TaxCycle 12.0.48763.0—Major T2/AT1 Update (2nd Revision)

This major update to TaxCycle T2 extends the supported corporate tax year ends for T2 and AT1 returns up to May 31, 2023. It also makes the calculation of immediate expensing of CCA fully automatic.

To install this version immediately, download the full installer from our website or request a free trial. Once we enable the automatic update for this version, TaxCycle will prompt you to install it according to the priority set in your TaxCycle Options. (To deploy auto-update files from your network, see the Auto-Update Files page.) Note that we encourage you to download the full installer to ensure the smoothest upgrade from version 11 to version 12.

Release Highlights

Revisions

We originally released version 12.0.48650.0 on November 25, 2022, with the changes below. On December 1st, 2022, we released version 12.0.48701.0 to resolve the following issues:

On December 8, 2022, we released version 12.0.48763.0 to:

- Resolve various issues related to the Client Manager server.

- Adjust the 2020 and 2021 Canada Recovery Benefit (CRB) clawback calculations in TaxCycle T1. This change potentially change the amount of social benefits repayment (T1 line 23500) for any client that received the CRB as well as EI and/or OAS during either of these two years. CRA has confirmed that they will identify and reassess any T1 returns that were already processed. For more details, please see the section on CRA Changes to 2020 and 2021 CRB Clawback, below.

On December 14, 2022, we provided an automatic update from TaxCycle version 11. We still encourage you to download the full installer to ensure the smoothest upgrade from version 11 to version 12.

.NET 6 Upgrade

TaxCycle now uses .NET 6, Microsoft’s latest version of .NET that offers long-term support (LTS). This upgrade allows TaxCycle to take advantage of the performance, connectivity, and security enhancements offered in this new version of .NET.

What you need to know:

- You do not need to preinstall .NET 6. The TaxCycle setup program will automatically install .NET 6 on your system when you update TaxCycle.

- Files created and saved with the new .NET 6 version of TaxCycle remain compatible with the previous .NET version of TaxCycle.

- TaxCycle's auto-update will continue to work as before.

- To ensure a smooth transition, please update your Client Manager Server at the same time. This ensures searches and filters continue to work between TaxCycle and the server.

- You must also re-index the Client Manager after updating. We recommend manually re-indexing the Client Manager immediately after updating the Client Manager Server. See the Indexing and Monitored Folders help topic for more details.

- To continue sharing data between TaxCycle and DoxCycle, please also update DoxCycle to the latest version.

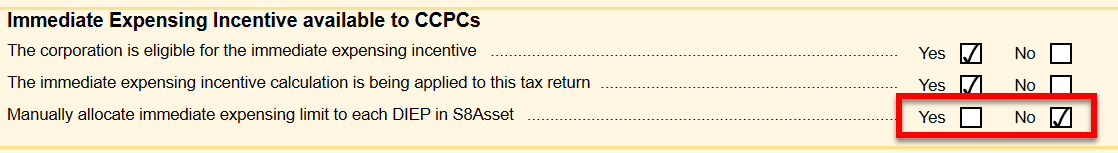

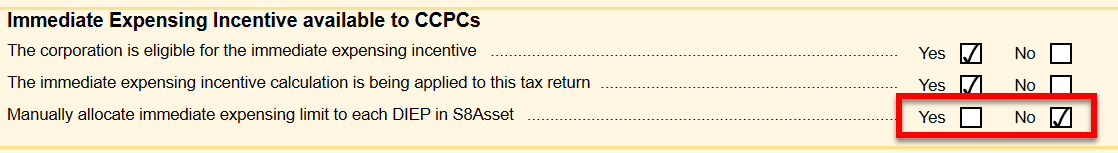

Automatic Calculation of T2 Immediate Expensing

This version of TaxCycle T2 makes immediate expensing calculations fully automatic. The S8Claim worksheet now contains the following question:

- Answer No (default) to have TaxCycle automatically calculate the immediate expensing claim as you enter capital asset additions on the S8Asset worksheet or other S8 forms.

- Answer Yes to manually enter the claim or use the Quick Fix review message to enter the claim for immediate expensing.

If you have any T2 immediate expensing files in progress as of this release, we strongly recommend answering No to this question.

