TaxCycle 12.0.48916.0—2022 Slips Filing

This major TaxCycle release is ready for filing 2022 slips with the Canada Revenue Agency (CRA) when systems open on January 9, 2023. The 2022 versions of T3010/TP-985.22 and T5013/TP-600 returns are also ready for filing.

To install this version immediately, download the full installer from our website or request a free trial. Once we enable the automatic update for this version, TaxCycle will prompt you to install it according to the priority set in your TaxCycle Options. (To deploy auto-update files from your network, see the Auto-Update Files page.)

Release Highlights

2022 Slips and Relevés Ready for Filing

The following 2022 federal slips and forms are ready for electronic filing with the Canada Revenue Agency (CRA) when systems open on January 9, 2023:

- T4 Statement of Remuneration Paid

- T4A Statement of Pension, Retirement, Annuity, and Other Income

- T5 Statement of Investment Income

- T5018 Statement of Contract Payments

- T2202 Tuition and Enrolment Certificate

- NR4 Statement of Amounts Paid or Credited to Non-Residents of Canada (in TaxCycle NR4 module, not T3 module)

- T4A-NR Payments to Non-Residents for Services Provided in Canada (in TaxCycle NR4)

Important! Before closing the transmission dialog box, make sure TaxCycle has copied the submission number from the CRA into the related field on the dialog box. If not, please manually copy the submission number from the CRA web page and paste it into the field. If you do not do this, you will see a message asking you to confirm with the CRA that they have received the return.

The following 2022 federal slips and forms are ready for paper filing with the CRA:

- T4PS Statement of Employee Profit-Sharing Plan Allocations and Payments

- T4A-RCA Statement of Distributions from a Retirement Compensation Arrangement (RCA)

The following 2022 Québec relevés are ready for filing with Revenu Québec:

- RL-1 Employment and Other Income

- RL-2 Retirement and Annuity Income

- RL-3 Investment Income

- RL-15 Partnership Income

- RL-24 Childcare expenses

- RL-31 Information about a leased dwelling

This release also adds billing and invoicing to 2022 slips modules.

T5013 and TP-600 for 2022

TaxCycle T5013 and TP-600 is ready to file 2022 returns. T1135 EFILE now also allows filing of statements with year ends up to May 31, 2023.

This version also includes the following changes:

- Added T5013SCH65, Air Quality Improvement Tax Credit.

- SR&ED T661

- Added T1145, Agreement to allocate assistance for SR&ED between persons not dealing at arm's length.

- Added T1263, Third-party payments for SR&ED.

- Included T661 in T5013FIN and schedules electronic filing.

- TaxCycle automatically calculates allocations to partners and includes them on the slips.

- TP-600

- Added TP130EN, Immediate Expensing Limit Agreement.

- Added CO130AD, Capital Cost Allowance for Immediate Expensing Property.

- Added billing and invoicing.

Please note that Schedule 8 is still under review, see below.

T5013 Schedule 8 and Immediate Expensing

TaxCycle T5013 now includes the CRA’s new 2022 version of Schedule 8. This version of the form contains the new Part 1, along with various new columns in the Part 2 CCA table meant to calculate immediate expensing of CCA.

Despite the updated form, TaxCycle T5013 does not yet have the calculations to support the immediate expensing measure. If you prepare T5013 Schedule 8 and S8Asset in the 2022 T5013 module in this release, CCA will calculate without the immediate expensing measure. Work on these calculations is underway and we hope to finalize them for the next release of T5013 in a few weeks.

Meanwhile, if you wish to claim immediate expensing, please complete and override the new Part 1 table and the new columns in Part 3, as applicable.

Please refer to the following topics for additional information on immediate expensing:

TaxCycle RL Updates

- Added support for electronic signatures for RL-31.

- When printing an RL slip that was not electronically filed, TaxCycle now adds a message to the printed slip that reads, “For Review only. Transmit slips before printing.” The message is removed once the slip is transmitted.

