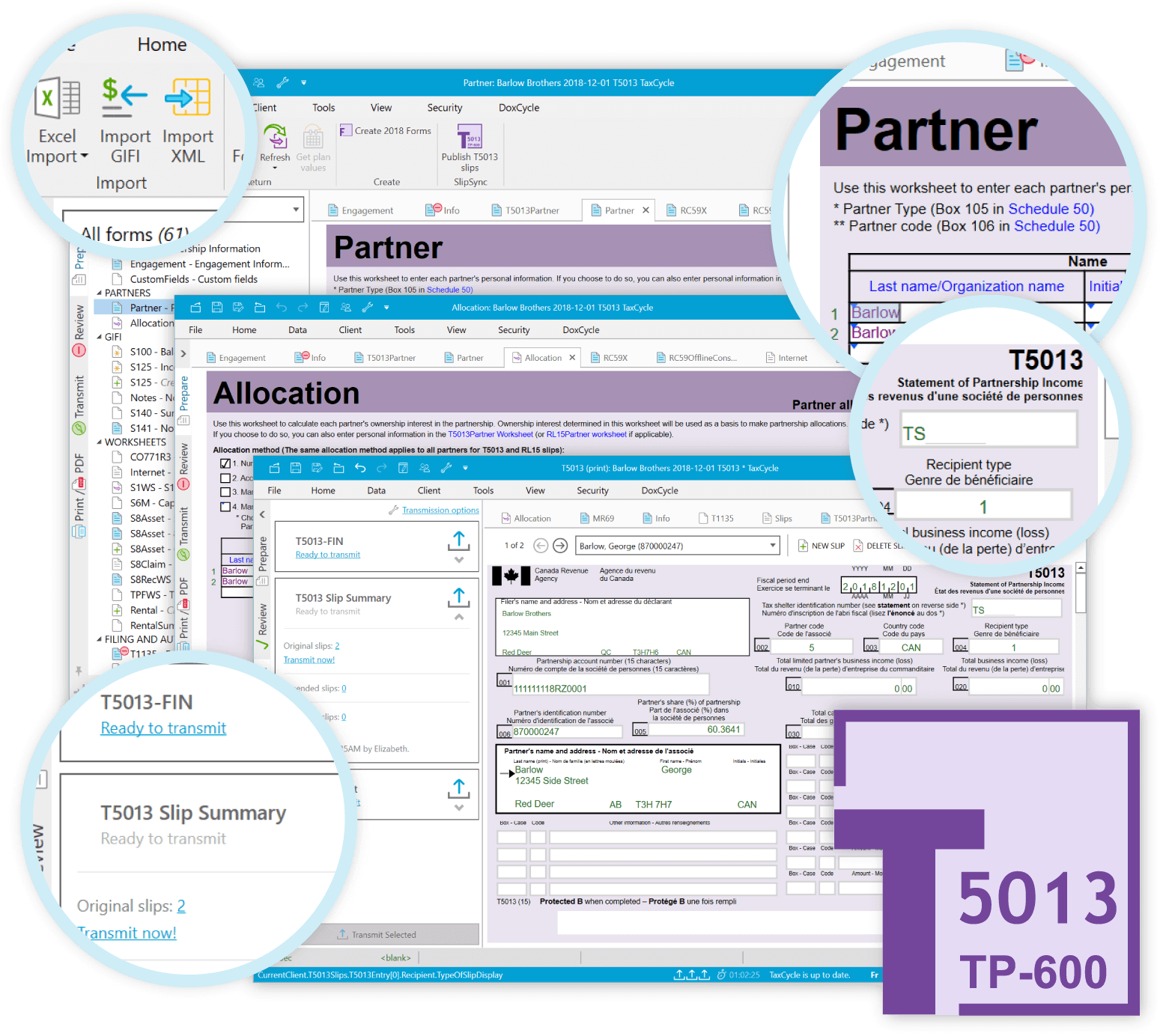

All the great features you're used to in other TaxCycle tax modules, paired with worksheets and calculations specifically for partnership returns.

Prepare and electronically file unlimited federal T5013 returns and slips, as well as Québec TP-600 returns and RL-15 slips.

TaxCycle T5013/TP-600 is included in the Complete Paperless Tax Suite or available as a separate module.

Drag and drop import General Index of Financial Information (GIFI) from all major accounting packages: QuickBooks®, Sage®, CaseWare®, etc.

Enter information about each partner on the Partner and Allocation worksheets. Information flows between the two. Or, edit information directly on T5013 slips.

Instant data flow between Schedule 8 CCA schedule and Asset worksheets make for quick data entry and powerful management of assets.

Prepare T5013 slips and publish them to SlipSync. If you're preparing a T1 return for one of the slip recipients, TaxCycle alerts you to import the slip data.

A separate module for partnership returns allows us to build T5013-specific features, and lets you set specific options and create files just for T5013s. All through the same, familiar TaxCycle interface.

Create an Excel® spreadsheet template from any form. Customize it and give it to your clients to track amounts, then import it back into TaxCycle.

