This release is the first version that includes immediate expensing in TaxCycle T2.

To install this version immediately, download the full installer from our website or request a free trial. Once we enable the automatic update for this version, TaxCycle will prompt you to install it according to the priority set in your TaxCycle Options. (To deploy auto-update files from your network, see the Auto-Update Files page.)

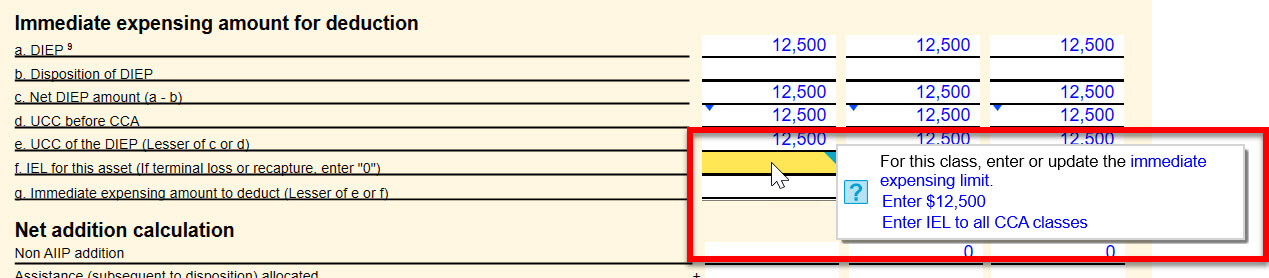

TaxCycle T2 now contains the first version to support immediate expensing in corporate tax returns. At the moment, this process still involves some manual steps, as we continue to evolve the worksheet and calculations.

Note that this release of TaxCycle T2 does not yet include the CRA's new version of Schedule 8, released on July 28, 2022. We will add it in a future release. Meanwhile, we have revised TaxCycle’s current Schedule 8 and S8Asset forms to calculate immediate expensing by incorporating the new columns from the Part 2 CCA table. Immediate expensing claims are then included in column 217 of the Part 2 CCA table on Schedule 8. However, these new columns and the new Part 1 table are not transmitted to the CRA when you file the return.

To learn how to claim immediate expensing using the S8Claim and S8Asset worksheets, see the instructions in the T2 Immediate Expensing help topic.

TaxCycle T2 also includes the automobile deduction limit changes announced by the Department of Finance on December 23, 2021:

Form T1135 was updated in version 2022 of TaxCycle T1, T2, T3 and T5013 to the new 2022 version released by the Canada Revenue Agency (CRA). In addition, messages were added to ensure that the year-end amount does not exceed the maximum amount for the year.

Forms have been updated to 2022 versions. Please note the following:

This release makes usability changes to certain forms in the Prepare sidebar. These changes affect TaxCycle T1, T2 and the Forms module for 2021 and 2022. You'll find: