TaxCycle 11.0.45841.0—2021 Slips Filing and T1/TP1 Preview (Revised)

This major TaxCycle release is ready for filing 2021 slips with the Canada Revenue Agency (CRA) when systems open on January 10, 2022. It also contains preview calculations and forms for 2021 T1 and TP1 and updates to Québec CO-17.

To install this version immediately, download the full installer from our website or request a free trial. Once we enable the automatic update for this version, TaxCycle will prompt you to install it according to the priority set in your TaxCycle Options. (To deploy auto-update files from your network, see the Auto-Update Files page.)

Release Highlights

Revisions

We originally released these changes on December 24, 2021, as version 11.0.45751.0. After the CRA slips filing system opened, we released a subsequent update to resolve an issue with creating XML for filing T5013 slips returns, fixed competitor carry forwards in slips modules and added updated exchange rates.

2021 Slips and Relevés Ready for Filing

The following 2021 federal slips and forms are ready for electronic filing with the Canada Revenue Agency (CRA) when systems open on January 10, 2022:

- T4 Statement of Remuneration Paid

- T4A Statement of Pension, Retirement, Annuity, and Other Income

- T5 Statement of Investment Income

- T5018 Statement of Contract Payments

- T2202 Tuition and Enrolment Certificate

- NR4 Statement of Amounts Paid or Credited to Non-Residents of Canada (in TaxCycle NR4 module, not T3 module)

- T4A-NR Payments to Non-Residents for Services Provided in Canada (in TaxCycle NR4)

The following 2021 federal slips and forms are ready for paper filing with the CRA:

- T4PS Statement of Employee Profit-Sharing Plan Allocations and Payments

- T4A-RCA Statement of Distributions from a Retirement Compensation Arrangement (RCA)

The following 2021 Québec relevés are ready for filing with Revenu Québec:

- RL-1 Employment and Other Income

- RL-2 Retirement and Annuity Income

- RL-3 Investment Income

- RL-24 Childcare expenses

- RL-31 Information about a leased dwelling

T3010/TP-985.22 Ready for Filing

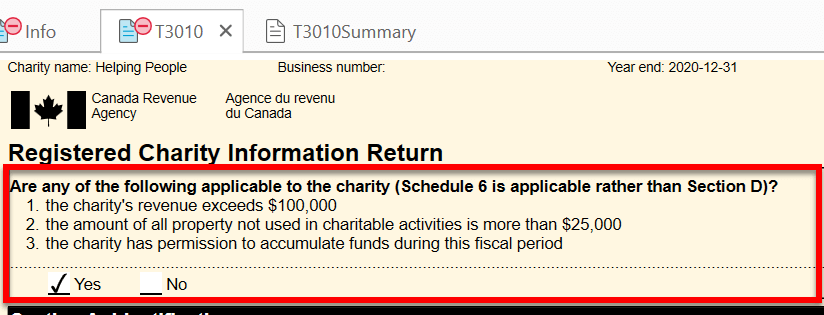

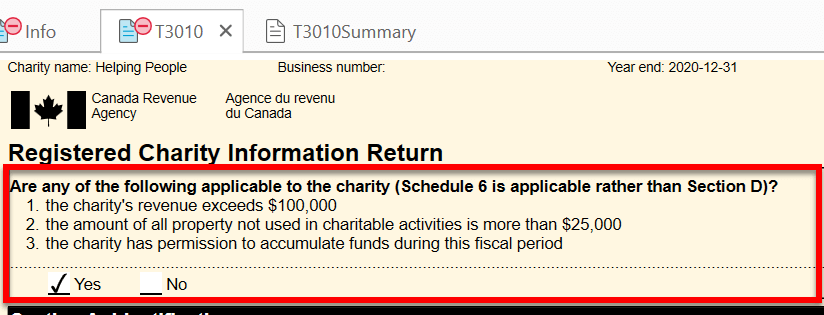

The federal T3010, Registered Charity Information Return, and the Québec TP-985.22 are final and ready for filing. Changes to the T3010 forms for this year were limited to minor text changes, and the TP-985.22 had no revisions.

We added a new question to the top of the T3010 jacket to help you determine whether to complete Section D or Schedule 6 of the T3010. It shares fields with the same question on the Info worksheet, so you can answer it in either place.

