TaxCycle 11.1.46243.0—T3 EFILE (Revised)

The Canada Revenue Agency (CRA) has certified TaxCycle T3 for electronic filing T3RET, T3RCA and T1135 returns.

To install this version immediately, download the full installer from our website or request a free trial. Once we enable the automatic update for this version, TaxCycle will prompt you to install it according to the priority set in your TaxCycle Options. (To deploy auto-update files from your network, see the Auto-Update Files page.)

Release Highlights

Revisions

We originally released version 11.1.46179.0 on February 25, 2022 with the changes below.

Upon enabling the automatic update on March 2, 2022, we released version 11.1.46201.0 with the following changes:

- If you downloaded the version 11.1.46179.0 and wish to transmit T3RET, T3RCA or T1135, you must upgrade to the latest version.

- Removed the Preview watermark from all farming statements, including the T2042, T1163, T1164, T1273, T1274 and the new T2043. For clients with farms in more than one province, the EFILE exclusion for multiple jurisdictions also applies to the T2043.

- Corrected an issue in T1 returns where the S14 and client letters showed an estimated Climate action incentive payment (CAIP) for the spouse if the calculation included amounts for qualified dependants. We also added separate calculations for dependants in shared custody to match the draft legislation posted by the Department of Finance in the fall.

- Corrected an issue in T5013 returns where the calculation in box 113 Return of Capital on the T5013Partner slip (box 43 on the RL15Partner) was overwriting to NIL any amounts entered in earlier TaxCycle versions.

- Added rounding to T5013 S50 box 15 to fix critical a review message that you could not resolve even though the amounts matched.

- Changed a review message for RL-15 box 24c (Paid-up capital – Member corporation’s share of total assets) to a Caution message to allow sign-off when there is a NIL allocation.

- Corrected an issue where the T2202 slip incorrectly included the Filer account number in box 15 for student copies of slips.

A week later, we released another update to resolve the following issues:

- T2043 Tax Credit Included in Income Twice. The return of fuel charge proceeds to farms tax credit (claimed on the T2043) is no longer included in income twice. The income inclusion was doubling when the taxpayer had a farming statement for a farm they owned 100%, and one for a farm that was a partnership. This issue affected both the T2042 and the T1273/4 farming statements.

- T3RET EFILE Fails for First-Time Filers. TaxCycle now allows transmission when you indicate a copy of the trust documents or will, and a list of assets at death, were included with the T3APP. We also added a warning message that prevents transmission if the account number is blank and you choose the Attached to T3RET option.

- TaxCycle not calculating subtotal on the S1M in T3 returns if you entered an exchange rate on the form. We resolved this issue for 2019, 2020 and 2021 T3 returns.

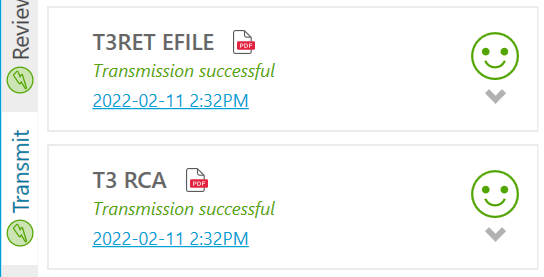

New! T3 EFILE for T3RET and T3RCA

The Canada Revenue Agency (CRA) has certified TaxCycle T3 for electronic filing T3 returns and T1135 statements.

TaxCycle supports T3 EFILE for the following return types with fiscal periods ending in 2021 and after:

- T3RET Trust Income Tax and Information Return

- T3RCA Retirement Compensation Arrangement (RCA) Part XI.3 Tax Return

For detailed instructions, please read the T3 EFILE and T1135 EFILE help topics.

You may continue to file T3 and NR4 slips, as well as T2000 and T3P returns, using the CRA Internet File Transfer (XML) website. Québec TP-646 returns may only be filed on paper. RL-16 slips can be filed online through NetFile Québec.

