TaxCycle 11.2.47092.0—T2, AT1 and T5013 for 2022

This certified release of TaxCycle T2 and AT1 extends the supported corporate tax year ends up to October 31, 2022. It also adds the 2022 module for TaxCycle T5013.

To install this version immediately, download the full installer from our website or request a free trial. Once we enable the automatic update for this version, TaxCycle will prompt you to install it according to the priority set in your TaxCycle Options. (To deploy auto-update files from your network, see the Auto-Update Files page.)

Release Highlights

Revisions

We originally released these changes on June 2, 2022, as version 11.2.47047.0. Upon releasing the automatic update, we added the following changes:

T2 and AT1 Filing Date Extension

TaxCycle supports the preparation and filing of federal T2 and Alberta AT1 corporate tax returns with tax year ends up to October 31, 2022.

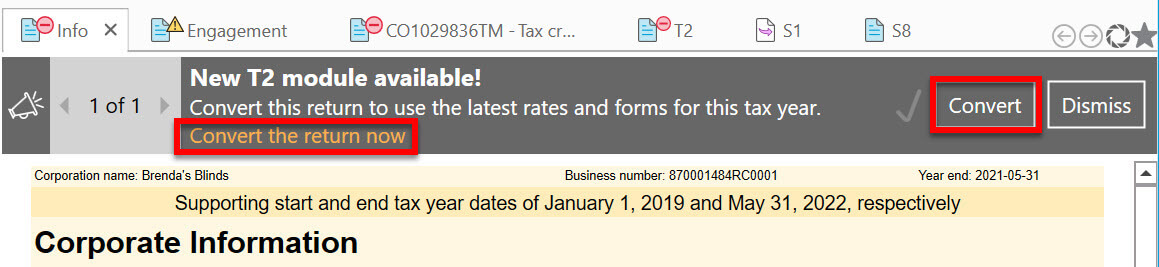

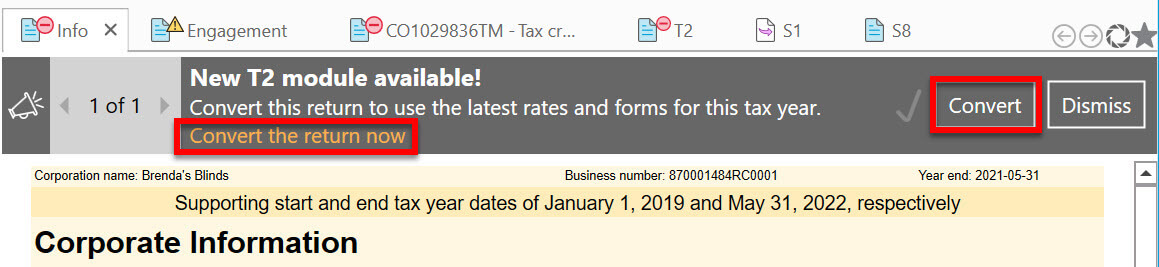

T2 File Conversion Message

When you open an in-progress T2 return, TaxCycle may prompt you to convert it to the new module. This message appears when the status of the T2 return you are working on is other than Completed and the corporation’s tax year starts on or after January 1, 2020.

- Click the Convert button or link to convert the return to the newer module.