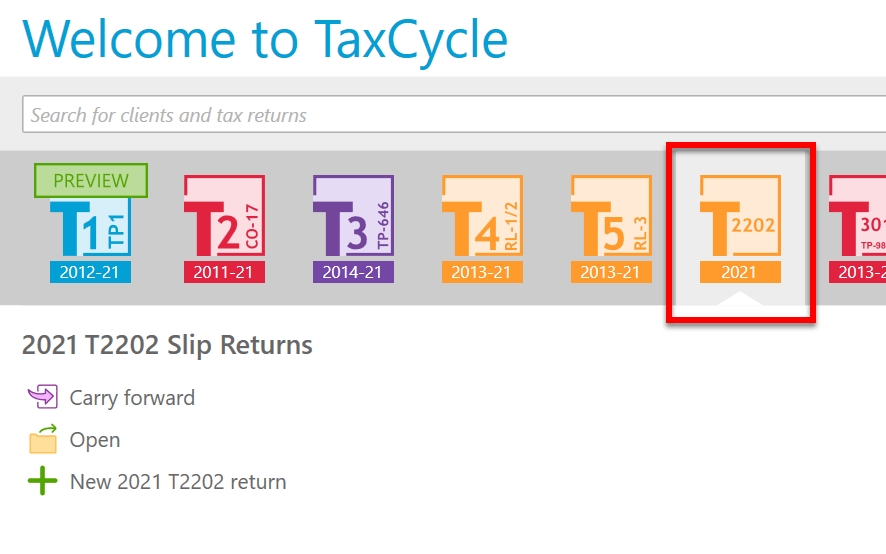

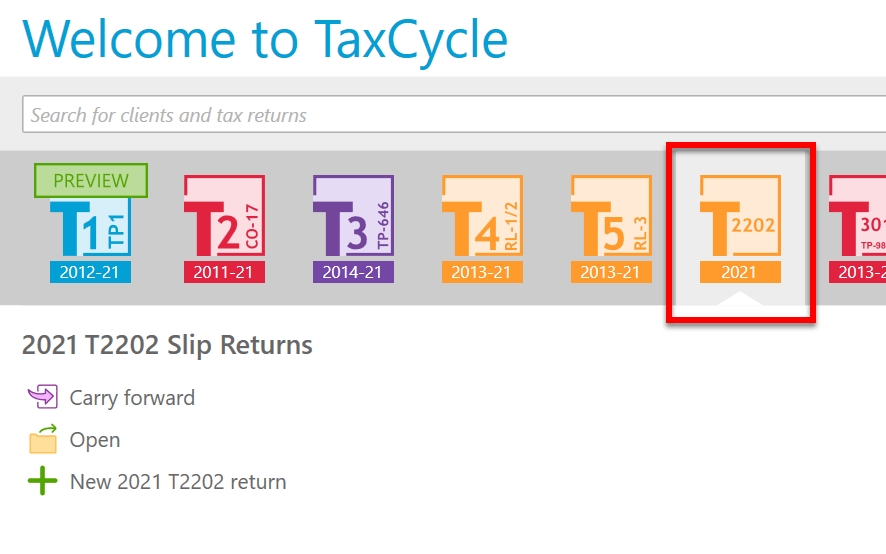

New TaxCycle T2202

This release adds a new TaxCycle T2202 module, automatically included in any license for the Complete Paperless Tax Suite. This module allows you to prepare and file the federal T2202 Tuition and Enrolment Certificate for 2021.

- The module contains the following forms and worksheets:

- T2202—Tuition and Enrolment Certificate

- T2202Summary—Tuition Summary

- Info—Transmission Information

- Engagement—Engagement Information

- CustomFields—Custom Fields

- InternetWS—Internet File Worksheet

- Workflow—Workflow Summary

- Memos—Memo Summary

- Slips—Slip Summary

- Tapes—Tape Summary

- MLetter—Missing Slips Letter

- You can carry forward T2202 slips from ProFile®, Cantax® and Taxprep®.

- This module is ready for electronic filing with the Canada Revenue Agency (CRA) when systems open on January 10, 2022.

- You can create a template from this module to import slips from Excel®. Note that when you enter the dates for the start and end of each session, make sure the cells are in the Date format in Excel®. TaxCycle will ignore the day and only enter the month and year on the slips. (If you prefer to show the data in the spreadsheet with just the month and year, you must create a custom cell format using yyyymm.)