The CRA has approved the new T2043, Return of Fuel Charge Proceeds to Farmers Tax Credit, in TaxCycle. We removed the preview watermark from it and other farming statements (T2042, T1163, T1164, T1273 and T1274).

Returns containing multiple jurisdiction forms (T2203) remain in preview and are excluded from EFILE. This includes farms in more than one province and the new T2043 form.

All other T1 forms are final.

Customer Requests

- T1—Added quarterly breakdown of payments for the Climate Action Incentive (CAI) to the 2021 client and joint client letters. (As requested in this topic in protaxcommunity.com.)

- T3—Added a new Remittance template to provide details of a payment to the CRA made by cheque.

- Template Editor—Added new

{{ upper(...) }} and {{ lower(...) }} functions to transform text to uppercase or lowercase when pulled from a field in TaxCycle. For example, {{upper(CurrentClient.Info.ID.FirstName)}} prints the client's first name in uppercase in the template regardless of how it shows in the field on the form.

Resolved Issues

- Batch EFILE—Fixed batch transmissions from the Client Manager for 2021 T1 returns.

- T5013—Fixed an issue with RL-15 box 14, Gross Income, and related boxes 14-1 through 14-6. TaxCycle was reporting the partner’s share of gross income instead of the gross income for the partnership.

Status of 2021 Federal Returns and Slips

- T1—Ready for filing.

- T2—Certified to file tax year ends up to May 31, 2022.

- T3—Ready for filing.

- T3 slips—Ready for filing.

- NR4 (in T3 module)—Ready for filing.

- T4—Ready for filing.

- T4A—Ready for filing.

- T4PS—Ready for filing.

- T4A-RCA—Ready for filing.

- T5—Ready for filing.

- T5013-FIN—Ready for filing.

- T5013 slip summary—Ready for filing.

- T5018—Ready for filing.

- NR4 slips (standalone NR4 module)—Ready for filing.

- T4A-NR slips (in NR4 module)—Ready for filing.

- T3010—Ready for filing.

Status of 2021 Québec Returns and Relevés

- TP1—Ready for filing.

- TP-646—Ready for filing.

- RL-16—Ready for filing.

- RL-1—Ready for filing.

- RL-2—Ready for filing.

- RL-3—Ready for filing.

- TP-600—Ready for filing.

- RL-15—Ready for filing.

- RL-24—Ready for filing.

- RL-31—Ready for filing.

- TP-985.22—Ready for filing.

Status of File Carryforwards from 2020 to 2021

As of this release, all 2020 to 2021 carryforwards are up to date. This includes:

- T1/TP1—TaxCycle, ProFile®, Taxprep®, Cantax®, DT Max®

- T2/CO-17—Carryforwards from TaxCycle, ProFile®, Taxprep®, Cantax®, DT Max®, creating files with year ends up until May 31, 2022

- T3/TP-646, RL-16—TaxCycle, ProFile®, Taxprep®, Cantax®, DT Max®

- T5013/TP-600, RL-15—TaxCycle, ProFile®, Taxprep®, Cantax®

- T4, T4A, RL-1/RL-2—TaxCycle, ProFile®, Taxprep®, Cantax®

- T4PS—TaxCycle, ProFile®, Taxprep®, Cantax®

- T4A-RCA—TaxCycle, ProFile®

- T5, RL-3—TaxCycle, ProFile®, Taxprep®, Cantax®

- T2202—ProFile®, Taxprep®

- T5018—TaxCycle, ProFile®, Taxprep®, Cantax®

- T3010/TP-985.22—TaxCycle, ProFile®, Taxprep®, Cantax®

- NR4—TaxCycle, ProFile®, Taxprep®, Cantax®

- Forms—TaxCycle, ProFile®, Taxprep®, Cantax®

- RL—TaxCycle, ProFile®, Taxprep®, Cantax®