This release includes a new field required by the CRA for the repayment of federal COVID-19 benefits, Client Manager indexing enhancements, the implementation of customers requests and resolved issues.

Get this version as a full download from our website or a free trial. An auto-update will be available shortly.

In TaxCycle T1 2020, a new field 23210 has been added on the Deductions worksheet to enter the amount claimed for the repayment of federal COVID-19 benefits, made after 2020 and before January 1, 2023, that is claimed in 2020 on line 23200, Other deductions. When an amount is entered, TaxCycle includes line 23210 in the EFILE transmission, as well as in the bar code of the T1Condensed, or in the ReFILE transmission and T1-ADJ for amended returns. See the CRA page Tax Treatment of COVID-19 Benefits for details.

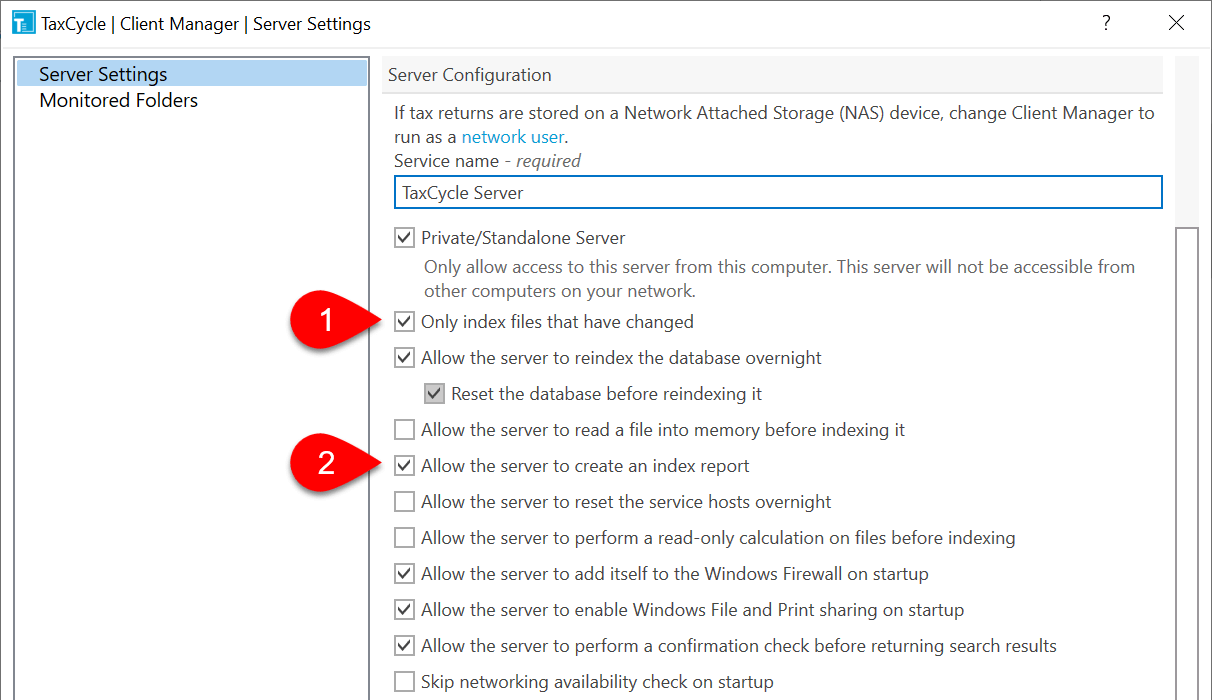

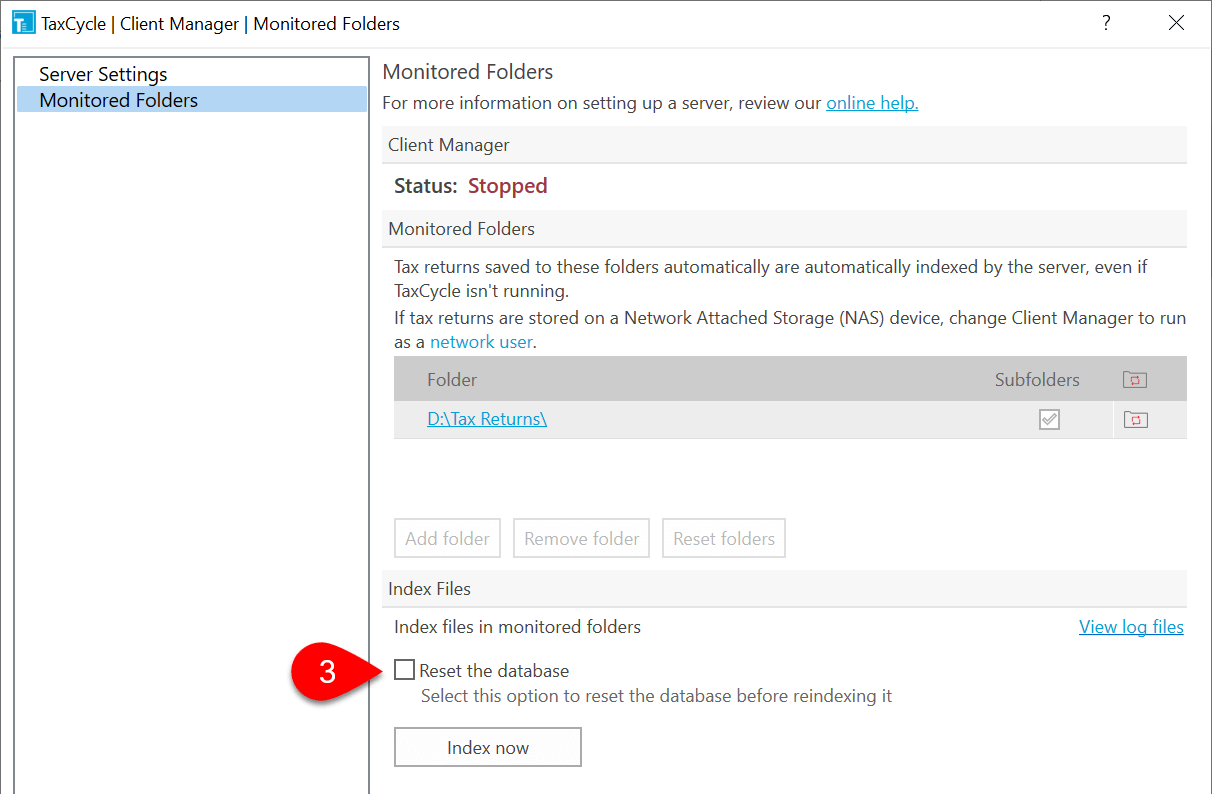

This release changes some behaviour of indexing and logging into the Client Manager. These changes should improve the speed of indexing a large volume of files. The changes include:

Also note, this release also removes the ability to index Visual Tax files in the Client Manager. We discontinued support for carryforward from Visual Tax in 2018.

We added a field to the T5013Partner worksheet for entering a Partner ID. This change was requested by firms preparing returns where the same partner entity may have slips issued to different individuals, but the partner is the same entity for the slip (such as one partnership but multiple slips within the same partnership). It provides a way to identify the individual to whom the slip is attributed.

The Partner ID is now part of the slip name in the Prepare sidebar and the slip drop-down menu. The new format prepends the Partner ID, in the following order: “T5013Partner - Partner ID - Entity/Individual Name, Entity Tax Number.”

This field is shared with the RL-15 and slip name in the sidebar and drop-down menu. This field can also be added as an optional column on the Partner, Allocation and Slips summaries.