- SlipSync for T2202 will be available in a future release.

T1/TP1 Preview Forms and Calculations for 2021

This release updates the T1 federal and provincial schedules, as well as many other forms, to the latest versions available from the Canada Revenue Agency (CRA). It also updates the TP1 jacket and all schedules to the latest versions available from Revenu Québec.

All forms, other than authorization forms, remain in a preview state and include a preview watermark. We will remove the watermark once we receive approval of the T1 Condensed and bar code from the CRA, as well as a number of final forms, and complete our carryforward and calculation testing. We will likely begin removing the watermarks from forms in mid-January.

Update to this release to try the latest forms and calculation changes to T1 and TP1. You can begin data entry, but you must wait for CRA and Revenu Québec certification before filing. We also strongly recommend waiting to perform any batch carryforward for files to 2021 until those changes are complete.

Important Updates

- T1 line 23210 added for repayment of federal COVID-19 benefits.

- These repayments appear in box 201 on a T4A slip or are included in the amount in box 30 on a T4E slip. If reported in box 30 on a T4E, Service Canada also provides a letter indicating the portion of that amount that was COVID-19 benefits.

- The amount to declare on line 23210 is net of any portion the client chose to deduct on their 2020 return, by way of an adjustment to that return. See the Deductions worksheet in TaxCycle.

- T1 line 48900

- Eligible educator school supply tax credit increased to 25% for 2021 and later, as announced in the Economic and Fiscal Update on December 14, 2021.

- Schedule 6, Canada Workers Benefit

- Adjusted thresholds and amounts according to the 2022 Budget Bill C-30. This includes a secondary earner exemption of $14,000 that reduces the adjusted family net income used in the calculation of the benefit.

- The amounts for Québec, Alberta and Nunavut are generally different than those for residents of other provinces.

- Schedule 14 for Alberta, Manitoba, Ontario and Saskatchewan

- As announced on December 3, 2021, the Climate Action Incentive will be delivered quarterly starting in July 2022. It will no longer be paid as a refundable credit on the T1 return.

- Schedule 14 now only contains the question about whether the client resides outside a census metropolitan area.

- You will also see an estimate of the quarterly payments for the 2022-2023 fiscal year. The amounts are currently those for 2021 and will be updated once the Minister of Finance announces the amounts for 2022.

- The CRA will determine the actual payments for each quarter based on the information they have on file at the time.

- T777S and TP-59.S

- Temporary flat rate for those using the simplified rules to claim employment expenses for working at home due to COVID-19 was increased to $500, as announced in the Economic and Fiscal Update on December 14, 2021.

- TP1 Schedule C and TP-1029.SA, changes from Québec’s economic update on November 25, 2021:

- A new schedule of rates for the Tax Credit for Childcare Expenses (Schedule C) based on family income.

- Increased maximum credits for the Senior Assistance Tax Credit (TP-1029.SA).

Changes to Provincial Schedules

- PE428

- Added the Children’s Wellness Tax Credit

- MB479

- Added the Teaching Expense Tax Credit

- Removed the Seniors Economic Recovery Credit

- ON479

- Added the Jobs Training Tax Credit

- Removed the Apprenticeship Training Tax Credit

Forms Added

- NL479 Physical Activity Tax Credit

- ONS12 Seniors’ Home Safety Tax Credit

- SKS12 Saskatchewan Home Renovation Expenses

- SK479 Saskatchewan Active Families Benefit

Forms Removed

- RL-23 Recognition of Volunteer Respite Services

- TP1 Schedule O, Tax Credit for Respite of Caregivers

T2 Updates

- T2SCH305, Newfoundland and Labrador Capital Tax on Financial Institutions, was updated to the latest final version.

- T2SCH444, Yukon Business Carbon Price Rebate: A new “Business rebate factor” was added to line 500. This is calculated as $39.62 for each $1,000 of eligible Yukon UCC if your tax year ends after March 31, 2022 (enter 0.03962 at line 500).

- T2 Summary effective tax rate is now calculated as a percentage of the total tax payable on line 770 (previously Part I tax payable on line 700) divided by the total taxable income on line 360 on the T2 return.

