TaxCycle 10.2.43570.0—Major T2 Update (Revised)

This certified release of TaxCycle T2 and AT1 extends the supported corporate tax year ends up to October 31, 2021.

Get this version as an automatic update, a full download from our website or a free trial. (To deploy auto-update files from your network, see the Auto-Update Files page.)

Release Highlights

Revisions

We originally released these changes on May 31st, 2021, as version 10.2.43455.0. Since then, we have added the following changes:

T2 and AT1 Filing Date Extension

TaxCycle supports the preparation and filing of federal T2 and Alberta AT1 corporate tax returns with tax year ends up to October 31, 2021.

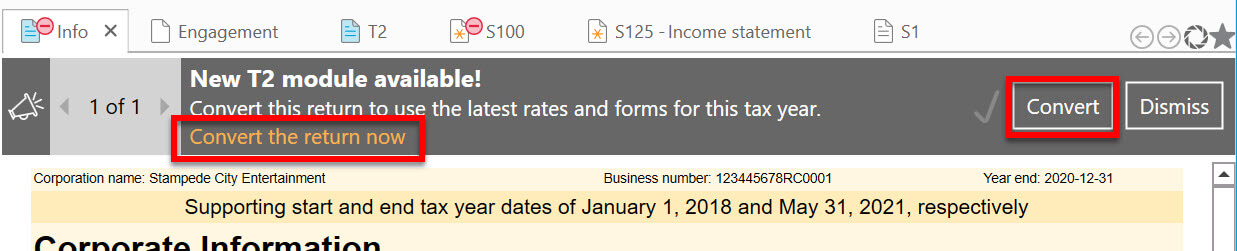

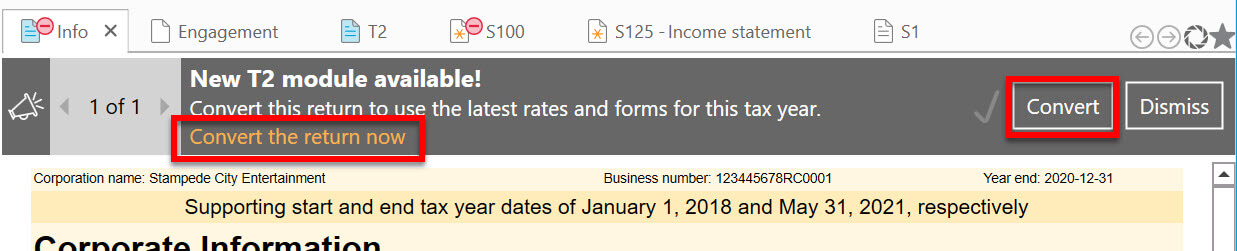

T2 File Conversion Message

When you open an in-progress T2 return, TaxCycle may prompt you to convert it to the new module. This message appears when the status of the T2 return you are working on is other than Completed and the corporation’s tax year starts on or after January 1, 2019.

- Click the Convert button or link to convert the return to the newer module.

