TaxCycle 12.1.50574.0—T2 and AT1 Certification, T5013 and T3010 Update (Revised)

This certified release of TaxCycle T2 and AT1 extends the supported corporate tax year ends up to October 31, 2023. It also updates the T5013 and T3010 modules for 2023.

To install this version immediately, download the full installer from our website or request a free trial. Once we enable the automatic update for this version, TaxCycle will prompt you to install it according to the priority set in your TaxCycle Options. (To deploy auto-update files from your network, see the Auto-Update Files page.)

Release Highlights

Revisions

We originally released version 12.1.50435.0 on June 5, 2023, with the changes below. On June 21, 2023, we released version 12.1.50574.0 to resolve the following issue:

T2 and AT1 Filing Date Extension

TaxCycle supports the preparation and filing of federal T2 and Alberta AT1 corporate tax returns with tax year ends up to October 31, 2023.

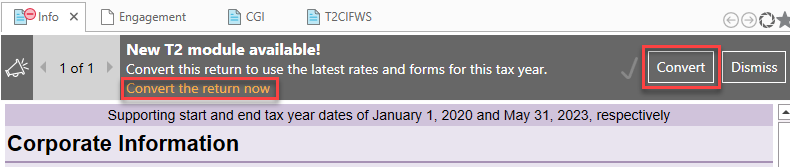

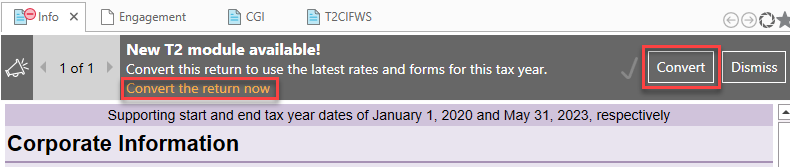

T2 File Conversion Message

When you open an in-progress T2 return, TaxCycle may prompt you to convert it to the new module. This message appears when the status of the T2 return you are working on is other than “Completed” and the corporation’s tax year starts on or after January 1, 2021.

- Click the Convert button or the link to convert the return to the newer module.

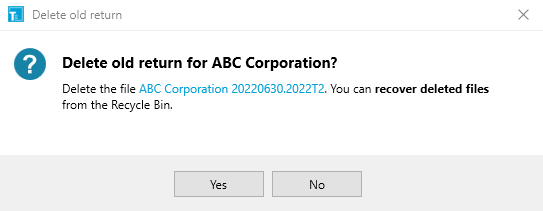

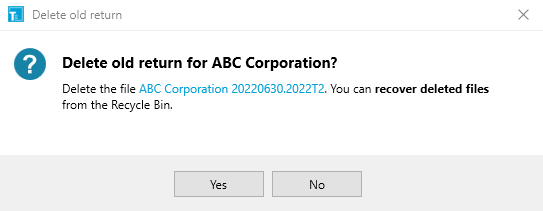

- Save the new return. You can choose to delete the old file by answering Yes to the Delete old return question in the dialog box that pops up. Once a file is deleted, it will no longer appear in the Client Manager or in the recent files list.

- The new file extension is .2023T2 and supports returns up to October 31, 2023. To learn more about T2 file name extensions, read the T2 File Name Extensions help topic.

