This TaxCycle release rolls over the T3 module to 2022. We initially released this version as a full download only. We will make the auto-update version available after the T1 filing deadline. Install this version if you would like to try a new feature, or if you need a change included in this release.

To install this version immediately, download the full installer from our website or request a free trial. Once we enable the automatic update for this version, TaxCycle will prompt you to install it according to the priority set in your TaxCycle Options. (To deploy auto-update files from your network, see the Auto-Update Files page.)

The new module for TaxCycle T3 allows you to begin data entry for 2022 federal and Québec Trust income tax and information returns. Please note the following:

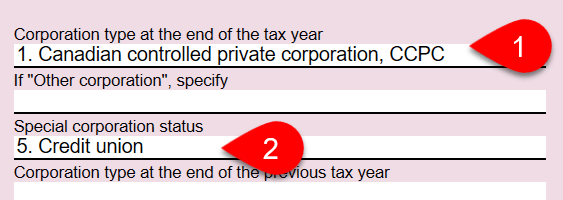

When credit unions or cooperative corporations meet a definition of a Canadian controlled private corporation (CCPC), the T2 guide requires that you select CCPC as the type of corporation for line 040 in the T2 jacket:

"Credit unions or cooperative corporations should tick box 1 at line 040 if they meet the definition of a Canadian-controlled private corporation under subsection 125(7) (without reference to subsections 137(7) or 136(1) respectively)."

When this situation applies, TaxCycle will no longer calculate the "Refundable portion of Part I tax" (line 450) on page 6 or the "Refundable tax on CCPC's investment income" (line 604) on page 8 of the T2 jacket, in accordance with exceptions listed under ITA subsection 137(7).

To meet this requirement in TaxCycle T2:

Revenu Québec no longer requires that you attach the financial statements and related to the transmission of a CO-17 return. However, they still recommend you include them, if possible. To accommodate this new change, we have revised the wording in CO-17 transmission process in TaxCycle.