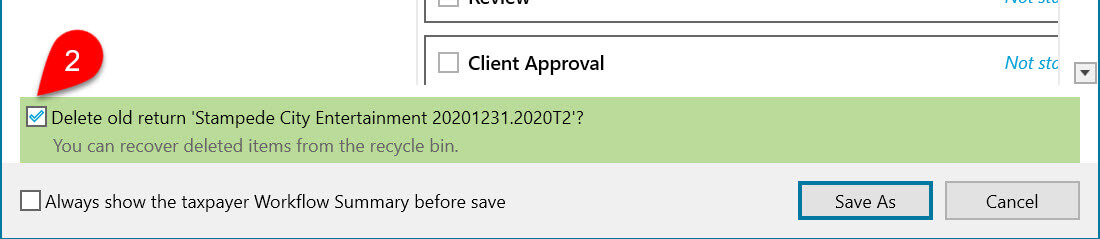

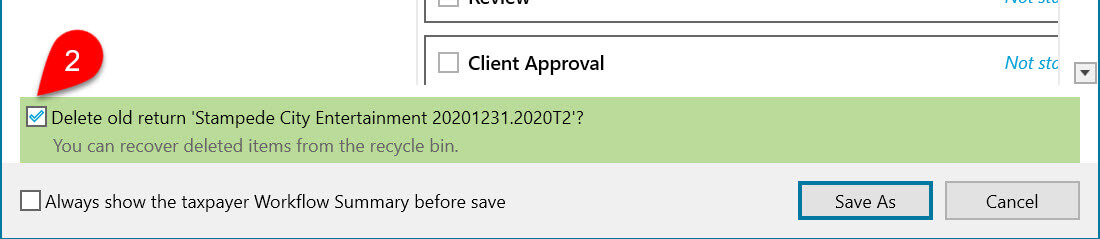

- Save the new return. You can choose to delete the old file (checked by default) or save (clear the check mark) it at the bottom of the workflow dialog box. Once a file is deleted, it will no longer appear in the Client Manager or in the recent files list.

- The new file has the file extension .2021T2 and supports returns up to October 31, 2021. To learn more about T2 file name extensions, read the T2 File Name Extensions help topic.

T2 Jacket

- Removed line 085 tax-exempt check box, Exempt under paragraph 149(1)(t), on page 1. Also removed the corresponding selection in the tax-exempt drop down field on the Info worksheet.

- Removed line 370, Income exempt under paragraph 149(1)(t), and amount Z, Taxable income for a corporation with exempt income under paragraph 149(1)(t) on page 3.

- Removed lines 425 and 427 on page 4 related to tax year 2018.

- Removed RDTOH and dividend refund sections related to pre-2019.

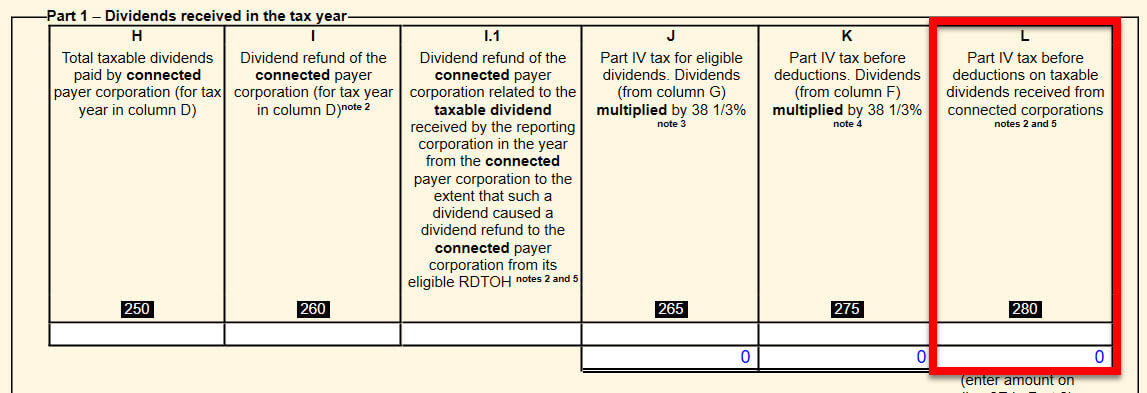

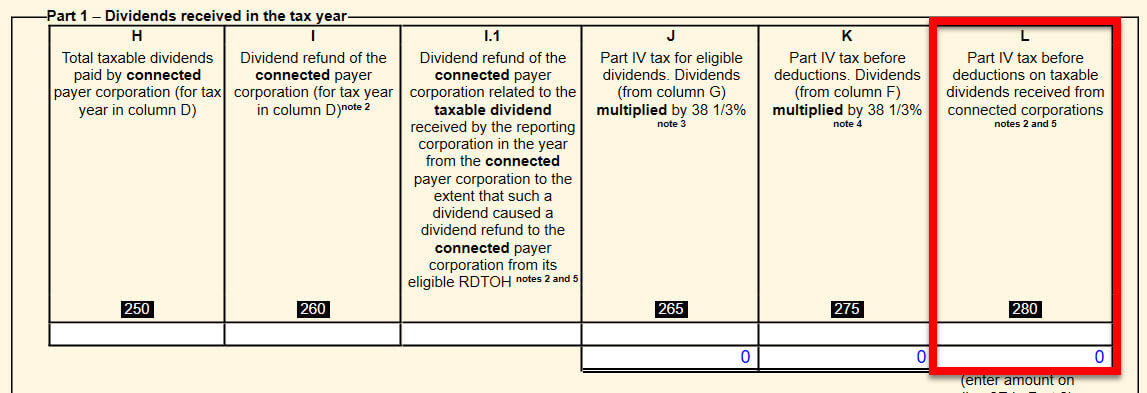

Schedule 3

Added column L / 280 to the table in Part 1.