Please read the updated T2 Immediate Expensing help topic for details.

T2 Updates

This TaxCycle T2 release extends the supported corporate tax year ends up to May 31, 2023.

Schedule 5

New lines added to T2SCH5:

- 506—Newfoundland and Labrador non-refundable green technology tax credit

- 508—Newfoundland and Labrador non-refundable manufacturing and processing investment tax credit

- 523—Newfoundland and Labrador refundable manufacturing and processing investment tax credit

- 526—Newfoundland and Labrador refundable green technology tax credit

- 222—Nova Scotia financial institutions capital tax

- 324—Manitoba data processing investment tax credits

- 685—British Columbia clean buildings tax credit

Schedule 8

When you select Class 43.1 or 43.2, TaxCycle prompts you to complete the table at the bottom of Schedule 8. Column 301 of this table now includes the following codes:

- 25—Pumped hydroelectric energy storage

- 26—Solid biofuel production systems

- 27—Equipment used to produce hydrogen by electrolysis of water

- 28—Hydrogen refuelling equipment

- 29—Air-source heat pump systems

Schedule 27

- New Line 9K in Part 9 for claiming the tax credit for manufacturing zero-emission technology.

- New Parts 14 through 17 for calculating the tax reduction for zero-emission technology manufacturing (ZETM). New lines include:

- 305—ZETM cost of capital

- 306—ZETM cost of labour

- 310—ZETM profits

- 350—ZETM deduction

- ZETM is applicable for corporate tax years that begin after 2021 ITA 125.2 (1)

Schedule 31

- Line 242 in Part 5 removed.

- Previous parts 22 and 23, new expenditures for childcare spaces, removed.

- Line 390 in Part 9 relocated to Part 2A.

- Question 650 in previous Part 14 relocated to new Part 2B.

Schedule 392

Per CRA’s request, we reinstated this schedule.

New Schedules for Nova Scotia Capital Tax

- Schedule 352, Nova Scotia Financial Institutions Capital Tax

- Schedule 353, Nova Scotia Financial Institutions Capital Tax–Agreement Among Related Corporations

- Nova Scotia capital tax is applicable for tax year commencing November 1, 2021, and later.

T106, T1134 and T1135

When printing a return that has not been EFILED, TaxCycle now adds a watermark to these forms that reads, “For electronic signature only—DO NOT SEND BY MAIL to CRA.”

You can remove the watermark by checking the Hide electronic signature watermark box at the bottom of the form.

Note: We will add this to T1135 in other modules in a future TaxCycle release.

T2054

Updated to the latest 2022 version.

Minor Updates

The following schedules received minor updates:

- T2SCH3, Dividends Received, Taxable Dividends Paid, and Part IV Tax Calculation

- T2SCH17, Credit Union Deductions

- T2SCH53, General Rate Income Pool (GRIP) Calculation

- T1197, British Columbia Production Services Tax Credit

- T2SCH322, Prince Edward Island Corporation Tax Calculation

- T2SCH346, Nova Scotia Corporation Tax Calculation

- T2SCH387, Manitoba Small Business Venture Capital Tax Credit

- T2SCH388, Manitoba Film and Video Production Tax Credit

- T2SCH411, Saskatchewan Corporation Tax Calculation

- T2SCH428, British Columbia Training Tax Credit

- T2SCH430, British Columbia Shipbuilding and Ship Repair Industry Tax Credit

- T2SCH443, Yukon Corporation Tax Calculation

- T2SCH461, Northwest Territories Corporation Tax Calculation

- T2SCH500, Ontario Corporation Tax Calculation

- T2SCH570, Ontario Regional Opportunities Investment Tax Credit (2021 and later tax years)

Alberta AT1 Updates

- AT1 jacket—removed lines 018, 019, 020, 021, 022, 023, 024, 027 (address for notice of assessment)

- AS10—removed address lines 056, 058, 060, 062, 064, 066, 068

Québec CO-17 Updates

The following new schedules were added to support immediate expensing calculations:

- CO-130.AD Capital Cost Allowance in Respect of Immediate Expensing Property. This new form calculates automatically from T2SCH8.