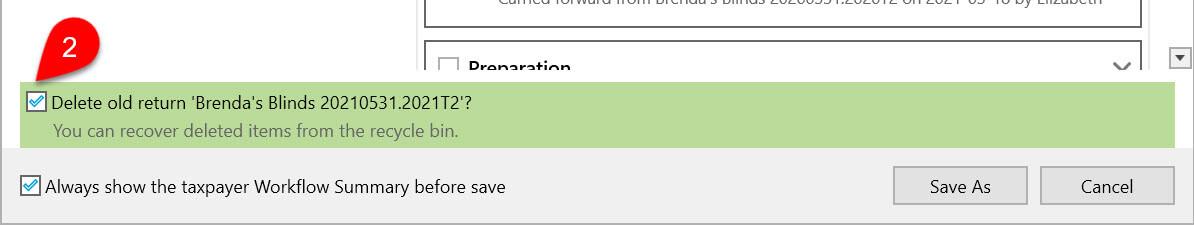

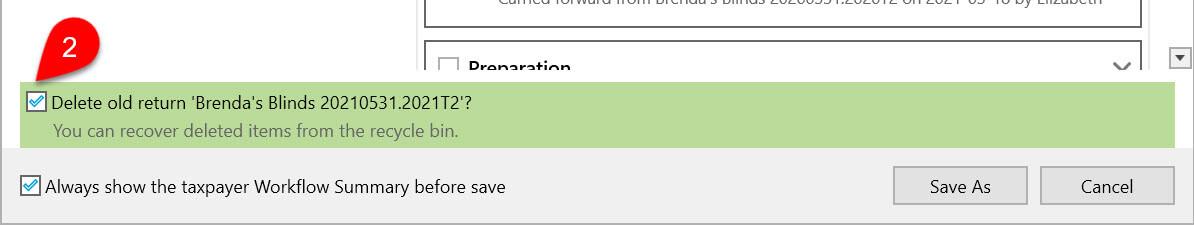

- Save the new return. You can choose to delete the old file (checked by default) or save (clear the check mark) it at the bottom of the workflow dialog box. Once a file is deleted, it will no longer appear in the Client Manager or in the recent files list.

- The new file extension is .2022T2 and supports returns up to October 31, 2022. To learn more about T2 file name extensions, read the T2 File Name Extensions help topic.

- Customer Request S8AssetSummary, AS13AssetSummary and QC8AssetSummary. These summaries show a list of the assets entered in the T2, AT1 and CO-17 returns, respectively.

- TX-19 Asking for a Clearance Certificate.

- Schedule 59 Information Return for Non-Qualified Securities. Use this schedule if you are an employer to report, as required under subsection 110(1.9), that a security to be issued or sold under an employee security option agreement between your employee and a qualifying person is a non-qualified security. When you prepare Schedule 59, TaxCycle selects the new line 274 on page 3 of the T2 jacket.

- Schedule 63 Return of fuel charge proceeds to farmers tax credit

- Schedule 65 Air quality improvement tax credit. This currently appears as a worksheet version of the form, as the CRA has indicated that this form will be available for processing in the fall 2022 update.

- Schedule 351 Additional certificate numbers for the Nova Scotia capital investment tax credit.

Updated T2 Forms

T2 Jacket

- Removed lines 910, 914 and 918 in the Direct deposit request section on page 9.

- Added lines 273 (Schedule 63), 274 (Schedule 59) and 275 (Schedule 65).

Schedule 141

- Updated schedule to comply with CSRS 4200.

- Added new question 111 in Part 1.

- Added fourth option for “Other” to the Type of involvement in Part 2.

Schedule 5

Removed the following lines:

- Nova Scotia: 565 (Nova Scotia film industry tax credit), 836 (Certificate number)

- New Brunswick: 595 (New Brunswick film tax credit), 850 (Certificate number)

- British Columbia: 653 (British Columbia political contribution tax credit), 896 (Contribution)

Schedule 13

Minor update.

Schedule 17

Removed Part 2 for Saskatchewan (lines 500, 600, 700, 750 and 800).

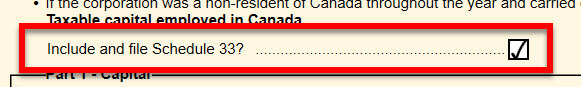

Schedule 33

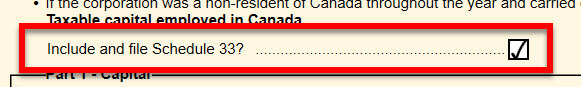

Added a new screen-only check box on Schedule 33 to include it in the transmission and bar code of the T2 return. The answer to this question flows from the response question 233 on page 2 of the T2 jacket, which TaxCycle automatically checks when the amount in box 233 on the CGI worksheet is greater than $10,000,000.

Schedule 58

Minor update.

