TaxCycle 11.1.46117.0—2021 T1/TP1, T3/TP-646 and T5013/TP-600 Ready for Filing

The Canada Revenue Agency (CRA) has certified TaxCycle T1 for filing 2021 returns when EFILE systems open on Monday, February 21, 2022. T3, T5013 and Québec TP1, TP-646 and TP-600 returns for 2021 are also ready for filing.

To install this version immediately, download the full installer from our website or request a free trial. Once we enable the automatic update for this version, TaxCycle will prompt you to install it according to the priority set in your TaxCycle Options. (To deploy auto-update files from your network, see the Auto-Update Files page.)

Release Highlights

TaxCycle T1 2021 Ready for EFILE

The Canada Revenue Agency (CRA) has certified TaxCycle T1 2021 for electronic filing when the systems reopen on February 21, 2022. As of that date, you can use TaxCycle T1 to access the following electronic services:

- T1 EFILE for 2017, 2018, 2019, 2020 and 2021 initial personal income tax and benefit returns.

- Auto-fill my return (AFR) for data from 2016 through 2021 (AFR for 2016 to 2020 only retrieves slip data).

- ReFILE for 2018, 2019, 2020 and 2021 amended T1 returns.

- Express NOA for notices of assessment from 2017, 2018, 2019, 2020 and 2021.

- T1135 foreign income verification statement for 2017, 2018, 2019, 2020 and 2021.

- Pre-authorized debit (PAD) requests for 2021 (PAD only supports paying a balance due on current year returns).

- Authorization requests (AuthRep) for 2021.

- Business authorization/cancellation requests (AuthRepBus) for 2020 and 2021.

Returns containing farming and multiple jurisdiction forms are currently excluded from EFILE. As such, the following forms still show the Preview watermark:

- T2203, Provincial and Territorial Taxes for Multiple Jurisdictions

- T2042, Statement of Farming Activities

- T2043, Return of Fuel Charge Proceeds to Farmers Tax Credit

- AgriStability/AgriInvest forms (T1163/1164 and T1273/1274)

Farming-related forms remain in Preview mode as we complete testing and obtain approval for Form T2043. All other T1 forms are final.

TaxCycle TP1 2021 Ready for NetFile

Revenu Québec has approved TaxCycle T1/TP1 2021. You can use TaxCycle T1/TP1 to access the following electronic services:

T3 and TP-646 for 2021

TaxCycle T3 is ready for filing T3 and TP-646 returns for 2021 with the Canada Revenue Agency (CRA) and Revenu Québec.

We are still awaiting EFILE certification for T3RET and T3RCA returns. Please file these returns on paper until we release a version of TaxCycle with T3 EFILE certification.

You may continue to file T3 and NR4 slips, as well as T2000 and T3P returns, using the CRA Internet File Transfer (XML) website.

Québec TP-646 returns may only be filed on paper. RL-16 slips can be filed online.

T5013 and TP-600 for 2021

TaxCycle T5013 and TP-600 is ready to file 2021 returns. T1135 EFILE now also allows filing of statements with year ends up to May 31, 2022.

This release also includes the following customer requests:

- Added new fields for lines 300 through 350 and beginning/ending adjusted cost base (ACB) to show the totals for the partnership for All partners in the relevant sections on T5013Partner and RL15Partner slips.

- Updated the At-risk section of the RL15Partner to automatically bring in amounts entered from the T5013Partner.

- Expanded the Capital Account section on the T5013Partner to populate partner drawings from the Schedule 1 amounts for salaries and wages, cost of products consumed by the partner and personal expenses paid by the partnership. This includes a new line for recording the return of capital and a new expanding table for other partner drawings, as needed.

- Added a Capital Account section to the RL15Partner, with amounts shared from the federal capital account.

- Changed line 410 on the T5013Partner and line P on the RL-15Partner to a calculated field when using the manual allocation method.

- Added new summaries for T5013 Schedule 50 and ACB, and TP-600 Schedule A and ACB, named S50Summary and TPASummary, respectively. You can enter data directly on these summaries and customize the columns in the same way you can on the Slips summary.

- Added boxes 26 (at-risk amount) and 43 (return of capital) to the RL-15 slips summary.

- Added a review message that triggers when the partner identification number only contains zeros.

- Added a section to calculate ACB on withdrawal and related deemed capital gains (losses) of a partner for the following:

- Dissolution of the partnership. This updates all partners automatically when you select Final return before dissolution on the Info worksheet.

- Retired partner (income interest).

- Retirement of a partner (residual interest).

- Fixed the carryforward of eligible limited loss balances for limited partners.

TaxFolder-Related Changes

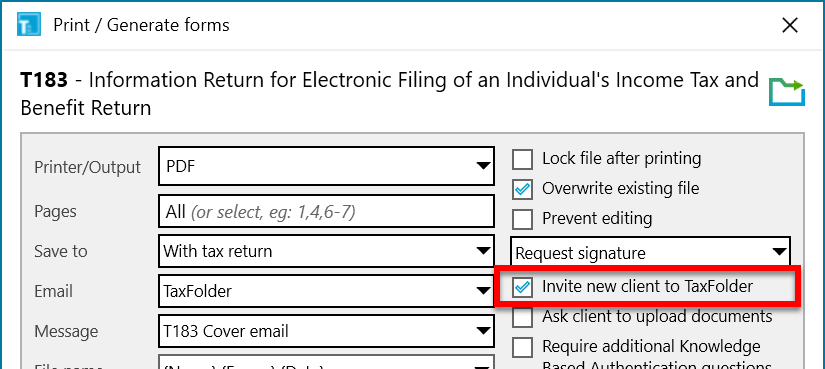

The following change will only work AFTER the next TaxFolder update, expected within the next week.