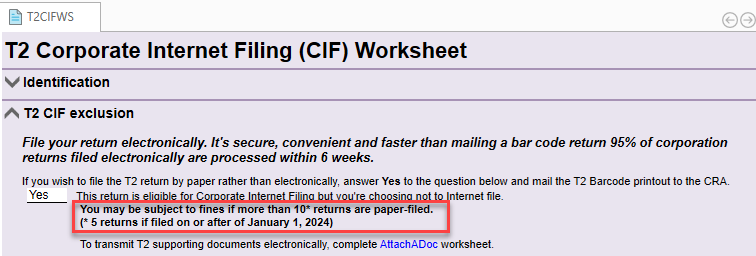

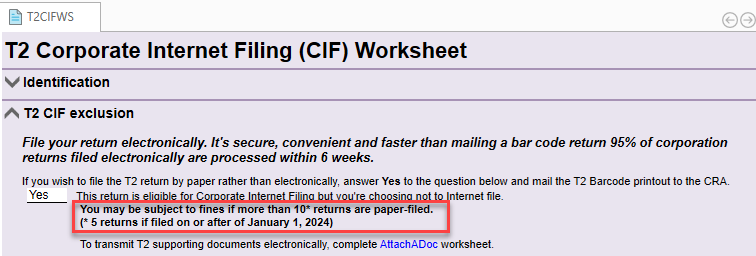

Federal Bill C-47 on Mandatory T2 Corporate Internet Filing

When a corporation’s gross revenue exceeds $1 million, the T2 return must be electronically filed unless the corporation is:

- an insurance corporation as defined in subsection 248 (1) of the Act;

- a non-resident corporation;

- a corporation reporting in functional currency as defined in subsection 261 (1) of the Act; or

- a corporation that is exempt under section 149 of the Act from tax payable.

Bill C-47 eliminates the $1 million threshold, making Internet filing for T2 returns mandatory regardless of the amount of gross revenue. This new rule applies to any T2 returns with a tax year starting after 2023.

As of January 1, 2024, a tax preparer may be subject to fines if they file more than five T2 returns by paper. We have adjusted the T2CIF worksheet accordingly.

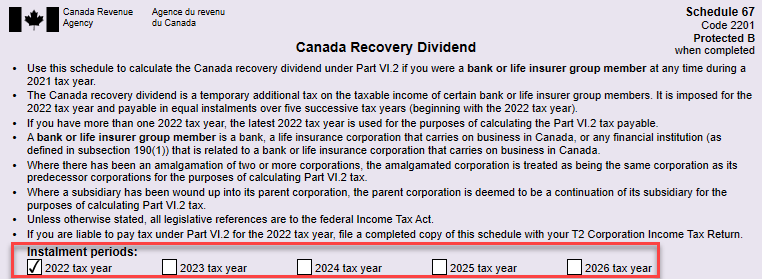

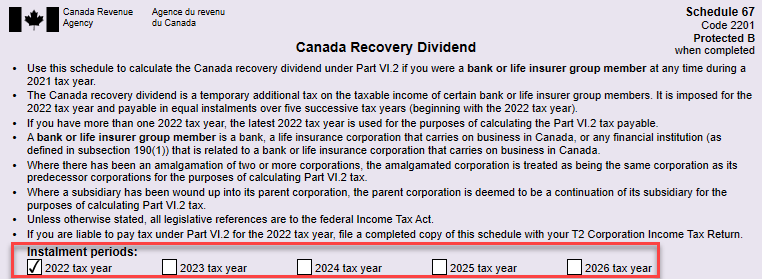

Schedule 67 (Canada Recovery Dividend)

- The Canada Recovery Dividend is a one-time tax on banking and life insurance groups. It is calculated as 15% of the average Canadian-based taxable income over 2020 and 2021 minus a $1 billion deduction. It is imposed for the 2022 taxation year and will be paid in equal instalments over five years.

- Added five check boxes above Part 1 of Schedule 67. When you check the box for the 2022 tax year and fill out the form, TaxCycle calculates the Canada Recovery Dividend in Part 3 of Schedule 67.

- You must submit Schedule 67 to the Canada Revenue Agency (CRA) only for the 2022 tax year. However, in subsequent years, the second and subsequent instalment payments will still be calculated in Part 3 and will transfer to the T2 jacket on line 725. But, in those subsequent years, you must not submit Schedule 67 to the CRA.

- Added a Schedule 67 section to the CGI worksheet to allocate the $1 billion exemption among the members of the related group.

Schedule 68 (Additional Tax on Banks and Life Insurers)

- This is a new tax imposed on members of bank and life insurer groups for tax years that end after April 7, 2022. A $100 million taxable income exemption is allocated by agreement among group members. For a tax year that includes April 7, 2022, the additional tax is prorated based on the number of days in the tax year after April 7, 2022.

- TaxCycle calculates the tax in Part 2, which flows to the T2 jacket line 565.