Schedule 97

Minor update.

Manitoba

- Schedule 387—Minor update.

New Brunswick

- Schedule 5—Removed lines 595 and 850. (See Schedule 5, above.)

- Schedule 365—Removed entire form. (See Removed T2 Schedules, below.)

Nova Scotia

- Schedule 5—Removed lines 565 and 836. (See Schedule 5, above.)

- Schedule 345—Removed entire form. (See Removed T2 Schedules, below.)

Ontario

- Schedule 502—Labelled the fields for amounts 1A and 1C in Part 1 with the line numbers 030 and 040.

- Schedule 568—Minor update.

Prince Edward Island

- Schedule 321—Minor update.

Saskatchewan

Schedule 411

- Removed the Credit union section in Part 1.

- Added the following lower tax rates:

- 1% for days in the tax year after June 30, 2022 and before July 1, 2023.

- 2% for days in the tax year after June 30, 2023.

Alberta AT1 Form Changes

- AT1 Jacket—Removed line 064, Royalty tax deduction (Schedule 5, line 021).

- AT1 Schedule 12—Removed line 092.

Customer Request New Québec Forms

- CO-156.TZ Additional Deduction for Transportation Costs of Small and Medium-Sized Businesses Located in a Special Remote Area.

- COZ-1179 Logging operations return.

- COZ1179Subcontractor List of subcontractors for logging operations return.

Removed T2 Schedules

- Schedule 345 Additional certificate numbers for the Nova Scotia film industry tax credit.

- Schedule 365 Additional certificate numbers for the New Brunswick film tax credit.

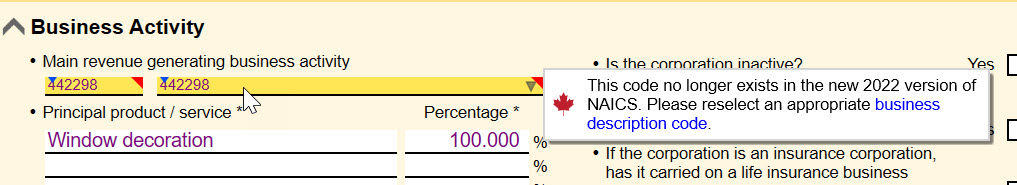

New! NAICS Codes for 2022

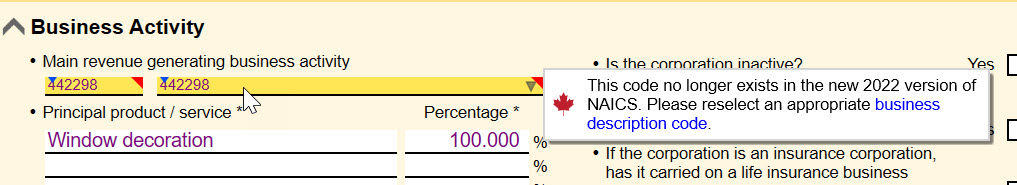

TaxCycle T2 and T5013 now include the updated list of North American Industry Classification System (NAICS) codes for 2022. Ninety-five codes became obsolete and 90 new codes were added. See New and Obsolete NAICS Codes for 2022 for a list.

- In TaxCycle T2, these changes affect the NCAIS fields on the Info worksheet, form T106 and the 2021 version of form T1134.

- In TaxCycle T5013, this only affects the fields on the Info worksheet.

If you carry forward a file that uses a deprecated code, TaxCycle retains the old code but displays a review message asking you to select a new code.

Schedule 8 Immediate Expensing of Depreciable Property

We have started work on adding the immediate expensing calculations to TaxCycle T2 for a future release. Meanwhile, if you wish to make a claim for immediate expensing, please follow the steps in our news item on Bill C-19 Immediate Expensing of Depreciable Property.

We will add support for immediate expensing to TaxCycle T5013 once we receive guidance from the CRA.

Status of New Automobile Deduction Limits

In December, the government announced the 2022 automobile deduction limits and expense benefit rates for businesses.

