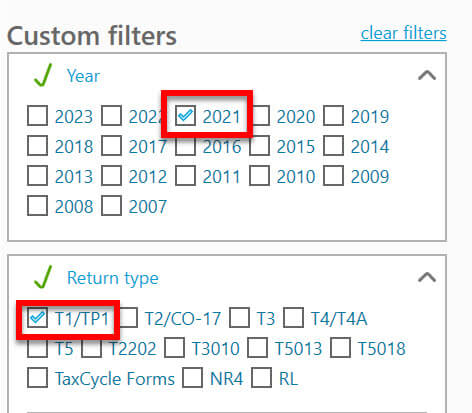

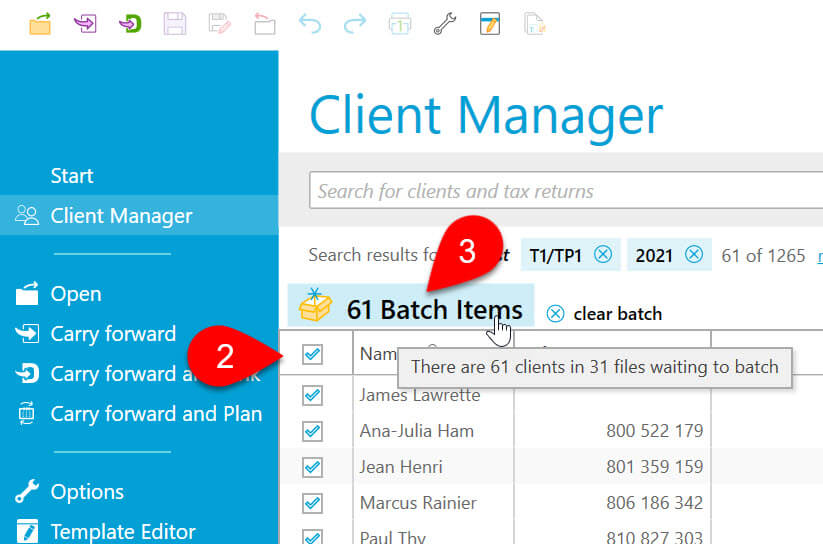

Since the first quarterly Climate Action Incentive Payments (CAIP) were issued on July 15, we have learned that some clients are not receiving the additional 10% supplement for residents of small and rural communities.

This issue only affects clients who are married or common law, as the Canada Revenue Agency (CRA) pays the CAIP to the spouse whose return is assessed first. It occurs when the CRA paid the CAIP to the spouse who was not chosen as the person expected to receive the payment on Schedule 14 in TaxCycle.