Find out for yourself why thousands of tax preparers have already switched. Get up and running in just 10 minutes with your free trial of the TaxCycle Suite. Seamlessly carry forward returns from DT Max®, Cantax®, Taxprep® and ProFile® software.

| RETURNS | |

|---|---|

| Number of returns | Unlimited |

| Federal T5013 returns and slips | 2013 onward |

| Québec TP-600 and RL-15 | 2018 onward |

| CARRY FORWARD | |

| TaxCycle T5013 | |

| ProFile® FX | |

| Cantax® FormMaster | |

| Taxprep® Forms | |

| ELECTRONIC FILING | |

| T5013FIN | |

| T5013 Slips | |

| RL-15 | |

| Business Authorization/Cancellation Request (formerly RC59 and RC59X) | |

| Québec MR-69 | |

| ELECTRONIC SIGNATURES (TaxFolder and DocuSign®) | |

| AuthRepBus signature page (formerly RC59/RC59X) | |

| ELetter — Engagement letter | |

| DATA IMPORT/EXPORT | |

| General Index of Financial Information (GIFI) import from Xero, CaseWare®, QuickBooks®, CCH Engagement, Sage® and CSV | |

| Microsoft Excel® import into any form | |

| Create Forms files from a T5013 return | |

| Export slips to SlipSync (for import into T1 and T3 returns) | |

| GENERAL INDEX OF FINANCIAL INFORMATION (GIFI) | |

| T5013SCH100 — Balance Sheet Information | |

| T5013SCH125 — Income Statement Information | |

| T5013SCH140 — Summary Statement | |

| T5013SCH141 — Notes checklist | |

| Notes to Financial Statements | |

| FEDERAL JACKET, SCHEDULES and WORKSHEETS | |

| T5013FIN — Partnership Financial Return | |

| T5013SCH1 — Net Income (Loss) for Income Tax Purposes | |

| S1WS — S1 Allocation Worksheet | |

| T5013SCH2 — Charitable Donations, Gifts, and Political Contributions | |

| T5013SCH5 — Allocation of Salaries and Wages, and Gross Revenue for Multiple Jurisdictions | |

| T5013SCH6 — Summary of Dispositions of Capital Property | |

| S6M — Capital Property Disposition Manager | |

| T5013SCH8 — Capital Cost Allowance (CCA) | |

| S8Asset — Asset Manager | |

| S8Claim — CCA Claim | |

| S8RecWS — Fixed Asset Reconciliation Worksheet | |

| T5013SCH9 — List of Partnerships | |

| T5013SCH12 — Resource-Related Deductions | |

| T5013SCH50 — Partner’s Ownership and Account Activity | |

| T5013SCH52 — Summary Information for Partnerships that Allocated Renounced Resource Expenses to their Members | |

| T5013SCH58 — Canadian Journalism Labour Tax Credit | |

| T5013SCH65 — Air Quality Improvement Tax Credit | |

| QUÉBEC SCHEDULES and WORKSHEETS | |

| TP-600 — Partnership Information Return | |

| Schedule A — Partners' Interests and At-Risk Amounts | |

| Schedule B — Capital Cost Allowance (CCA) | |

| Schedule D — Member Corporations’ Shares of Paid-Up Capital | |

| Schedule E — Summary of Certain Information to Enter on RL-15 Slips | |

| Schedule F — Net Income for Income Tax Purposes | |

| TPSFWS — Schedule F allocation worksheet | |

| TP-130-EN — Immediate Expensing Limit Agreement | |

| CO-130.AD — Capital Cost Allowance for Immediate Expensing Property | |

| CO-771.R3 — Breakdown of business carried on in Québec and elsewhere | |

| MR69Results — MR-69 Attachments and results | |

| WORKSHEETS | |

| Info — Partnership Information | |

| Engagement — Engagement Information | |

| Partner — Partners' Information | |

| Allocation — Partner allocation | |

| Rental — Rental Income Worksheet | |

| RentalSummary — Summary of Rental Income | |

| Workflow — Workflow Summary | |

| Internet — Internet Filing Worksheet | |

| T661PPACapWS — Internet Filing Worksheet | |

| SLIPS and SUMMARIES | |

| T5013Partner — T5013 Partnership Details | |

| T5013 — Statement of Partnership Income | |

| T5013-INST — Instructions for Recipient | |

| RL15Partner — RL-15 Partnership details | |

| RL-15 — Statement of Partnership Income | |

| RL15 Instructions — RL-15 Instructions for Recipient | |

| Summary — Summary of Partnership Income | |

| SCIENTIFIC RESEARCH | |

| T661 — Scientific Research and Experimental Development (SR&ED) Expenditures Claim | |

| T1145 — Agreement to allocate assistance for SR&ED between persons not dealing at arm's length. | |

| T1263 — Third-party payments for SR&ED | |

| FILING and AUTHORIZATION | |

| AuthRepBus — Authorizing a representative (previously RC59OnlineConsent) | |

| AuthRepBusCancel — Cancelling a representative (previously RC59XCancel) | |

| AuthRepBusResults — History of submissions and results | |

| T1135 — Foreign Income Verification Statement | |

| T1135Declaration — T1135 Terms and Conditions | |

| T1135Results — T1135 Electronic Transmission Results | |

| SUMMARIES and COMPARATIVES | |

| 5YearComp S1 — T5013 5 Year Comparative for S1 | |

| 5YearComp SF — TP-600 5 Year Comparative for Schedule F | |

| RL15 Slips — Slip Summary | |

| Slips — Slip Summary | |

| Memos — Memo Summary | |

| Tapes — Tape Summary | |

| TEMPLATES and CLIENT CORRESPONDENCE | |

| CLetter — Client Letter | |

| Engagement letter | |

| AuthEmailBus — Business Authorization Cover Email | |

| ClientCopyEmail — Client Copy Cover Email | |

| EngagementEmail — Engagement Cover Email | |

| ESignatureEmail — E-Signature Cover Email | |

| MR69Receipt — Client MR-69 Receipt | |

| Notes — File notes | |

| T1135Receipt — T1135 Receipt | |

| T1135FRRMSReceipt — T1135 FRRMS Submit e-Doc Receipt | |