This included a new limit for $34,000 before tax for class 10.1, a $59,000 limit for class 54, and a $900 limit to automobile monthly leasing costs.

The CRA has directed us to wait to add these changes to TaxCycle.

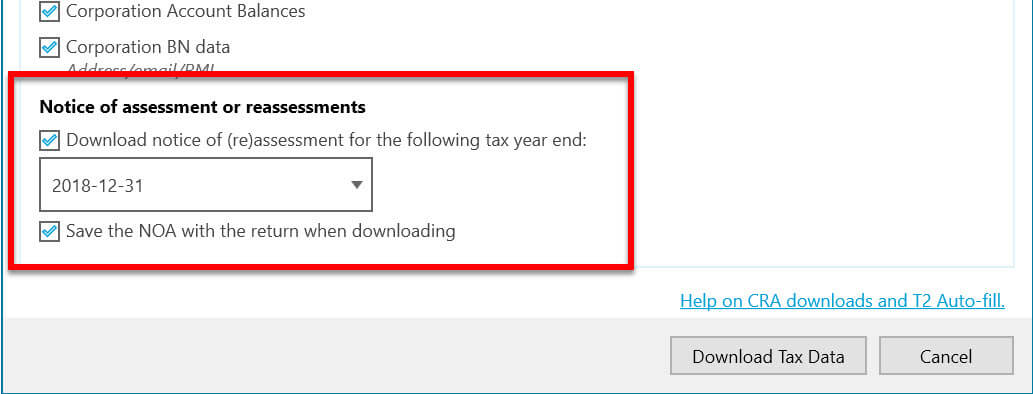

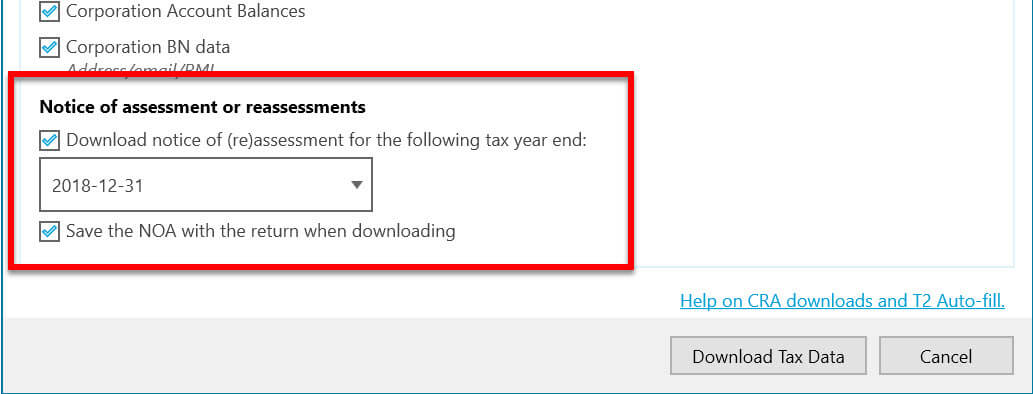

New! Download T2 Notice of Assessment

The CRA has added notices of (re)assessment (NOA) to T2 Auto-fill. When selecting tax data to download, choose the tax year end for the NOA you need. You may only download one year at a time.

After downloading, you can preview the NOA in the AFR matching window before importing. From the T2 Auto-fill (AFR) worksheet, you can open and view the NOA file in a browser.