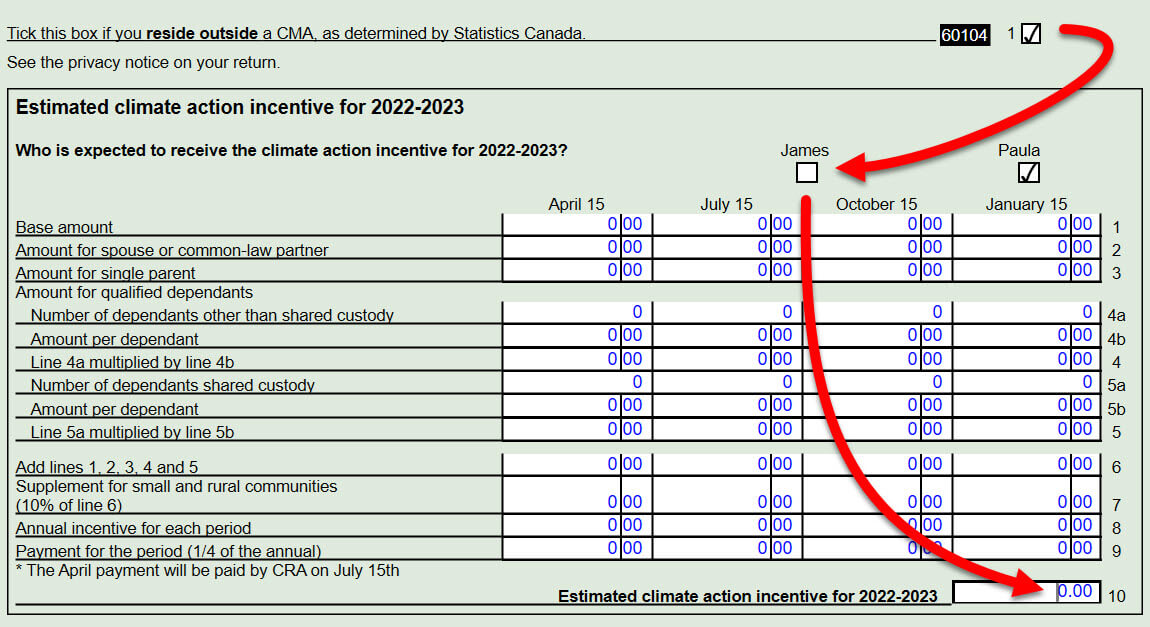

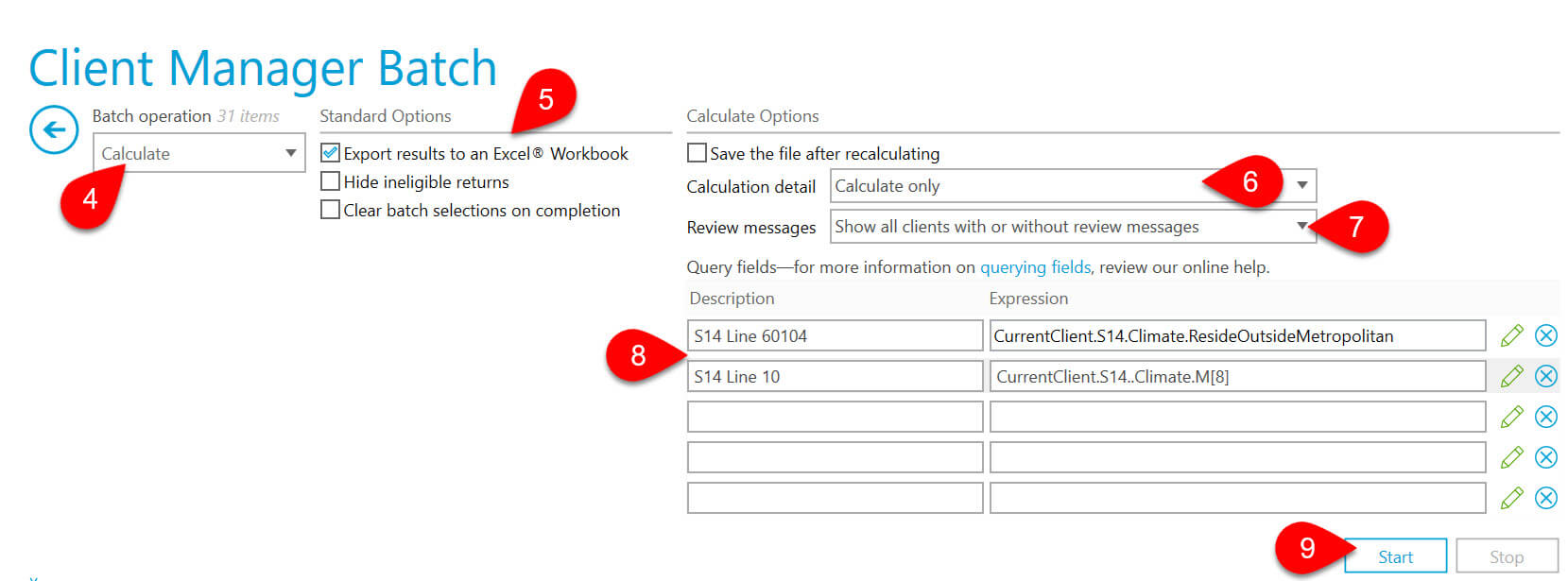

On Schedule 14 in TaxCycle, a checked field 60104 (indicating the taxpayer is a resident of a small or rural community) was only included in EFILE transmissions if the estimated CAIP was calculated at line 10. Line 10 did not calculate unless the preparer chose that person as the spouse expected to receive the payments. Therefore, the payment calculated by the CRA for this spouse does not include the 10% supplement to which they were entitled.

If the preparer chose the spouse whose return was assessed first, the CRA's payment included the supplement, as TaxCycle would have sent line 60104 to the CRA.

You can correct a client's answer to line 60104 using the Change my return service through Represent a Client or My Account.

The CRA will process this information and determine whether a change in payment applies to the client.

For more information on using the Change my return service, see the CRA page: Change my return: Online adjustments for income tax and benefits returns

You can correct a client's answer to line 60104 using ReFILE (until the next TaxCycle update, you must change the person expected to receive the payment to trigger the ReFILE process). Please also remember that you must obtain the client's signature on the T183 before transmitting an adjustment through ReFILE.

We resolved this issuein the latest TaxCycle update.