TaxCycle 10.2.43886.0—2021 T1 and T5013 Modules (revised)

This release includes the preview versions of the 2021 T1/TP1 module and rollover of the T5013/TP-600 module 2021.

Get this version as an automatic update, a full download from our website or a free trial. (To deploy auto-update files from your network, see the Auto-Update Files page.)

Release Highlights

2021 T1/TP1 Preview Rates and Forms

The new TaxCycle T1/TP1 2021 module includes preview forms, rates and calculations for 2021 personal tax returns. Use this module for planning and evaluation purposes only.

The government forms you see in the TaxCycle T1/TP1 2021 module are the 2020 forms updated to include 2021 indexed amounts announced or estimated, based on the information we have at this time and budget changes.

What you need to know:

- You can carry forward 2021 T1/TP1 returns from TaxCycle, ProFile®, Taxprep® and DT Max®. All carry forward conversions are currently under review and will be updated before the next tax season. We do not recommend batch carryforward at this time.

- All forms show a Preview watermark on screen and when printing.

- Files you create now will continue to work after the module receives certification from the CRA. EFILE is not available for 2021 tax returns until February 2022.

- The CRA has not yet certified TaxCycle T1/TP1 2021 for electronic or paper filing. However, you may use it to prepare and file a deceased taxpayer’s 2021 return.

- If you have purchased a 2021 TaxCycle license, you may prepare a 2021 T1 return for a deceased taxpayer by entering the date of death on the Info form or a 2021 T1 pre-bankruptcy return by entering the date of bankruptcy and selecting Pre-bankruptcy on the Info worksheet. This removes the Preview watermark, allowing you to print and paper file the T1Condensed. Note that the bar code will not show on the form.

To learn how to create planning files, review the following help topics:

T1 Tax Changes

- ON479A, the Ontario Childcare Access and Relief from Expenses (CARE) tax credit calculation includes the 20% enhancement announced in the 2021 budget.

- MB479 school tax credit amounts are those announced in the 2021 budget.

- Other budget changes will be implemented in our December release according to the CRA forms and will include the following:

- Canada Workers Benefit rate and threshold changes as well as the secondary earners exemption.

- Northern resident deduction standard travel amount.

- Prince Edward Island Children’s Wellness tax credit.

- Ontario Jobs Training tax credit.

- Saskatchewan Active Families tax credit.

TP1 New and Deleted Forms

The following TP1 forms have been added:

- TP-726.30-V, Income Averaging for Forest Producers

- TP-752.0.14-V, Certificate Respecting an Impairment

The following forms have been removed as the related credits can no longer be claimed as of 2021:

- Schedule O, Tax Credit for Respite of Caregivers

- RL-23, Recognition of volunteer respite services

Rollover of T5013/TP-600 to 2021

The new module for TaxCycle T5013 allows you to begin data entry for 2021 federal and Québec partnership returns. Please note the following:

- You can carry forward 2020 T5013 returns from TaxCycle and competitors.

- You can use this module to file partnership returns with fiscal year ends in 2021.

- The government forms are the 2020 forms updated to include 2021 indexed amounts and budget changes announced or estimated based on the information we have at this time. A review message appears on the year-end date field and in a bulletin at the top of the forms serve to remind you of this.

- This module permits CRA Internet File Transfer (XML) and transmission of RL slips to Revenu Québec.

- The T1135 in this module is certified for filing for year ends up to October 31, 2021.

COVID-19 Government Assistance on T2 Schedule 1

The CRA recently issued an updated T2 guide with a new position on how to report COVID-19 assistance for a corporation on Schedule 125 and Schedule 1. (You may have noticed a related discussion on protaxcommunity.com)

According to page 26 and the bottom of page 35 in the updated T2 guide:

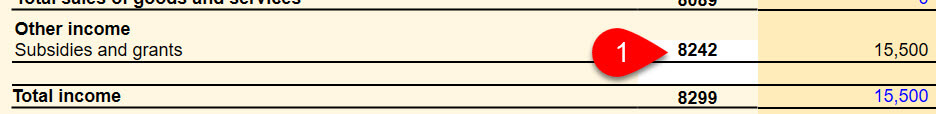

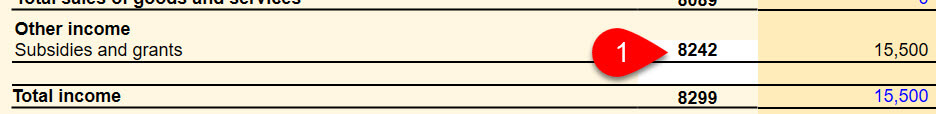

- On Schedule 125, you must report income from COVID-19 programs using the GIFI code 8242 - Subsidies and grants; and