- Added a Schedule 68 section to the CGI worksheet to allocate the $100 million exemption among the members of the related group.

Schedule 432 (Additional Certificate Numbers for the British Columbia Clean Buildings Tax Credit)

- The Clean buildings tax credit is a refundable income tax credit for qualifying retrofits that improve the energy efficiency of eligible commercial and multi-unit residential buildings with four or more units. The retrofit must improve the energy efficiency of an eligible building and meet energy-use targets. The credit amount is 5% of qualifying expenditures paid on the retrofit.

- You must make or incur the expenditures under the terms of an agreement entered into after February 22, 2022, and paid before April 1, 2025.

- If there is more than one certificate, complete Schedule 432. However, if there is only one certificate, enter the certificate number directly on line 884 in Schedule 5.

Updated T2 Forms

Schedule 200 (T2 jacket)

- Added the Japanese yen (05 JPY) to the currency field on line 079.

- Added the following new lines:

- Line 276 (Schedule 68 check box)

- Line 565 (Schedule 68)

- Line 616 (Schedule 27)

- Line 925 (RepID)

- Removed lines 460, 465 and 480.

Schedule 141

- Substantially revised Schedule 141.

- Updated the wording of question 111 in Part 1.

- Added the following lines:

- Part 2—lines 300, 301, 302, 303, 304 and 305

- Part 5—lines 310, 311, 312, 313 and 314

- Removed lines 110 and 198.

Schedule 5

- Removed lines 403, 454, 623 and 326.

- Added line 884 from BC’s Schedule 432.

- Added line 696 (from Yukon’s Schedule 444) to calculate the Yukon Business Carbon Price Rebate.

Schedule 27

- Updated to the final version dated February 21, 2023.

- Removed the calculation for amount 14C in Part 14.

- Revised Part 15 and Part 16.

Ontario Schedule 500 (S500)

- Ontario Bill-85, dated March 23, 2023, proposed to extend the phase‐out range for Ontario’s small business tax rate to between $10 million and $50 million of taxable capital employed in Canada. We have revised the calculation in Part 2 accordingly.

- This measure applies to taxation years that begin on or after April 7, 2022, for consistency with the federal effective date.

Schedule 38

Schedule 53

Schedule 387

Schedule 394

Schedule 430

Schedule 444

- Added sections 1 through 3 for the Yukon Business Carbon Price Rebate.

Alberta AT1 Form Changes

AT1 Schedule 13, Alberta Capital Cost Allowance (CCA)

AT1 Schedule 100 (AT1Exempt)

AT1 Schedule 1

AS29Project worksheet (AT4970)

Removed T2 Schedules

- Schedule 504, Ontario Resource Tax Credit

- Schedule 552, Ontario Apprenticeship Training Tax Credit

Rollover of T5013/TP-600 to 2023

The new module for TaxCycle T5013 allows you to begin data entry for 2023 federal and Québec partnership returns. Please note the following:

- You can carry forward 2022 T5013 returns from TaxCycle, including the creation of stub period returns. Please wait to carry forward competitor files.

- You can use this module to file partnership returns with fiscal year ends in 2023.

- The government forms are the 2022 forms updated to include 2023 indexed amounts and budget changes announced or estimated based on the information we have at this time. A review message appears on the year-end date field and in a bulletin at the top of the forms to remind you of this.

- This module permits CRA Internet File Transfer (XML) and transmission of RL slips to Revenu Québec.

- The T1135 in this module is certified for filing for year ends on or before May 31, 2023.

TaxCycle T5013 Updates

The following changes apply to the 2023 T5013 module only, unless otherwise indicated.

- Customer Request Added a review message to the Info worksheet to verify the residency of the partnership when a partner resides outside of Canada.

- Customer Request Added a new method to set the country of residence for partners as something other than the mailing address.

- Customer Reported Fixed the legislated filing date where all partners are corporations and the year-end date is after October of the filing year.

- Customer Reported Updated the wording in the client letter (CLetter) to reflect that not all partners are individuals.