Schedule 5

Removed the following lines:

- 525 PEI political contribution tax credit (for contributions made before June 12, 2018)

- 892 PEI political contribution

- 610 Manitoba Neighbourhoods Alive! tax credit (from Schedule 391)

- 612 Manitoba refundable cooperative development tax credit (from Schedule 390)

- 324 Manitoba data processing investment tax credits (from Schedule 392)

- 325 Manitoba nutrient management tax credit (from Schedule 393)

Schedule 54

Customer Suggestion Deduction of Financing Expenses Worksheet

The new S1FinancingWS worksheet calculates the deduction under ITA 20(1)(e). The deduction amount then flows to Schedule 1, line 395.

Minor Updates

- Schedule 4

- Schedule 6

- Schedule 8

- Schedule 17

- Schedule 31

Alberta Updates

AT1 Jacket

- Added line 129 (Innovation Employment Grant). For further information, see the section on AT1 Schedule 29, below.

- Removed lines 071 (Manufacturing and processing profits), 074 (Political contribution tax credit) and 093 (Fax number for a notice of assessment).

New! AT1 Schedule 29, AS29Step and AS29Project (Innovation Employment Grant)

The new AT1 Schedule 29 (AS29) calculates the Alberta Innovation Employment Grant tax credit.

To calculate and claim the credit, enter eligible expenditures in the project table on the AS29Project worksheet (AT4970), then complete the two-step calculation on the AS29Step worksheet. The refundable tax credit will flow from the AS29 to line 129 on the AT1 jacket.

See the AT1 Schedule 29 (Alberta Innovation Employment Grant) help topic for instructions on how to complete the AS29Project worksheet for tax years that straddle January 1, 2021.

For further information, please see the following:

AT1 Schedule 4

British Columbia Updates

- Minor update to Schedule 427.

- T1196 (Schedule 422)

- T1197 (Schedule 423)

Manitoba Updates

Unless otherwise indicated, the following forms received minor updates:

- Removed Schedule 391 Manitoba Neighbourhoods Alive! Tax Credit

- Schedule 392 Manitoba Data Processing Investment Tax Credits

- Schedule 393 Manitoba Nutrient Management Tax Credit

- Schedule 383 Manitoba Corporation Tax Calculation

- Schedule 381 Manitoba Manufacturing Investment Tax Credit

- Schedule 394 Manitoba Rental Housing Construction Tax Credit

- Adjusted Schedule 387 for the 2021 Manitoba budget. As of the 2021 taxation year, the maximum eligible investment by an investor increases from $450,000 to $500,000. In addition, the maximum tax credit claimable against Manitoba income tax in a given year increases from $67,500 to $120,000.

- Added line 876 to Schedule 388.

New Brunswick Updates

Minor update to Schedule 366.

Newfoundland Updates

Minor update to Schedule 307.

Nova Scotia Updates

Minor update to Schedule 346.

Northwest Territories Updates

Minor update to Schedule 461.

Nunavut Updates

Minor update to Schedule 481.

Ontario Updates

- Removed schedules 546, 547 and 548. As of May 15, 2021, the Canada Revenue Agency will no longer collect annual return information on behalf of the Ontario Ministry of Government and Consumer Services. See the recent news item about CRA No Longer Collecting S546, S547, S548 and RC232 for Ontario

- Minor update to schedules 500, 502, 558 and 560.

- Added the new Schedule 570 (previously a worksheet).

Prince Edward Island Updates

Minor update to Schedule 322.

Saskatchewan Updates

- Minor update to Schedule 411.