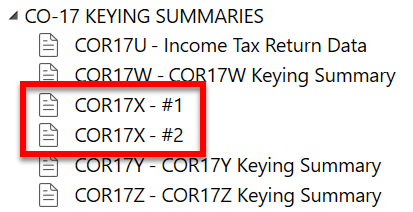

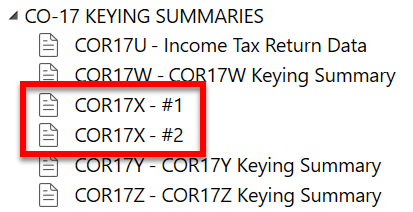

CO-17 Updates

Revenu Québec has approved TaxCycle T2 to support filing of Québec CO-17 returns with new and updated forms.

Updated forms:

- COR-17.U, Income tax return data and bar code

- COR-17.X, Keying summary for CO-130.A

- Changed to a multi-copy form.

- If you enter more than 10 CCA on the CO-130.A, TaxCycle automatically creates an additional COR-17.X.

- CO-771, Calculation of the income tax of a corporation

- Added section 12.2 to calculate the new small business deduction tax rates for the number of days in the tax year ending in 2020 and subsequent tax years, based on the March 2021 Quebec budget.

- CO-1029.8.33.6, Tax credit for an on-the-job training period

- Updated to the 2021 version.

- Revised the calculation of the tax credit rate on line 91, according to the revised note 43.

- CO-1029.8.33.13, Tax credit for the reporting of tips

- Updated to the 2021 version.

- Revised the rate calculation of the 2021 EI employer premium rate tax for Quebec employees on line 45 to the rate with three decimal places, 1.652% (previously, it was 1.65%).

- Added the new 2022 EI employer premium rate tax for Quebec employees on line 45 as 1.68% (1.2% x 1.4).

- CO-1029.8.36.DA, Tax credit for the development of e-business

- RD-1029.8.6, Tax credit for university research or research carried out by a public research centre or a research consortium

- Updated the Québec annual registration fee for line 441b of the CO-17 to reflect the following fees for 2022, according to RE-101 issued on December 15, 2021.

- $37: Association or other group of persons

- $95: For-profit legal person

- $37: Non-profit legal person

- $44: Cooperative

New forms

- CO-1029.8.36.II, Tax credit for investment and innovation

- When completing a copy of the form, first select the zone on page 1 and the period during which eligible expenses were incurred.

- Parts 5 through 12 appear only on the first copy of the form.

- The refundable tax credit calculated on line 140 is reported on page 4 of the CO-17 jacket under the miscellaneous tax credits.

- CO-1029.8.36.IK, Cumulative limit allocation agreement for the tax credit for investment and innovation

- Corporation’s allocated amount out of the $100 million cumulative limit flow to line 73 of the CO-1029.8.36.II.

- CO-1029.8.36.PS, Tax credit to support print media companies

- Changed to a multi-copy form.

- The refundable tax credit calculated on line 58 flows to page 4 of the CO-17 jacket, under the miscellaneous tax credits.