- TP-130.EN Immediate Expensing Limit Agreement. This new form is used to allocate the $1.5 million immediate expensing limit.

CRA Changes to 2020 and 2021 CRB Clawback

The CRA recently advised us that they issued revised worksheets to the T1 return and T4E slips, for both 2020 and 2021, as they realized that:

- subsection 60(v.2) of the Income Tax Act (ITA) (Canada Recovery Benefit (CRB) clawback) is not included in the definition of adjusted income in paragraph 180.1(2)(b) of the ITA (OAS clawback), and

- subsection 60(v.2) of the Income Tax Act is not included in the definition of income in section 144 of the EI Act (EI clawback).

The CRB clawback now reduces the income amount used to calculate the EI and OAS clawbacks instead of the other way around. This could potentially change the amount of social benefits repayment (T1 line 23500) for any client that received the CRB as well as EI and/or OAS during either of these two years.

CRA has confirmed that they will identify and reassess any T1 returns that were already processed. They asked that all certified software providers incorporate their corrected calculations for any returns being filed going forward. This TaxCycle update includes those revised calculations. You may have to file an amended TP1 for clients whose social benefits repayment has changed and who also filed a TP1 return.

Import T2125 and T776 Data From Xero

This release adds the import of data from Xero to the T2125 Statement of Business or Professional Activities and T776 Statement of Real Estate Rentals in TaxCycle T1. Xero partners with access to Beta features can try the import once it becomes available in the next few weeks.

If you are a Xero beta customer, read the T2125 or T776 GIFI Import From Xero help topic to learn how to import data from Xero to the T2125 and T776. Similar to the Xero T2 GIFI import, you must first map the accounts in the Xero organization to facilitate the import. When mapping your accounts in Xero, first select T1 + T2125 (TaxCycle) or T1 + T776 (TaxCycle) as the tax form in the Xero Tax Mapper.

T3 Updates

- Customer Reported Corrected an issue where AgriInvest Fund 2 was not allocating amounts to beneficiaries when applicable.

- Added carry forward information for non-capital losses to the Client Letter.

Other Changes

- AuthRepBus for T1, T2, T3 and T5013—TaxCycle now displays the following message when a Business Consent request is transmitted and accepted by the CRA: “Your authorization request has been received. Please have your client go to My Business Account to confirm the request.”

- T1—Updated the Guaranteed Income Supplement (GIS) amounts for the fourth quarter of 2022.

- T1, T2 and T3—Updated interest rates and added fields to the Interest and Penalty worksheet to record any additional taxes paid on or before the due date, in order to adjust the amounts used for the purpose of calculating interest and penalties.

- Customer Requested TaxCycle Forms—Added form RC193 Service Feedback.

- TaxCycle Forms—Updated GST60 GST/HST Return for Purchase of Real Property or Carbon Emission Allowances to the latest 2022 version.

- RL—Added carry forward of prior year address change from the Engagement worksheet (2020 to 2021). Additional fields were added to the Engagement worksheet to support this module for address updates. We also added a field for the mobile phone of the signer.

Template Changes

- Customer Requested Engagement Letter (ELetter)—Modified layout and wording to fit better on a single page, provided that the letterhead is not too large (English only). The French version of the letter has also been modified to be more compact.

- Customer Requested ELetter now uses the “Engagement Start Date” field from the Engagement worksheet to insert the date in the letter. If no date is entered on the Engagement worksheet, the letter will use today's date. This change only applies to T1 2021 and 2022. We will add it to other modules in a future TaxCycle release.

e-Courier Integration

As of this release, we are sunsetting the e-Courier integration with TaxCycle and DoxCycle. As a temporary measure to help you transition to a new workflow, we have created a way for you to re-enable the integration. See the Enable e-Courier in TaxCycle and DoxCycle help topic for more details.

Resolved Issues

- T2054—Corrected an issue where the name and position or office of the authorized officer did not properly populate in Part 11 of the form.

- T5013—Resolved an issue where, when there was a dissolution of the partnership and the adjusted cost base (ACB) was negative for a limited partner, the slip footnote incorrectly calculated a negative deemed capital gain under ITA 40(3.1) when claiming a deemed capital loss under ITA 40(3.12).