TaxCycle 12.1.49851.0—Download Only

This version of TaxCycle addresses recently reported customer concerns and updates several forms to the latest version available from the Canada Revenue Agency (CRA).

This is a download-only release!

We will not enable the automatic update for this version until after the T1 filing deadline on Monday May 1, 2023.

To install this version immediately, download the full setup program from our website. Or, you may deploy auto-update files from your network, available from the Auto-Update Files page.

Once we enable the automatic update for this version after the filing deadline, TaxCycle will prompt you to install it according to the priority set in your TaxCycle Options.

Release Highlights

This release resolves the following issues with immediate expensing calculations in TaxCycle T1:

- Applying the personal percentage twice to class 10.1 calculations, reducing the allowable claim by half.

- Applying the personal percentage twice for all classes of additions eligible for immediate expensing where IEL was not claimed.

- Not calculating the federal Immediate Expensing Limit (IEL) for class 50 in Québec returns.

- Not factoring inventory amounts into immediate expensing calculations for farming (T2042) or AgriStability and AgriInvest statements (T1163/4 and T1273/4).

If any of the above situations apply to your clients, we strongly recommend downloading and installing this update.

We have updated the following forms to the latest version available from the CRA:

- T1158, Registration of Family Support Payments

- RC325, Address change request

- PD24, Application for a Refund of Overdeducted CPP Contributions or EI Premiums

- T2058, Election on Disposition of Property by a Partnership to a Taxable Canadian Corporation

- T2059, Election on Disposition of Property by a Taxpayer to a Canadian Partnership

Masking of SIN or BN When Printing

Earlier this year, the CRA required that all certified software, including TaxCycle, produce paper copies of forms T1134 and T1135 showing the full Social Insurance Number (SIN) or Business Number (BN). This was to address the long delay in processing these forms when received with illegible SIN or BN, if they are able to process them at all.

Revenu Québec currently only accepts masked SINs or identification numbers on TP-1000, CO-1000 and, under certain circumstances, MR-69 forms. This release updates TaxCycle to ignore the print option to mask these numbers on all TP1 forms (except the TP-1000 and MR-69) unless the form was already electronically filed.

Template Changes

We improved the Engagement Letter (ELetter) in TaxCycle Forms so it can support multiple contacts and different types of taxpayers:

- Updated the Address snippet to only show the address for a T1 contact if T1 taxpayer type is selected.

- Updated the Salutation snippet to show both taxpayers in the address and salutation area if the file has two T1 contact people listed. Other types of taxpayers (T2, T5013, etc.) show “Dear client” for the salutation.

- Modified the wording in the first paragraph based on whether the engagement is for a T1 taxpayer or not.

- Fixed the names in the signature area to display the contact or authorized person for the correct taxpayer type.

- Added logic to show multiple signing fields if there are two T1 contacts or more than one authorized person for other taxpayer types.

Customer Requests

- Based on customer feedback, we made several improvements to QuickBooks® Invoicing and exporting to QuickBooks® Online Accountant and QuickBooks® Desktop.

Resolved Issues

- T1—Fixed an issue where TaxCycle incorrectly flagged an email address as invalid if it included a dash immediately before the @ symbol, which prevented signature requests from being sent to TaxFolder and DocuSign®.

- Customer Reported T5013—Resolved an issue where TaxCycle duplicated the rental income from the first property on the S1WS worksheet when multiple rental properties were entered.

- Customer Reported T5013 slips—Fixed an issue where TaxCycle incorrectly reported the non-resident individual partner tax ID number as a business number in the XML file.

- Customer Reported UHT-2900 data import—Fixed an error where importing data from an Excel® template which contained conditional statements would return #N/A in the import cell. Also added handling to ignore trailing spaces.

- Fixed the issue where emails generated from TaxCycle would show a black background on the text (as if redacted) when viewed in light mode on iOS, as reported on ProTaxCommunity.com.

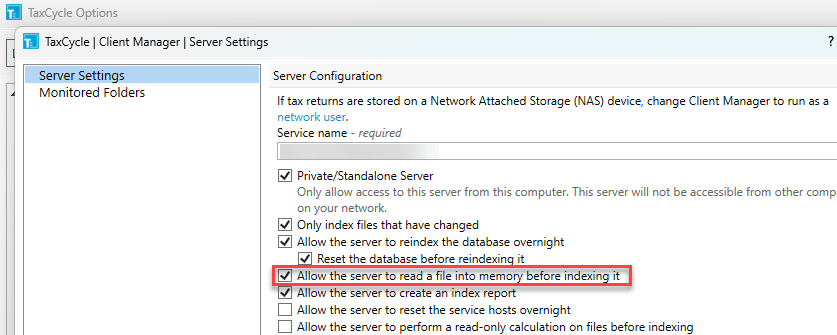

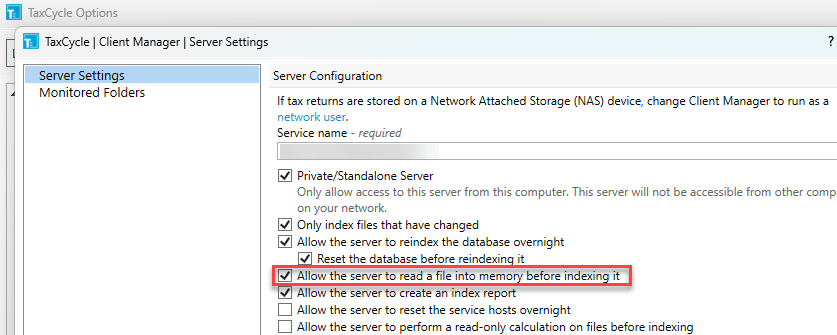

- Customer Reported Resolved an issue where TaxCycle failed to import GIFI files from Google Drive. If you store your files on Google Drive or a similar file storage service, we suggest checking the box to Allow the server to read a file into memory before indexing it in Client Manager Options.