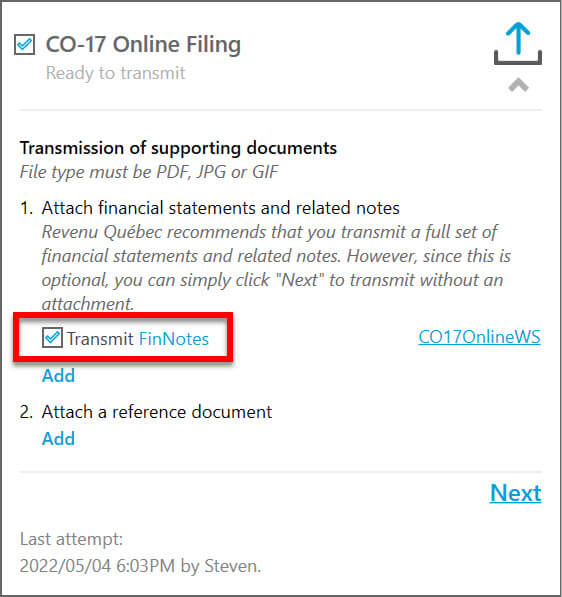

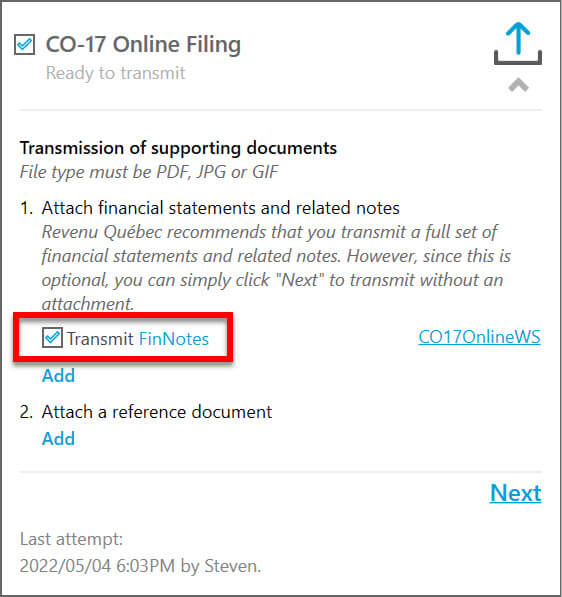

CO-17 Online Filing: Attaching Financial Statement Notes

Every CO-17 transmission already includes the financial statements (Schedules 100, 125 and 141); however, Revenu Québec does not require the notes to the financial statements (in FinNotes). We added the optional check box if you wish to include the FinNotes.

Instead of manually attaching financial statements notes during CO-17 transmission, you can now select a check box to include the financial statements notes from the TaxCycle FinNotes worksheet automatically in the transmission to Revenu Québec.

