Reaccelerated Investment Incentive Property (RIIP) in TaxCycle

We are providing an update on the Reaccelerated Investment Incentive Property (RIIP) measures introduced in Budget 2025 and subsequently in federal Bill C-15.

At the time of writing this article, Bill C-15 has not received Royal Assent. The Canada Revenue Agency (CRA) has indicated that the next version of T2 Schedule 8 containing new columns for RIIP will be officially introduced and processed in the CRA’s T2 system update in May of this year.

However, based on our latest communication, the CRA has advised that they are currently administering RIIP before Bill C-15 receives Royal Assent. In order to claim CCA from RIIP, the CCA would have to be manually calculated and overridden in T2 Schedule 8.

If you wish to incorporate RIIP in your clients’ T2 returns now, you can follow the examples and instructions in our help topic to manually modify Schedule 8 to apply RIIP measures.

We will update this article as soon as we receive more information from the CRA. Please stay tuned to the TaxCycle news feed for the latest developments.

Legislative Background

Bill C-15 (“An Act to implement certain provisions of the budget tabled in Parliament on November 4, 2025”) was introduced in the House of Commons following the delivery of Budget 2025. You can follow the progress of the bill on LEGISinfo.

The purpose of the RIIP measures is to restore and extend the accelerated CCA measure (AIIP or “Accelerated Investment Incentive Property” rule) previously announced in 2018 and which was set to expire after 2027.