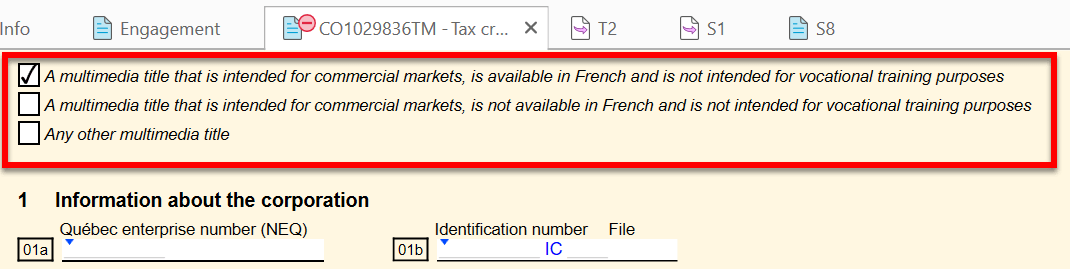

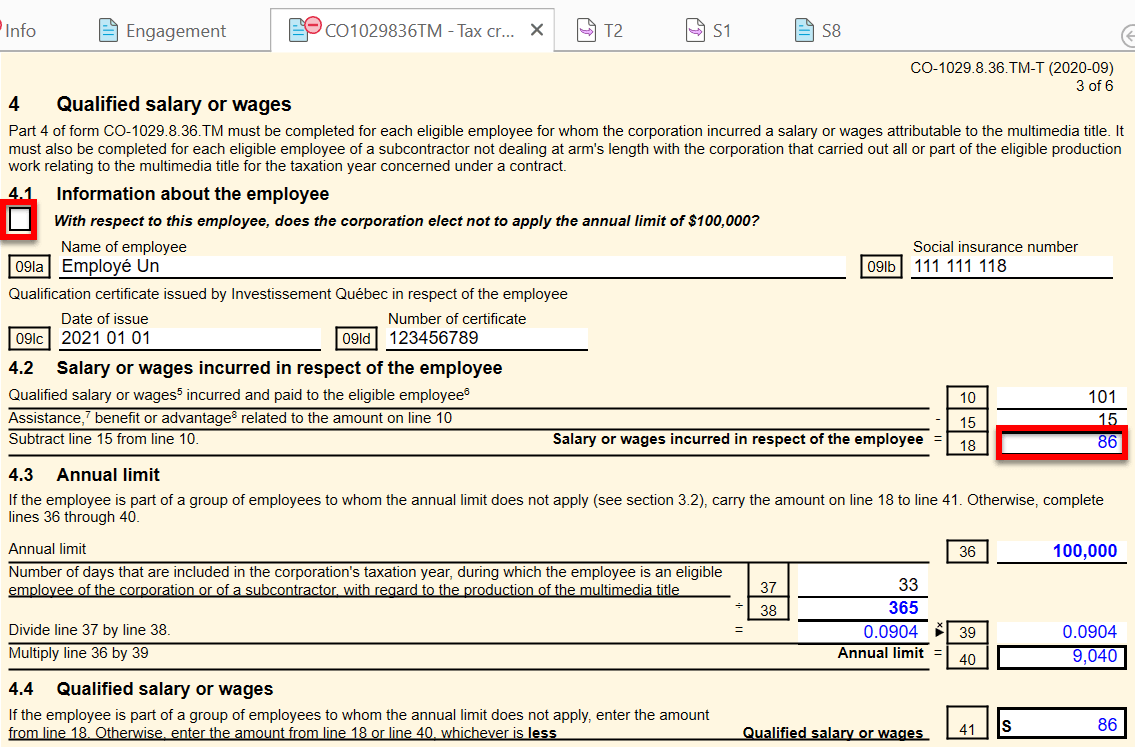

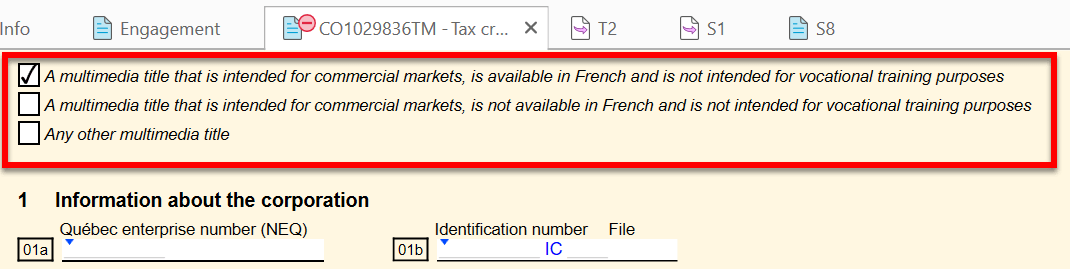

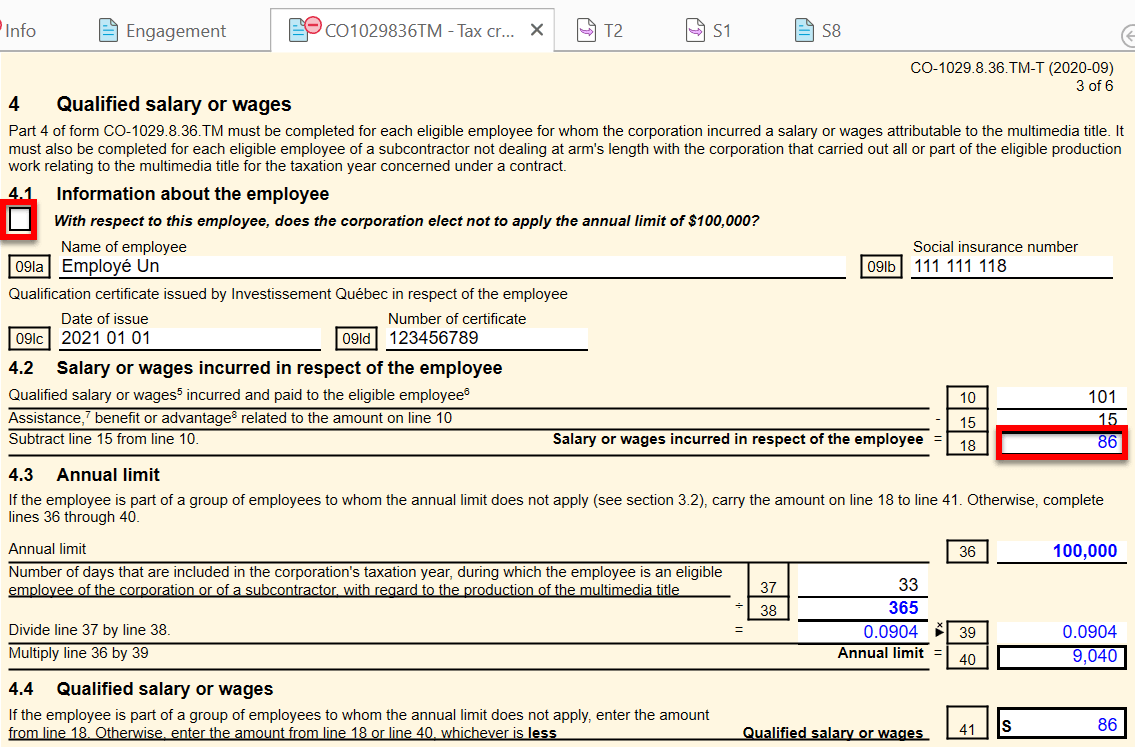

- CO-1029.8.36.TM, Tax credit for multimedia titles

- Complete this form to calculate Quebec’s tax credit for multimedia titles.

- Above Part 1, select the multimedia title type to calculate the tax credit rate on line 65 in Part 7:

- Enter employee information and complete the following fields in Part 4 to automatically generate the employee table:

- The refundable tax credit calculated on line 80 flows to page 4 of the CO-17 jacket, under the miscellaneous tax credits.

- CO-771.CH, Election concerning the number of employee remunerated hours for purposes of calculating the small business deduction

- New election form to support the CO-771.

T3RET EFILE Coming Soon

As of this release, you can no longer electronically file T3RET XML using the CRA Internet File Transfer method. The CRA is in the process of updating its systems in preparation for T3 EFILE coming in the new year. If you still need to file a T3RET from a prior year, please file it on paper.

Updated the following forms to the 2022 versions:

- TP-518 Transfer of Property by a Taxpayer to a Taxable Canadian Corporation

- TP-614 Transfer of Property to a Canadian Partnership

Customer Request T1 Pre-season/Post-season Letters

