from a TaxCycle T1/TP1 personal tax return into a TaxCycle T3/TP-646 trust return in a single click.

Electronically file T3 slips, NR4 slips, and the T3RET tax return (when eligible) through the CRA Internet File Transfer (XML) portal.

Prepare and file Québec TP-646 trust returns and the related RL-16 relevés for beneficiaries alongside your T3 return. For no extra cost.

Prepare (code 11) NR4 slips for non-resident trust beneficiaries right in TaxCycle T3/TP-646, without jumping to a separate slips module.

Bring forward existing trust return files from Intuit® ProFile® , Cantax® and Taxprep® . Save time when converting to TaxCycle.

Find out for yourself why thousands of tax preparers have already switched. Get up and running in just 10 minutes with your free trial of the TaxCycle Suite. Seamlessly carry forward returns from DT Max®, Cantax®, Taxprep® and ProFile® software.

| RETURNS | |

|---|---|

| Number of returns | Unlimited |

| Number of slips | Unlimited |

| Federal T3 returns | 2014 onward |

| Québec TP-646 returns | 2017 onward |

| CARRYFORWARDS | |

| TaxCycle T3 | |

| ProFile® T3 | |

| Cantax® FormMaster | |

| Taxprep® T3 | |

| ELECTRONIC FILING | |

| CRA Internet File Transfer (XML) for T3 slips, T3RET, T3P, T3ATH-IND, T3M, T3S and T2000 | |

| Business Authorization/Cancellation Request (formerly RC59 and RC59X) | |

| ELECTRONIC SIGNATURES (TaxFolder and DocuSign®) | |

| AuthRepBus signature page | |

| T3RET — T3 Trust Income Tax and Information Return | |

| T1135 — Foreign Income Verification Statement | |

| MR-69 — Authorization to Communicate Information or Power of Attorney (Québec) | |

| TP-646 — Trust Income Tax Return | |

| ELetter — Engagement letter | |

| BENEFICIARY SLIPS AND SUMMARIES | |

| T3Ben — T3 Allocations and Designations to a Beneficiary | |

| Allocation — Beneficiary Allocation | |

| Beneficiary — Beneficiary Information | |

| T3 — Statement of Trust Income Allocations and Designations | |

| T3SlipSummary — Summary of Trust Income Allocations and Designations | |

| NR4 — Statement of Amounts Paid or Credited to Non-Residents of Canada | |

| NR4Summary | |

| INCOME SLIPS AND RELEVÉS | |

| T3 — Statement of Trust Income | |

| RL-16 — Trust Income (Québec) | |

| T5 — Statement of Investment Income | |

| T5008 — Statement of Securities Transactions | |

| T5013 — Statement of Partnership Income | |

| T101 — Statement of Resource Expenses | |

| Foreign Income | |

| FEDERAL/PROVINCIAL SCHEDULES AND FORMS | |

| T3RET — T3 General | |

| T3P — Employees' Pension Plan Income Tax Return | |

| T3-RCA — Retirement Compensation Arrangement (RCA) Part XI.3 Tax Return | |

| T3ATH-IND — Amateur Athlete Trust Income Tax Return | |

| T3FFT — Federal Foreign Tax Credits | |

| T3GR — Group Income Tax and Information Return for RRSP, RRIF, RESP, or RDSP Trusts | |

| T3GR-WS — Worksheet for Part XI.1 Tax on Non-Qualified Property of an RRSP, RRIF, or RESP trust | |

| T3M — Environmental Trust Income Tax Return | |

| T3PRP — T3 Pooled Registered Pension Plan Tax Return | |

| T3RI — Registered Investment Income Tax Return | |

| T3S — Supplementary Unemployment Benefit Plan Income Tax Return | |

| T3SIFTWS — SIFT (specified investment flow-through) Worksheet | |

| T1061 — Canadian Amateur Athlete Trust Group Information Return | |

| T2000 — Calculation of Tax on Agreements to Acquire Shares (section 207.1(5) of the Income Tax Act) | |

| T244 — Registered Pension Plan Annual Information Return | |

| S1A — Capital Gains on Gifts of Certain Capital Property | |

| S1M — Capital property disposition manager | |

| S1 — Dispositions of Capital Property | |

| S2 — Reserves on Dispositions of Capital Property | |

| S3 — Eligible Taxable Capital Gains | |

| S4 — Cumulative Net Investment Loss | |

| S7 — Pension Income Allocations and Designations | |

| S8 — Statement of Investment Income | |

| S9 — Income Allocations and Designations to Beneficiaries | |

| S10 — Part XII.2 Tax and Part XIII Non-Resident Withholding Tax | |

| S11 — Federal Tax | |

| S11A — Donations and Gifts Tax Credit Calculation | |

| S12 — Minimum Tax | |

| S15 — Beneficial Ownership Information of a Trust | |

| T184 — Capital Gains Refund to a Mutual Fund Trust | |

| T1055 — Summary of Deemed Dispositions | |

| T2223 — Election to Defer Payment of Income Tax | |

| Provincial Tax and Credits: T3AB, T3BC, T3MB, T3NB, T3NL, T3NS, T3NT, T3NU, T3ON, T3PE, T3SK, T3YT | |