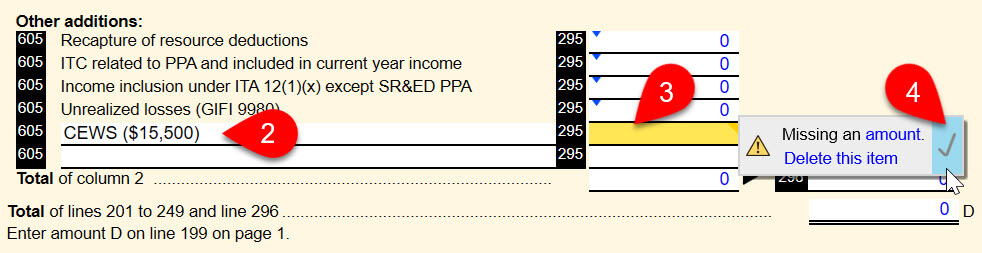

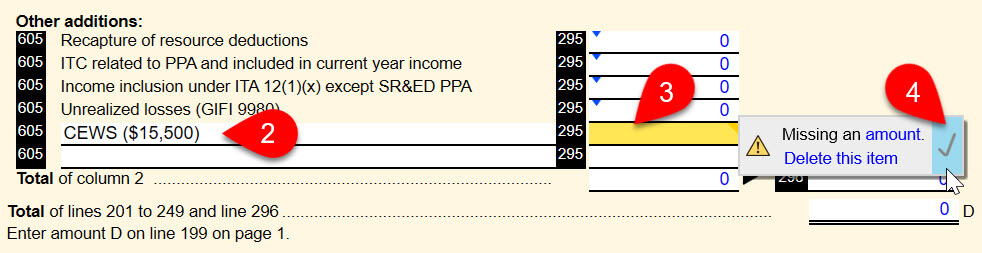

- On Schedule 1, you must clearly identify each of the COVID-19 subsidies received on line 605 (for example, “CEWS $15,500”) with a corresponding “0” entry on line 295.

To make these entries in TaxCycle T2:

- Enter the amount of the COVID-19 assistance on Schedule 125 using GIFI code 8242.

- On line 605 of Schedule 1, enter the name of COVID-19 subsidies received with the amount of the assistance in parentheses.

- Leave line 295 on Schedule 1 blank or zero. The amount of COVID-19 assistance entered on Schedule 125 is automatically included in the net income at line A at the top of Schedule 1; therefore, you do not need to add back the amount on line 295.

- Sign off the review message to approve the missing amount.

- TaxCycle will automatically transmit a value of zero for line 295 on Schedule 1 when line 605 contains a description and line 295 is blank.

Changes in CO-17

As requested by Revenu Quebec, the CO-400, Resource Deduction, was updated to the 2021-22 version. The changes consist of:

- New lines 74a, 74b in section 3.1.1

- New lines 138a, 138b in section 4.1.3

- Removed line in column F in the table in section 7.3

T5018 Slip and Summary

Both the T5018 slip and summary have been updated to the 2021 versions recently released by the Canada Revenu Agency (CRA). The banner message warning about the forms being those of 2020 and subject to change has been removed.

Competitor Carryforwards 2020 to 2021

This version of TaxCycle adds the conversion of files from the following competitors. (This is in addition to the conversions from prior years listed on the Carry Forward Prior Year Returns help topic.)

- ProFile® T1/TP1, T2, T3 2020

- Taxprep® T1/TP1, T2, T3 2020

- Cantax® T1, T2 2020

- DT Max® T1/TP1, T2, T3 2020

Important! All carry forwards are currently under review and will be updated before the next tax season. We do not recommend batch carryforward at this time.

Customer Requests

T5013 and RL-15: Added an automated footnote for the T5013 and RL-15 where Income Tax Act (ITA) 40(3.1) applies to a limited partner with a negative Adjusted Cost Basis (ACB) reported as a deemed capital gain.

Template Changes

T2—Adjusted the margins and layout of signature fields on the Engagement Letter (ELetter) to help it print on one page rather than two. (Please keep in mind, this depends on the height of the letterhead and logo for the letter.)

Resolved Issues