Based on customer feedback and a discussion on the ProTaxCommunity.com, we have revised the pre-season (PreSeason, JPreSeason and FPreSeason) and post-season letters (PostSeason, JPostSeason and FPostSeason) in TaxCycle T1 2021. (The post-season letter changes were also applied to the 2020 T1 module.)

The changes include:

- Splitting the contents of the former Tax Information Checklist over two pages instead of one.

- Creating the Checklist snippet for the second page of the letters. This one snippet is then used in all of the pre-season and post-season letters, making it easier to update and retain consistency.

- Creating a PreSeasonDocs snippet for the Supporting Documentation page that includes the automatic list of slips carried forward from the prior year. This snippet is referred to in all pre-season letters.

- Creating a PostSeasonDocs snippet for the Supporting Documentation page that includes the automatic list of slips used in the current-year return. This snippet is referred to in all post-season letters.

- Adding space to allow people to update their contact information.

- Adding a line for mobile phone number.

- Inserting the marital status and dependants and adding space to update if required.

- Adding a question about receiving support payments during the year.

- Expanding the section on sale of principal residence to collect information on the sale of other real property.

- Adding a section on foreign pensions.

- Adding a question about splitting pension income. (Visible only for taxpayers over 64.)

- Adding a section about the Quebec prescription drug insurance plan. (Visible only for residents of Quebec.)