Application in TaxCycle

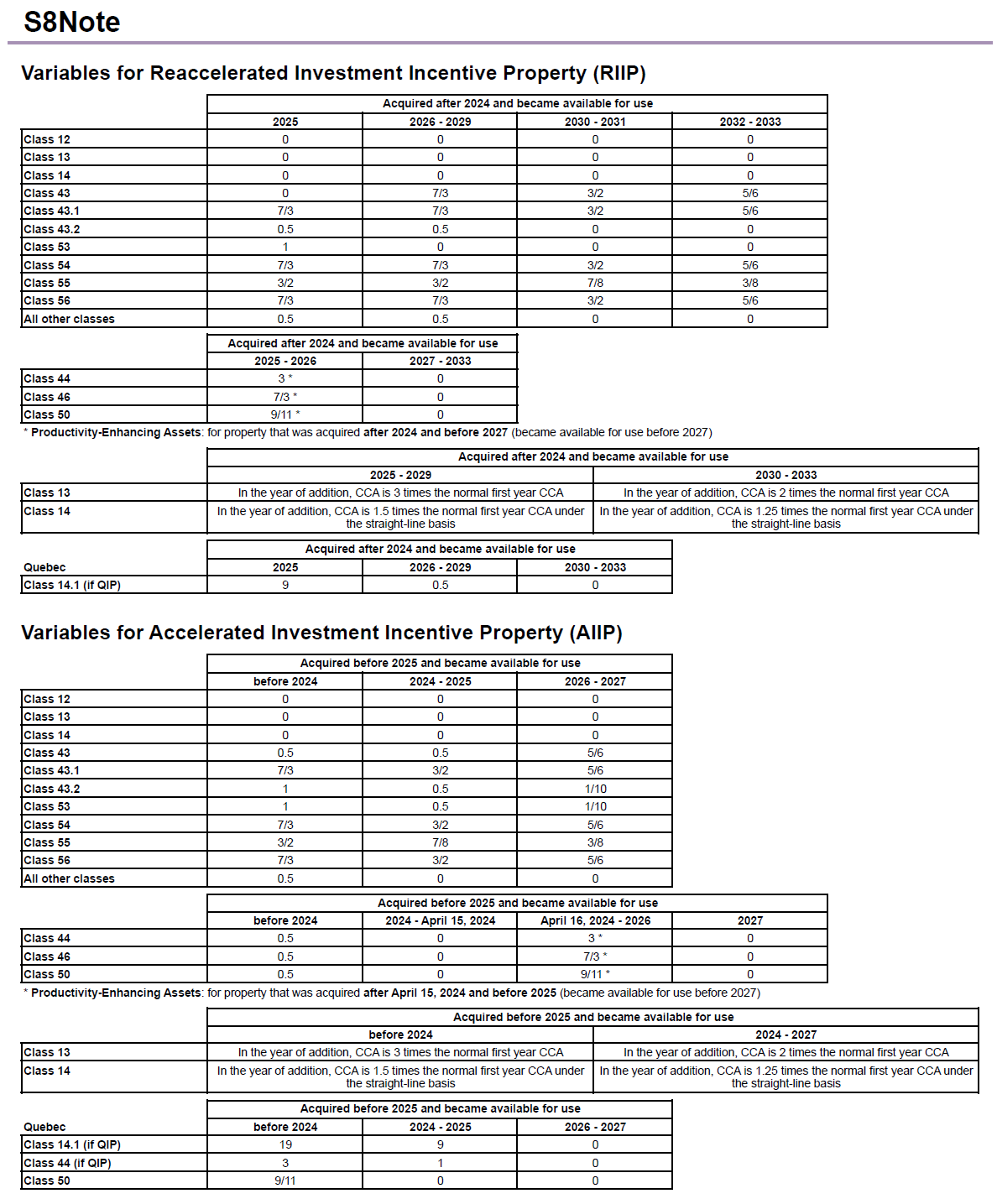

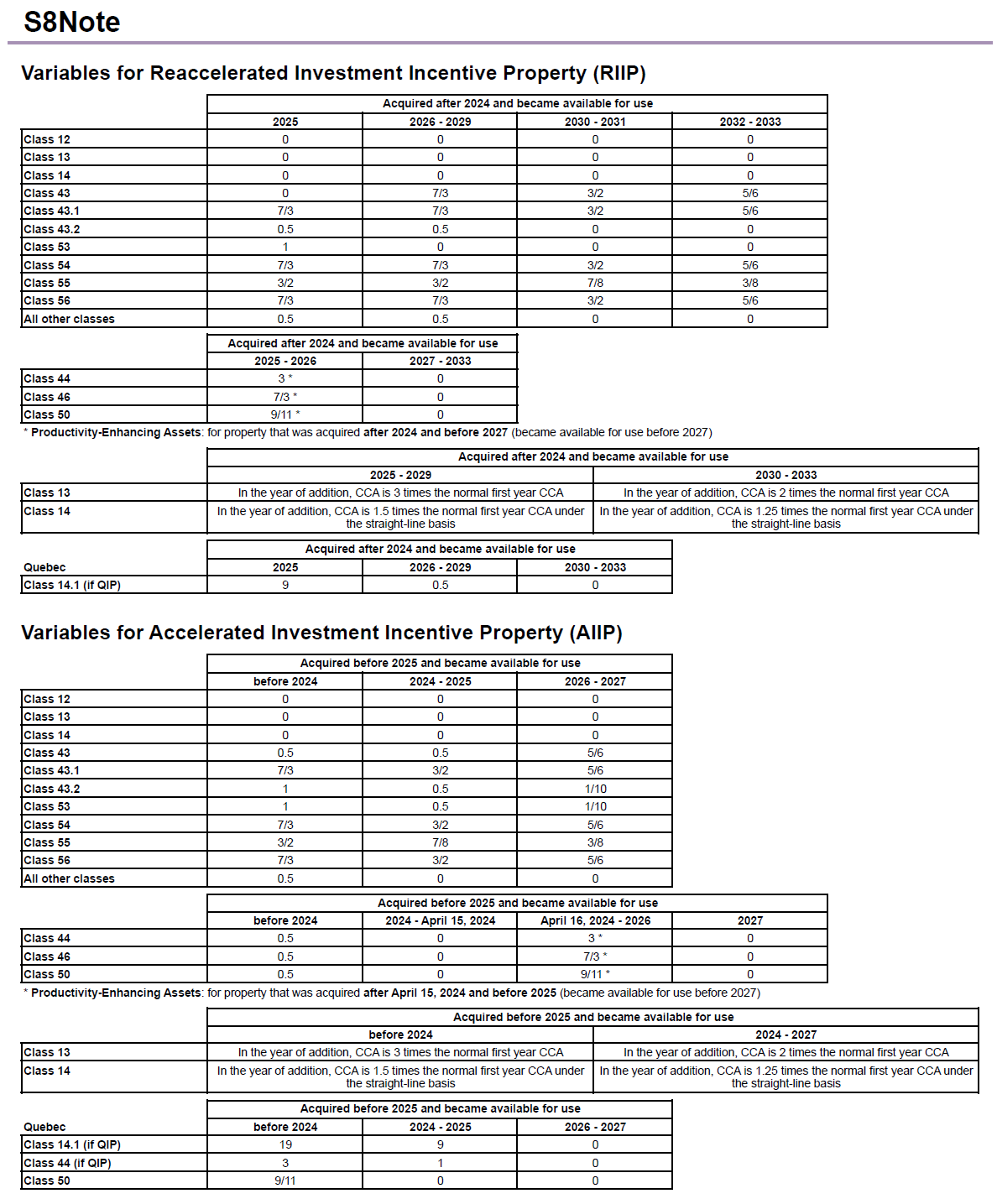

The mechanics of the CCA calculation for RIIP are very similar to those of the AIIP calculations. A specific relevant factor or multiplier is applied to the additions of RIIP. The result is an upward adjustment to UCC for the sole purposes of calculating CCA. Download a copy of the listing of relevant factors here.

We have also included the reference to relevant factors on the S8Note in TaxCycle T2 and T5013 2025, and the RIIPNote in T1 2025 and T3 2025.

For examples of how to apply RIIP in TaxCycle T2, please refer to the Reaccelerated Investment Incentive Property (RIIP) help topic. While the examples provided are for T2 returns, they can easily be adapted for T1, T3 or T5013.

Helpful Links