| T3MJ — Provincial and Territorial Taxes, Multiple Jurisdictions | |

| T1129 — Newfoundland and Labrador Research and Development Tax Credit | |

| T1232 — Yukon Research and Development Tax Credit | |

| T1241 — Manitoba Mineral Exploration Tax Credit | |

| T3PFT — Provincial Foreign Tax Credits | |

| WORKSHEETS | |

| Info — Trust Information | |

| Engagement — Engagement Information | |

| CustomFields — Custom Fields Worksheet | |

| Workflow — Workflow Summary | |

| ABIL — Allowable Business Investment Losses | |

| Donations — Charitable donations worksheet | |

| FTC — Foreign Tax Credits | |

| IncomeDeduction — Details of Various Income and Deduction Amounts | |

| Instalments Worksheet | |

| Interest & Late-Filing Penalty Worksheet | |

| Internet File Worksheet | |

| NetCapLoss — Net Capital Losses | |

| NonCapLoss — Non-Capital Losses | |

| Optimizations — Optimizations Worksheet | |

| S9Allocation — Beneficiary information | |

| T3ALossCB — Loss carryback worksheet | |

| T3RETEFILE — T3RET EFILE Worksheet | |

| INCOME STATEMENTS | |

| T1163/T1273 — AgriStability Statement A, plus related CCA/asset manager worksheets, farming inventory adjustment and 5-year summary | |

| T1164/T1274 — AgriStability Statement B, plus related CCA/asset manager worksheets, farming inventory adjustment and 5-year summary | |

| T776 — Real Estate Rentals, plus related CCA/asset manager worksheets and 5-year summary | |

| T2042 — Farming Activities, plus related CCA/asset manager worksheets, farming inventory adjustment and 5-year summary | |

| T2121 — Fishing Activities, plus related CCA/asset manager worksheets, and 5-year summary | |

| T2125 — Business or Professional Activities, plus related CCA/asset manager worksheets, and 5-year summary | |

| QUÉBEC TP-646 SCHEDULES AND FORMS | |

| TP-646-V — Trust Income Tax Return | |

| Schedule A (TPA) — TaxCycle Capital Gains and Designated Net Taxable Capital Gains | |

| TPASUM — Schedule A - Summary of dispostions | |

| Schedule B (TPB) — Investment Income, Gross-Up of Dividends Not Designated and Adjustment of Investment Expenses | |

| TPBSUM — Schedule B - Summary of investment income | |

| Schedule C (TPC) — Summary of Allocations and Designations | |

| Schedule D (TPD) — Carry-Back of a Loss | |

| Schedule E (TPE) — Income Tax on the Taxable Distributions Amount and Calculation of Eligible Dividends to Be Designated | |

| Schedule F (TPF) — Income Tax Payable by a Specified Trust for a Specified Immovable | |

| Schedule G (TPG) — Additional Information — Trust Resident in Québec That Owns a Specified Immovable | |

| Schedule H (TPH) — Recovery tax | |

| TPF-646.W — Keying Summary for the Trust Income Tax Return | |

| TPF-646.X — Keying Summary for Schedules A, F, G and H of the Trust Income Tax Return | |

| TPF-646.Y — Keying Summary for Forms TP-80-V and TP-128.F-V Filed with the Trust Income Tax Return | |

| TPF-646.Z — Keying Summary for Forms Filed with the Trust Income Tax Return | |

| TP-80 — Business or Professional Income and Expenses | |

| TP-128.F — Income Earned by a Trust from the Rental of Immovable Property | |

| TP128CCA — Rental Capital Cost Allowance | |

| TP-274.F — Designation of Property as a Principal Residence of a Personal Trust | |

| TP-653 — Deemed Sale Applicable to Certain Trusts | |

| TP-668.1 — Taxable Capital Gains of a Trust That Give Entitlement to a Deduction | |

| TP-729 — Carry-Forward of Net Capital Losses | |

| TP-750 — Income tax payable by a trust resident in Québec that carries on a business in Canada or outside Québec | |

| TP-77642 — Alternative Minimum Tax | |

| RL-16 — Revenus de fiducie | |

| TPIncomeDeductions — Details of various income and deduction amounts | |

| TPABIL — Québec Allowable Business Investment Losses | |

| TP-646 2 Year Variance Summary | |

| TP-646 5 Year Summary | |

| MR69Results — MR-69 Attachments and results | |

| FILING AND AUTHORIZATION | |

| AuthRepBus — Business Authorization/Cancellation Request (former RC59) | |

| AuthRepBusResults — History of Submissions and Results | |

| AuthRepBusCancel — Cancelling a Representative (former RC59X) | |

| AUT01 — Authorize a Representative for Offline Access | |

| MR-69-V – Power of Attorney, Authorization to Communicate Information, or Revocation | |

| S9Ben – Beneficiary Income Allocation Statement | |

| T3A — Request for Loss Carryback by a Trust | |

| T3ADJ — T3 Adjustment Request | |

| T3APP — Application for Trust Account Number | |

| T3DD — Direct Deposit Request for T3 | |

| T3F — Investments Prescribed to be Qualified Information Return | |

| T3QDT — Joint Election for a Trust to be a Qualified Disability Trust | |

| T733 — Application for a Retirement Compensation Arrangement Account Number | |

| T735 — Application for a Remittance Number for Tax Withheld from a Retirement Compensation Arrangement (RCA) | |

| T1079 and T1079WS — Designation of a Property as a Principal Residence by a Personal Trust | |

| T1135 — Foreign Income Verification Statement | |

| TX19 — Asking for a Clearance Certificate | |

| SUMMARIES | |

| 2-Year Client Summary | |

| 2-Year Variance Summary | |

| 5-Year Summary | |

| FTCSum — Foreign Tax Summary | |

| StatementSum — Summary of Business, Farming, Fishing and Rental Income | |

| Memos — Memo Summary | |

| T3 Summary for Trust | |

| Slips — T3 Beneficiary Slip Summary | |

| T3RETSummary — T3 RET Summary | |

| Slips Summary | |

| Tape Summary | |

| TEMPLATES AND CLIENT CORRESPONDENCE | |

| Client letter | |

| Engagement letter | |

| Electronic filing confirmation templates for all transmission types | |

| Cover email templates for electronic signatures and client copies | |

| File notes | |