- Minor update to Schedule 404.

Yukon Updates

- Minor update to Schedule 443.

- Minor update to Schedule 444.

Other Changes

- Minor updates made to the 2021 version of form T1134 (for tax year starting in 2021 or later).

- T2 Summary and T2 5-year comparative.

- T2 AgriStability/AgriInvest harmonized forms have been updated to the 2021 version from Agriculture and Agri-Food Canada.

- T3 amounts and rates for 2021 have been updated for all provinces including the New Brunswick change of rate for the lowest tax bracket to 9.4%, as announced on May 11 and included in Bill 48.

Corporation Linking Improvements

- On the CGI worksheet, a light green background now shows in fields where data flows from the source file.

- On the CGI worksheet, a light blue background now displays in fields where data flows from the target file.

- Full text from headings on the CGI worksheet text now show in the Section Navigator at the bottom of the Prepare sidebar.

- Addressed issues with the page scrolling when switching between windows.

- T1261 updated to current 2021 form version

- RC4288 updated to current 2021 form version

- GST190 updated to current 2020 form version and added GST190A

Customer Requests

- Printing Review Marks—A new check box on the print configuration dialog box allows you to include review marks when printing a form.

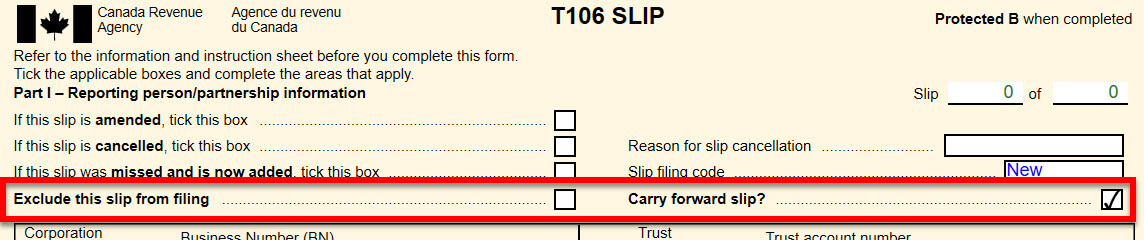

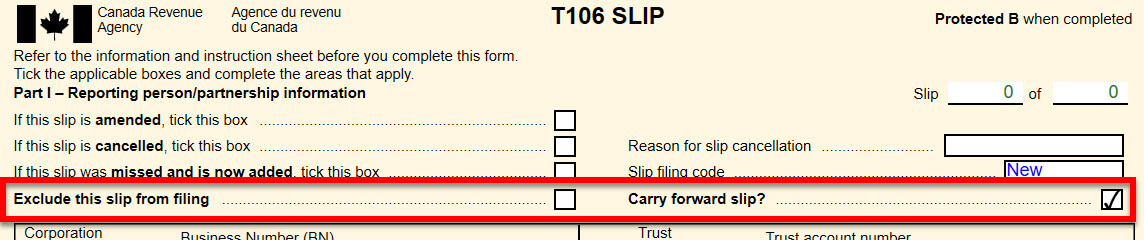

- T2 T106Slip—If a T106 slip for a non-resident entity does not have any reportable transactions in every tax year and you would like to carry forward the information in a T106 slip for that non-resident entity each year, you can choose to exclude the slip from being filed, as well as choose to carry forward that slip.

Resolved Issues

- T2SCH7, Part 2, line 730 and S7WS, line 730—The calculation has been revised to exclude capital dividend from T2SCH3, Part 1 table.

- T2SCH27—Line 120 is now calculated as amount Y in S7 Part 6 (previously, it was calculated as amount DD) to include Active Business Income from partnership.

- CO-771 Line 104, in Section 10 May Not Calculate

- AT1—Question 10 on the AT1Exempt worksheet was inadvertently removed in a prior release of TaxCycle. This caused TaxCycle to indicate that the AT1 return was exempt from filing, even if the return contained a completed AS10. In this release, we added back the question on the AT1Exempt worksheet, and changed the behaviour so that completing the AS10 triggers a filing requirement, even if you answer No to question 10 on the AT1Exempt worksheet.