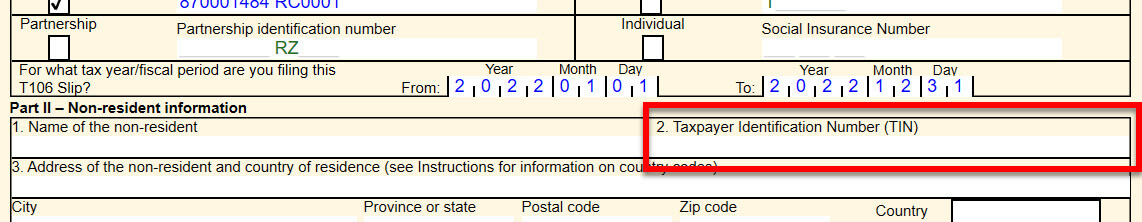

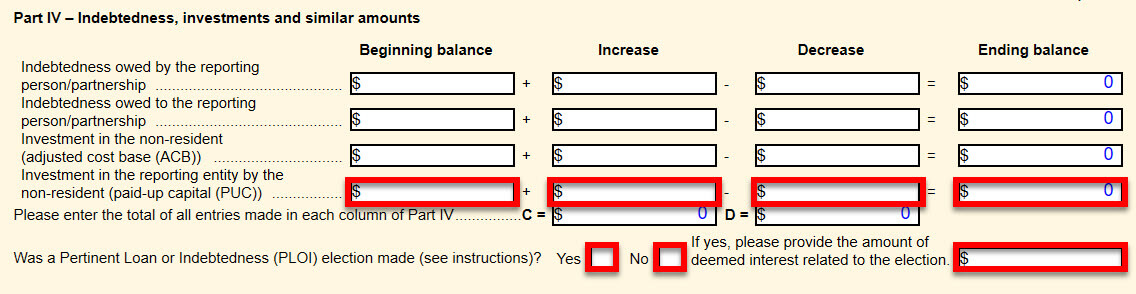

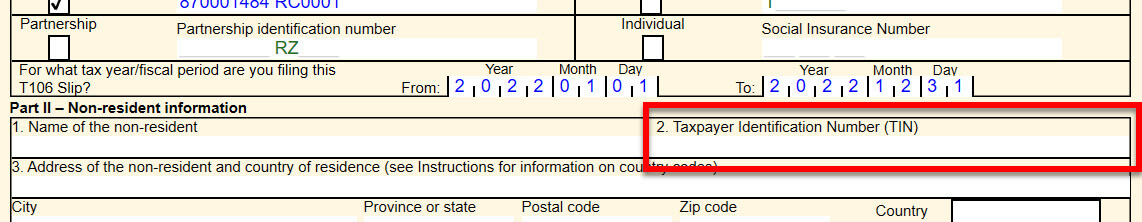

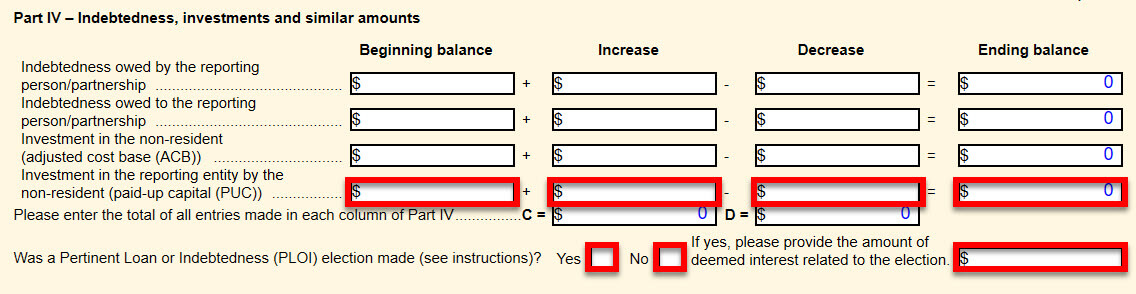

T106 (New 2022 Version)

The new version of form T106:

- Shows in TaxCycle if a corporation’s tax year starts on or after 2022.

- Supports up to 15-digits in amount fields.

- Has the same fields as the previous version of T106.

- Adds a new Taxpayer Identification Number (TIN) field to Part II of the T106 slip.

- Adds six new fields to Part IV of the T106 slip.

Rollover of T5013/TP-600 to 2022

The new module for TaxCycle T5013 allows you to begin data entry for 2022 federal and Québec partnership returns. Please note the following:

- You can carry forward 2021 T5013 returns from TaxCycle, including the creation of stub period returns. Please wait to carry forward competitor files.

- You can use this module to file partnership returns with fiscal year ends in 2022.

- The government forms are the 2021 forms updated to include 2022 indexed amounts and budget changes announced or estimated based on the information we have at this time. A review message appears on the year-end date field and in a bulletin at the top of the forms to remind you of this.

- This module permits CRA Internet File Transfer (XML) and transmission of RL slips to Revenu Québec.

- The T1135 in this module is certified for filing for year ends on or before May 31, 2022.

TaxCycle T5013 Updates

The following changes apply to the 2022 T5013 module only, unless otherwise indicated.

- New! Added the S444 Eligible Yukon UCC Worksheet for Partnerships to the 2021 and 2022 modules to facilitate the calculation of the Yukon business carbon price rebate.

- Added new review messages to identify issues that cause electronic filing errors:

- S100: Using GIFI code 2178 in conjunction with other intangible asset GIFI codes.

- S125: Leaving the schedule blank.

- Updated the Resources sections on the T5013Partner and RL15Partner data entry slips:

- Added new fields to track eligible carry forward loss balances related to resource expenses for limited partners.

- Added calculations for Adjusted At-Risk (ARA) restricted amounts and loss carry forward for resource expenses and deductions.

- TaxCycle-to-TaxCycle carry forward for ACB adjustments related to resource expenses.