- Customer Requests Added a check box to remove the prior sequence number for re-amended RL slips. If a slip was amended or transmitted, check the box and TaxCycle will display a message instructing you to remove the prior sequence number. Previously, the RL slip sequence number was not updating correctly for slips that were amended multiple times and there was an issue where the printed RL slip was not correctly incrementing when printed before electronically filing.

T3010/TP-985.22 Ready for Filing

The federal T3010, Registered Charity Information Return, and the Québec TP-985.22 are final and ready for filing.

T2: 2023 Automobile Deduction Limits

TaxCycle T2 now includes the 2023 automobile deduction limits and expense benefit rates announced by the Department of Finance on December 16, 2022. This includes the following changes:

- Schedule 8 and S8AssetManager

- The CCA ceiling for Class 10.1 passenger vehicles has increased to $36,000 for new and used vehicles acquired on or after January 1, 2023.

- The CCA ceiling for Class 54 (zero-emission passenger vehicles) has increased to $61,000 for new and used vehicles acquired on or after January 1, 2023.

- Motor Vehicle Worksheet

- Deductible leasing costs for new leases entered on or after January 1, 2023, have increased to $950.

- The maximum allowable interest deduction for new automobile loans remains at $300 for 2023.

T2: Bill C-32, Fall Economic Statement Implementation Act

On December 15, 2022, Bill C-32 received Royal Assent. This particular bill contains various business measures affecting corporations.