- Resolved an issue where TaxCycle did not correctly transfer rental income to the TPFWS worksheet when there were multiple rental properties for the RL-15 slip calculations.

- Customer Reported Updated the variance on line 220 of the T5013 and line H of the RL-15 to take into account limited losses that cannot be carried forward by partners that are partnerships (tiered partnerships).

TaxCycle T3010 Updates

This version of TaxCycle updates the T3010 module for 2023. If you need to file a T3010 return for a prior year, enter the prior tax year when creating a new T3010 return from the Start screen.

- T3010 jacket—Added question C16 (lines 5840 to 5843) and a new line 5045 that populates the total amount of grants made to non-qualified donees from the new form T1441 (see below).

- Note that answering Yes to question C16 requires you to complete lines 5841 through 5843.

- The T3010 jacket populates line 5045 in either Section D or Schedule 6, depending on how you answer the charity question on the Info worksheet.

- T3010 Summary—Added new fields to summarize the amounts from line 5045 (grants to non-qualified grantees) and line 5050 (gifts to qualified donees).

- 2 Year and 5-Year Comparative Summary—Added a new row for total grants reported.

- T3010—Added a Privacy statement check box under Section F of the T3010 form, as required by the CRA. TaxCycle displays a caution review message if you do not check this box.

- Added electronic signature support to forms AUT01 and AUT01X.

Forms Added

New! T1441 Qualifying Disbursements: Grants to Non-Qualified Donees (Grantees)

- You must complete this form if you answer Yes to the question on line 5841 of the T3010. This means that the charity provided grants to any grantees totalling more than $5,000. Note that TaxCycle counts all amounts from both cash and non-cash disbursements for the total.

- TaxCycle will trigger a caution review message if you answer Yes to line 5841 but do not report any amounts on form T1441.

- Form T1441 contains an expanding table so you can enter as many grantee rows as needed.

- The section at the bottom of the T1441 is for review purposes only and does not show up when the form is printed.

Forms Removed

RC232 Corporations Information Act Annual Return for Ontario Not-for-Profit Corporations

Note that the T3010 return must be paper-filed. For more information on how to file a T3010 return in TaxCycle, see our T3010 Registered Charity Information Return help topic.

Underused Housing Tax (UHT-2900)

This version of TaxCycle also includes some changes related to the Underused Housing Tax (UHT-2900).

- T2 and T5013—Added a new question to the Filing section of the Info worksheet to track whether filing a UHT-2900 return is required. Answering Yes to this question adds a new paragraph in the client letter (CLetter) to communicate the filing obligation and deadline.

- Client Manager—Updated the Client Manager to show queries based on the new UHT-2900 field from the Info worksheet.

- Customer Request Added smart copy/paste support for UHT forms.

Customer Requests

- Client Manager—Added a Household and Household Dependants column to the Client Manager search results. The Household column lists every member of the household including dependants entered on the dependant worksheet (Dep), while the Household Dependants column lists all dependants including those entered on the Dep worksheet.

- T1—TaxCycle now displays a review message when a rebate is claimed on the GST370 and there is no prior year GST rebate included in the income.

- TaxCycle Forms—Updated form T1261 Application for a Canada Revenue Agency Individual Tax Number (ITN) for Non-Residents to the latest version available from the CRA.

- TaxCycle Forms—Added form T2055 Election in Respect of a Capital Gains Dividend Under Subsection 131(1).

Resolved Issues

- Customer Reported TaxCycle Forms—Fixed an issue where review messages for T2057, T2058 and T2059 incorrectly highlighted the wrong column for total fair market value (FMV) of the consideration received.

- Customer Reported TaxCycle Forms—Fixed an issue related to the transfer of the corporate business number (BN) from the Info worksheet to the T106S.

- T1—TaxCycle no longer includes the spouse or common-law partner’s net income in the calculation of family net income for the purposes of the Ontario Seniors Care at Home Tax Credit if either the client or their spouse passed away before December 31, 2022.

- T1—The calculation of the Employment Insurance (EI) benefits repayment at line 23500 no longer reduces the net regular EI benefits by the CERB repayment amounts included in box 30 of the T4E slip.