A new check box on the Printer and PDF Output Options dialog box allows you to invite a new client to TaxFolder.

- Check this box to send an email invitation to a new client, asking them to activate their new TaxFolder account.

- Uncheck this box to prevent the email invitation and only send an email requesting signature or approval of a document.

- This check box works together with a Notification setting coming in the next update of TaxFolder. Both must be enabled for new clients to receive an email invitation to create an account in TaxFolder, triggered by a request from TaxCycle.

This change responds to feedback from TaxFolder users asking for a way to disable invitation emails for clients who only need to sign or approve a document sent from TaxCycle.

Customer Requests

- T1—Updated the filing due date to May 2, 2022, in the 2020 post-season letters, and to use the legislated filing deadline from the Engagement worksheet in the 2021 pre-season letters.

- T1—Updated the T1 workflow to allow you to set individual taxpayers within the same T1 file as Not Filing. Not Filing now appears in a separate check box on the Engagement worksheet.

- T5018—Fixed the display of the business name in the missing slips template (MLetter) in 2021.

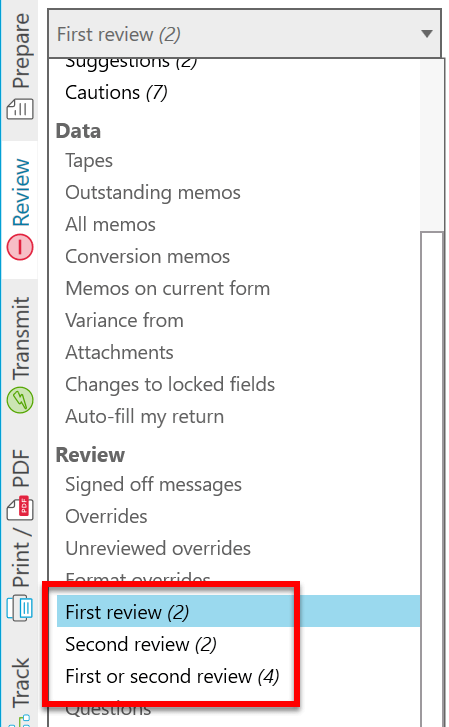

- Added views to the Review sidebar to allow you to show only fields with a First review check mark or Second review check mark. (This is in addition to the First or second review view that was already there.)

Resolved Issues

- This release addresses an issue with the T3Rec worksheet in TaxCycle T1 when dealing with T3 slips from a joint investment account that are split between spouses. For details, see this topic on protaxcommunity.com.

- The signature status was not updating correctly on the T183Corp in TaxCycle T2.

Status of 2021 Federal Returns and Slips

- T1—Ready for filing when EFILE systems open on February 21, 2022. See T1 EFILE.

- T2—Certified to file tax year ends up to May 31, 2022.

- T3—Ready for paper-filing. Awaiting EFILE certification.

- T3 slips—Ready for filing.

- NR4 (in T3 module)—Ready for filing.

- T4—Ready for filing.

- T4A—Ready for filing.

- T4PS—Ready for filing.

- T4A-RCA—Ready for filing.

- T5—Ready for filing.

- T5013-FIN—Ready for filing.

- T5013 slip summary—Ready for filing.

- T5018—Ready for filing.

- NR4 slips (standalone NR4 module)—Ready for filing.

- T4A-NR slips (in NR4 module)—Ready for filing.

- T3010—Ready for filing.

Status of 2021 Québec Returns and Relevés

- TP1—Ready for filing when NetFile opens on February 21, 2022.

- TP-646—Ready for filing.

- RL-16—Ready for filing.

- RL-1—Ready for filing.

- RL-2—Ready for filing.

- RL-3—Ready for filing.

- TP-600—Ready for filing.

- RL-15—Ready for filing.

- RL-24—Ready for filing.

- RL-31—Ready for filing.

- TP-985.22—Ready for filing.

Status of File Carryforwards from 2020 to 2021

As of this release, all 2020 to 2021 carryforwards are up to date. This includes:

- T1/TP1—TaxCycle, ProFile®, Taxprep®, Cantax®, DT Max®

- T2/CO-17—Carryforwards from TaxCycle, ProFile®, Taxprep®, Cantax®, DT Max®, creating files with year ends up until May 31, 2022

- T3/TP-646, RL-16—TaxCycle, ProFile®, Taxprep®, Cantax®, DT Max®

- T5013/TP-600, RL-15—TaxCycle, ProFile®, Taxprep®, Cantax®

- T4, T4A, RL-1/RL-2—TaxCycle, ProFile®, Taxprep®, Cantax®

- T4PS—TaxCycle, ProFile®, Taxprep®, Cantax®

- T4A-RCA—TaxCycle, ProFile®

- T5, RL-3—TaxCycle, ProFile®, Taxprep®, Cantax®

- T2202—ProFile®, Taxprep®

- T5018—TaxCycle, ProFile®, Taxprep®, Cantax®

- T3010/TP-985.22—TaxCycle, ProFile®, Taxprep®, Cantax®

- NR4—TaxCycle, ProFile®, Taxprep®, Cantax®

- Forms—TaxCycle, ProFile®, Taxprep®, Cantax®

- RL—TaxCycle, ProFile®, Taxprep®, Cantax®