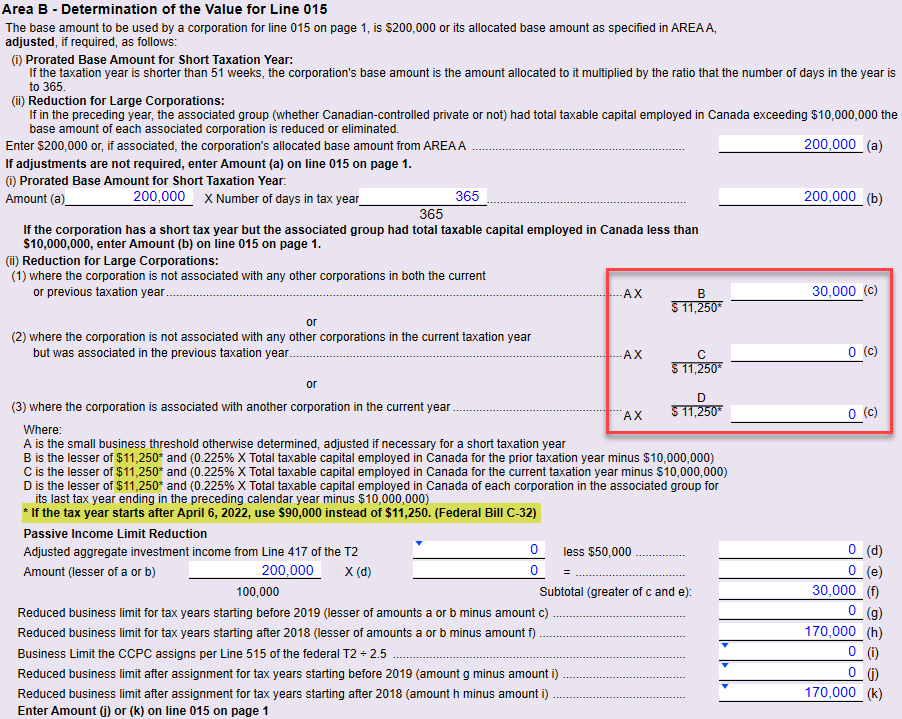

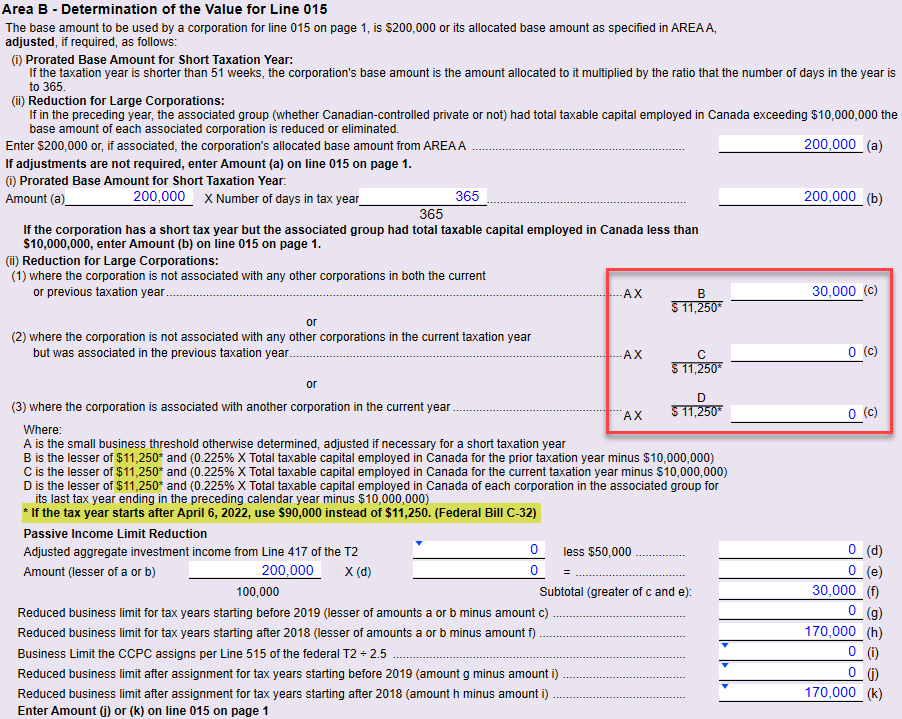

One of the measures in this Bill is the increase in the range of the small business deduction limit grind-down. Previously, a corporation’s small business deduction limit is reduced when a corporation’s taxable capital employed in Canada is between $10 million and $15 million. For tax years starting after April 6, 2022,

this range has now been increased to be between $10 million and $50 million to make small business deduction more accessible to corporations.

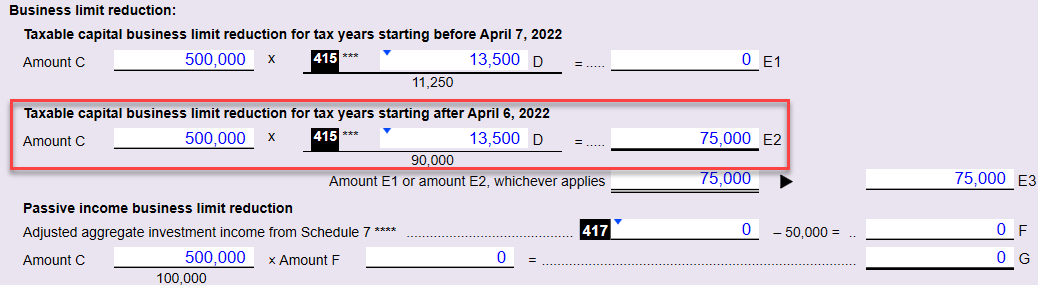

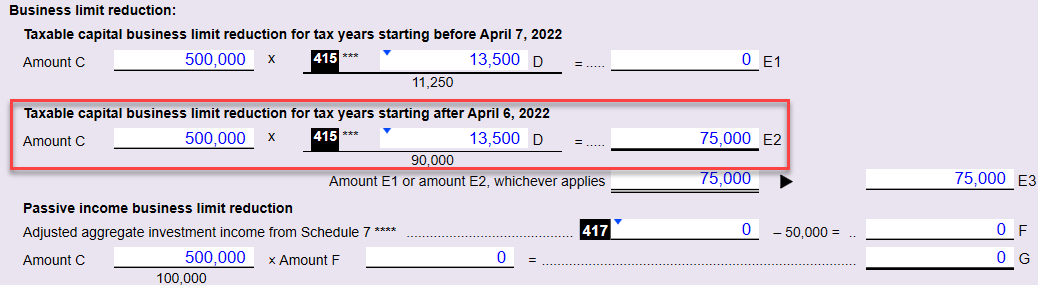

New lines on page 4 of the T2 jacket to calculate the business limit reduction:

Revised calculations on the following on page 2 of Alberta AT1 Schedule 1:

Customer Requests Template Changes

- T1—Added mention of the digital news subscription tax credit to the pre-season and post-season letters in 2021 and 2022 T1 returns.

