The Ontario small business Corporate Income Tax (CIT) rate is available to Canadian Controlled Private Corporations (CCPC). Ontario’s small business CIT rate is currently subject to a small business limit of $500,000 of active business income that phases out when a CCPC, or an associated group of CCPCs, has between $10 million and $15 million of taxable capital employed in Canada.

In Ontario Bill-85, dated March 23, 2023, the Ontario government proposes to extend the phase‐out range to between $10 million and $50 million of taxable capital employed in Canada.

This proposed measure would then mirror the federal government’s extension of the federal phase‐out range for the federal small business CIT rate, which was recently legislated, and it would apply to taxation years that begin on or after April 7, 2022, for consistency with the federal effective date.

We will revise Ontario Schedule 500 in an upcoming TaxCycle release.

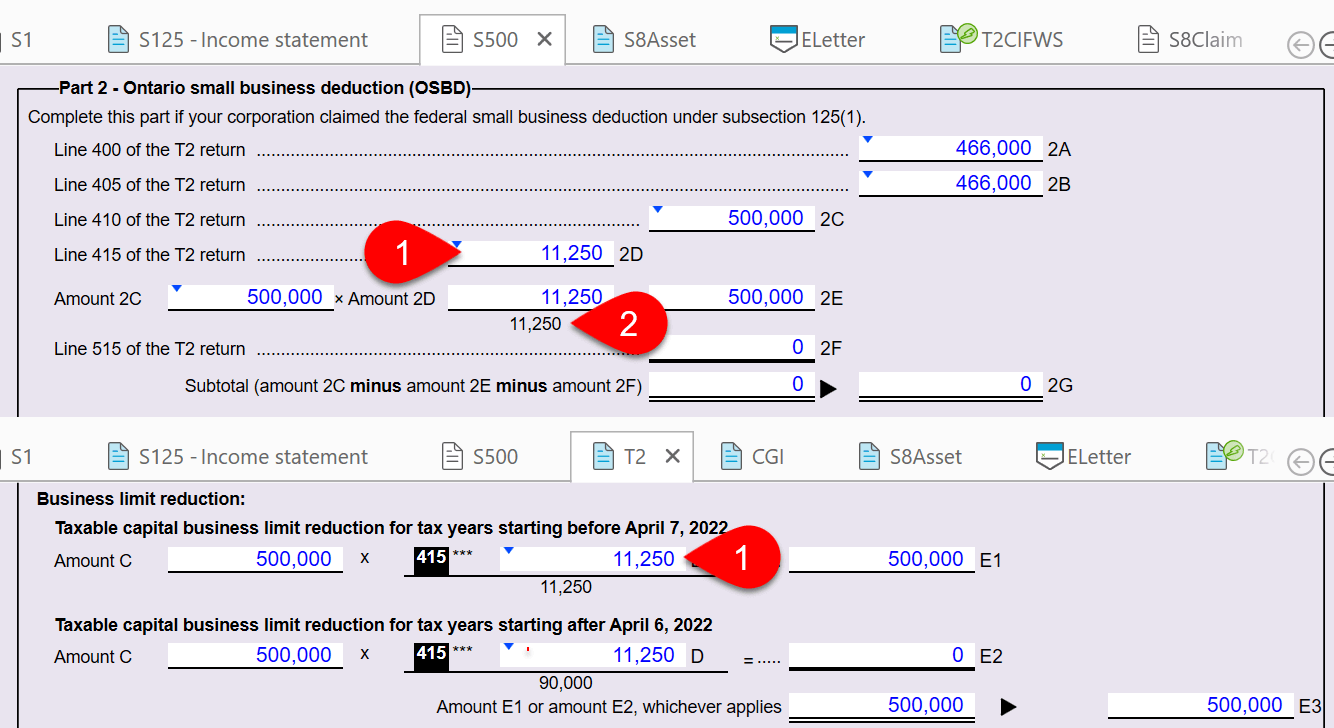

Meanwhile, for T2 returns with tax year start dates after April 6, 2022, with taxable capital employed in Canada for the CCPC and its associated group of CCPCs that exceeds $10 million, please override the following amounts on Schedule 500:

We revised Ontario Schedule 500 in TaxCycle version 12.1.50574.0.