- Adding a reminder to collect receipts of legal fees paid in case of separation or divorce. (Visible only for residents of Quebec.)

More Template Changes

- T1—Updated the field code used to display tuition transfers from a supporting person so that the paragraph also shows for tuition transfers between spouses. This change applies to the CLetter, JLetter and DLetter templates for 2020 and 2021.

- T1—Fixed the field codes related to pre-authorized debit (PAD) requests that were still referencing the T183 rather than the T185. This change applies to the CLetter and JLetter templates for 2020 and 2021.

- T1—Enhanced the HTML and CSS code to keep headings with the following paragraph. This makes the headings compatible with the Keep with next paragraph property in the template editor and should prevent page breaks appearing after a heading and before the related paragraph. This change applies to the CLetter, JLetter, DLetter, ELetter and DELetter templates for 2021.

- T1—Interest and Penalties paragraph in the deceased client letter (DLetter) were updated to specify the individual amounts related to penalties, interest and other penalties.

- T2, T3, T5013 and Forms—Added the AdobeSignatureEmail cover letter email template to TaxCycle T2 (back to 2017), TaxCycle T3 (back to 2017), TaxCycle T5013 (back to 2019) and TaxCycle Forms (2021).

Updates to Workflow and Tasks

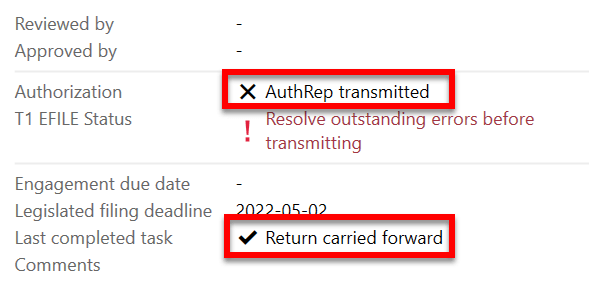

This release includes updates to workflow task and status wording to standardize the behaviour across all modules and years. Changes include:

- All dates now use the YYYY-MM-DD format.

- The status for manually-completed tasks always displays as Completed by {name} on {date}.

- All 2021 modules now include a field for Return Purpose on the Engagement worksheet that is linked to the same field on the Info worksheet. This field is indexed and searchable in the Client Manager.

- Customer Request Added a Not Filing state to the Return Purpose which, when selected, will automatically complete the related Not Filing task in the workflow. These returns display in dark grey in the Client Manager.

- Workflow tasks and status information in the Track sidebar now wrap to support narrow sidebars.

- Added workflow tasks for RL-24 slips to TaxCycle RL.

- Added a new workflow for importing GIFI from Sage or from Xero.

- Improved speed and performance of Client Manager when searching and displaying workflow information

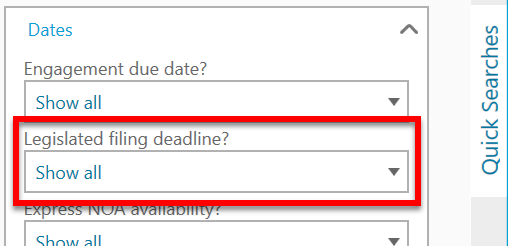

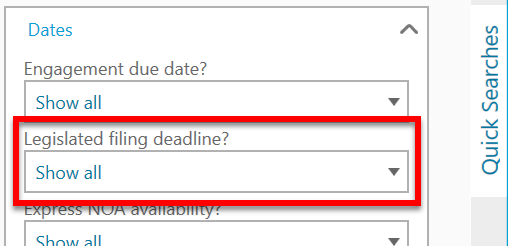

- Added an option to filter by Legislated filing deadline in the Client Manager.

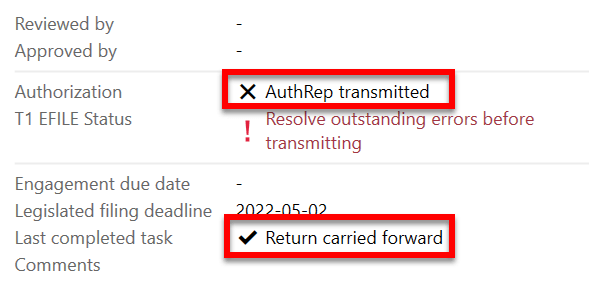

- Updated the Client Manager client details preview to show a checkmark for completed workflow items and an X those pending completions.