- Updated the NAICS codes on the Info worksheet to use the 2022 version (see above for details).

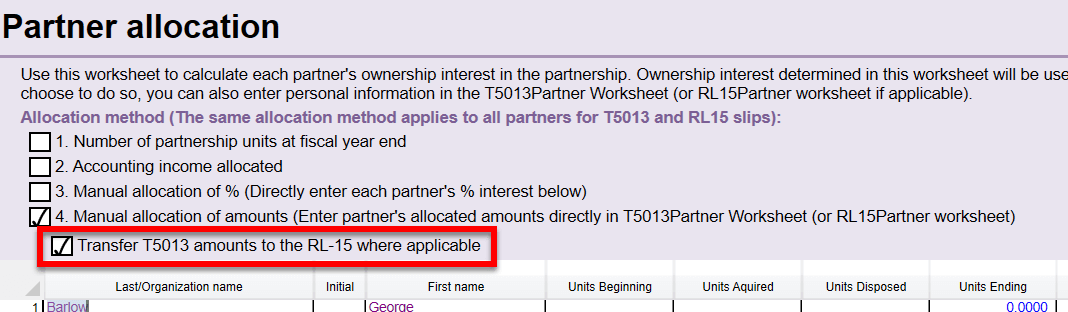

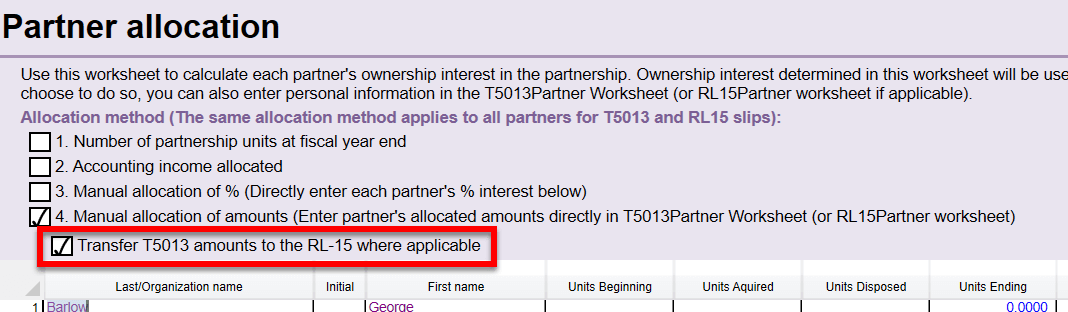

- New! The Allocation worksheet now includes a new allocation option to copy federal amounts to the RL-15 when using manual allocation of amounts for the T5013. To apply these amounts, check the allocation method 4. Manual allocation of amounts, then check Transfer T5013 amounts to the RL-15 where applicable.

T1 Updates

PEI bill 64 recently received Royal Assent. The bill increases the base sales tax credit for the period from July 2022 to June 2023 from $110 to $670, as well as changing the reduction percentage from 2% to 4% for family net income over $50,000. TaxCycle 2021 now includes the updated amounts in the estimated PEI sales tax credit for 2022/2023.

T3010 Supports 2022 Tax Years

We've extended supported tax years for the TaxCycle T3010 to the end of 2022. The CRA has indicated that the form will remain unchanged until the end of the year.

License Agreement Update

This release updates the TaxCycle Software License. Aside from replacing references to “Trilogy Software Inc.” with “Xero Software (Canada) Limited”, there have been no other changes.

Customer Requests

- T2—Added more detail from S511 to the CGI worksheet and Corporate Linking. See Corporate Group Information—Schedule ON511 on the ProTax Community.

- T1 Joint Client Letter (English only)—Fixed a closing condition on the Canada Training Credit paragraph that was causing the rest of the paragraphs for the spouse to disappear.

- T1—Added a message to highlight when AFR data regarding capital losses claimed in prior years does not match the data entered in the table at the top of the T657 with QuickFix to copy the AFR data.

- T1—Added the Supplemental Information form for Saskatchewan participants in the AgriStability program which must be submitted directly to SCIC.