- T1—Moved combined balance to the top of the joint and family invoice in 2022 T1 returns.

- T1—Improved the RRSP conditions in the RRSP contribution paragraph to better address RRSP overpayments. This change applies to the client and joint client letters in 2022 T1 returns.

Resolved Issues

- Customer Reported Fixed an issue where TaxCycle would not scroll through the list of workflow items using the mouse scroll wheel.

- All slips modules—Fixed carryforward for email and phone number of the signer.

Status of File Carryforwards from 2021 to 2022

As of this release, the following 2021 to 2022 carryforwards are up to date. However, we strongly recommend you only perform batch carryforward on tax modules that are ready for filing in the list, below. We anticipate the rest of the modules will be finalized later in January.

Ready for batch carryforward:

- T2/CO-17—Carryforwards from TaxCycle, ProFile®, Taxprep®, Cantax®, DT Max®, creating files with year ends up until May 31, 2023

- T4, T4A, RL-1/RL-2—TaxCycle, ProFile®, Taxprep®, Cantax®

- T4PS—TaxCycle, ProFile®, Taxprep®, Cantax®

- T4A-RCA—TaxCycle, ProFile®

- T5, RL-3—TaxCycle, ProFile®, Taxprep®, Cantax®

- T2202—ProFile®, Taxprep®

- T5018—TaxCycle, ProFile®, Taxprep®, Cantax®

- T3010/TP-985.22—TaxCycle, ProFile®, Taxprep®, Cantax®

- NR4—TaxCycle, ProFile®, Taxprep®, Cantax®

- Forms—TaxCycle, ProFile®, Taxprep®, Cantax®

- RL—TaxCycle, ProFile®, Taxprep®, Cantax®

Wait for batch carryforward:

- T1/TP1—TaxCycle, ProFile®, Taxprep®, Cantax®, DT Max®

- T3/TP-646, RL-16—TaxCycle, ProFile®, Taxprep®, Cantax®, DT Max®

- T5013/TP-600, RL-15—TaxCycle, ProFile®, Taxprep®, Cantax®

Status of 2022 Federal Returns and Slips

- T1—Preview of 2022 forms and calculations. You may begin data entry, but you must wait for CRA certification before filing.

- T2—Certified to file tax year ends up to May 31, 2023.

- T3RET—In progress. Wait to file 2022 returns.

- T3 slips—In progress. Wait to file 2022 slips.

- NR4 (in T3 module)—In progress. Wait to file 2022 returns.

- T4—Ready for filing upon system opening on January 9, 2023.

- T4A—Ready for filing upon system opening on January 9, 2023.

- T4PS—Ready for filing upon system opening on January 9, 2023.

- T4A-RCA—Ready for filing upon system opening on January 9, 2023.

- T5—Ready for filing upon system opening on January 9, 2023.

- T5013-FIN—Ready for filing upon system opening on January 9, 2023.

- T5013 slip summary—Ready for filing upon system opening on January 9, 2023.

- T5018—Ready for filing upon system opening on January 9, 2023.

- NR4 slips (standalone NR4 module)—Ready for filing upon system opening on January 9, 2023.

- T4A-NR slips (in NR4 module)—Ready for filing upon system opening on January 9, 2023.

- T3010—Ready for filing.

Status of 2022 Québec Returns and Relevés

- TP1—Preview of 2022 forms and calculations. Please wait for a future update before filing.

- TP-646—In progress. Wait to file 2022 returns.

- RL-16—In progress. Wait to file 2022 returns.

- TP-600—Ready for filing.

- RL-15—Ready for filing.

- RL-1—Ready for filing.

- RL-2—Ready for filing.

- RL-3—Ready for filing.

- RL-24—Ready for filing.

- RL-31—Ready for filing.

- TP-985.22—Ready for filing.