Status of File Carryforwards from 2020 to 2021

As of this release, the following 2020 to 2021 carryforwards are up to date. However, we strongly recommend you only perform batch carryforward on tax modules that are ready for filing in the list, below. We anticipate the rest of the modules will be finalized later in January.

Ready for batch carryforward:

- T2/CO-17—Carryforwards from TaxCycle, ProFile®, Taxprep®, Cantax®, DT Max®, creating files with year ends up until May 31, 2022

- T4, T4A, RL-1/RL-2—TaxCycle, ProFile®, Taxprep®, Cantax®

- T4PS—TaxCycle, ProFile®, Taxprep®, Cantax®

- T4A-RCA—TaxCycle, ProFile®

- T5, RL-3—TaxCycle, ProFile®, Taxprep®, Cantax®

- T2202—ProFile®, Taxprep®

- T5018—TaxCycle, ProFile®, Taxprep®, Cantax®

- T3010/TP-985.22—TaxCycle, ProFile®, Taxprep®, Cantax®

- NR4—TaxCycle, ProFile®, Taxprep®, Cantax®

- Forms—TaxCycle, ProFile®, Taxprep®, Cantax®

- RL—TaxCycle, ProFile®, Taxprep®, Cantax®

Wait for batch carryforward:

- T1/TP1—TaxCycle, ProFile®, Taxprep®, Cantax®, DT Max®

- T3/TP-646, RL-16—TaxCycle, ProFile®, Taxprep®, Cantax®, DT Max®

- T5013/TP-600, RL-15—TaxCycle, ProFile®, Taxprep®, Cantax®

Status of 2021 Federal Returns and Slips

- T1—Preview of 2021 forms and calculations. You may begin data entry, but you must wait for CRA certification before filing.

- T2—Certified to file tax year ends up to May 31, 2022.

- T3RET—In progress. XML transmission via Internet File Transfer is no longer available. The CRA is in the process of converting the filing system to EFILE. Wait to file 2021 returns and file any remaining prior year returns on paper. Forms will be updated to latest versions later in January, once approved by the CRA.

- T3 slips—In progress. Wait to file 2021 returns.

- NR4 (in T3 module)—In progress. Wait to file 2021 returns.

- T4—Ready for filing upon system opening on January 10, 2022.

- T4A—Ready for filing upon system opening on January 10, 2022.

- T4PS—Ready for filing upon system opening on January 10, 2022.

- T4A-RCA—Ready for filing upon system opening on January 10, 2022.

- T5—Ready for filing upon system opening on January 10, 2022.

- T5013-FIN—In progress. Wait to file 2021 returns.

- T5013 slip summary—In progress. Wait to file 2021 returns.

- T5018—Ready for filing upon system opening on January 10, 2022.

- NR4 slips (standalone NR4 module)—Ready for filing upon system opening on January 10, 2022.

- T4A-NR slips (in NR4 module)—Ready for filing upon system opening on January 10, 2022.

- T3010—Ready for filing.

Status of 2021 Québec Returns and Relevés

- TP1—Preview of 2021 forms and calculations. Please wait for a future update before filing.

- TP-646—In progress. Wait to file 2021 returns. Forms will be updated to the latest versions later in January, once approved by Revenu Québec.

- RL-16—In progress. Wait to file 2021 returns.

- RL-1—Ready for filing.

- RL-2—Ready for filing.

- RL-3—Ready for filing.

- TP-600—In progress. Wait to file 2021 returns.

- RL-15—In progress. Wait to file 2021 returns.

- RL-24—Ready for filing.

- RL-31—Ready for filing.

- TP-985.22—Ready for filing.

Customer Requests

- Xero—Revised the transfer of address information when creating a new contact upon exporting an invoice:

- The taxpayer address previously went into the Street Address in Xero. It now goes into the Postal Address.

- For corporate tax returns, the Mailing address in TaxCycle now goes into the Postal Address in Xero. The Head office address in TaxCycle now goes into the Street Address in Xero.

- The Care of field in TaxCycle now goes into the Attention field in Xero.

- The ability to create a current or next year T3 return from a T1 return. This applies to TaxCycle T1 for 2018, 2019 and 2020.

Resolved Issues