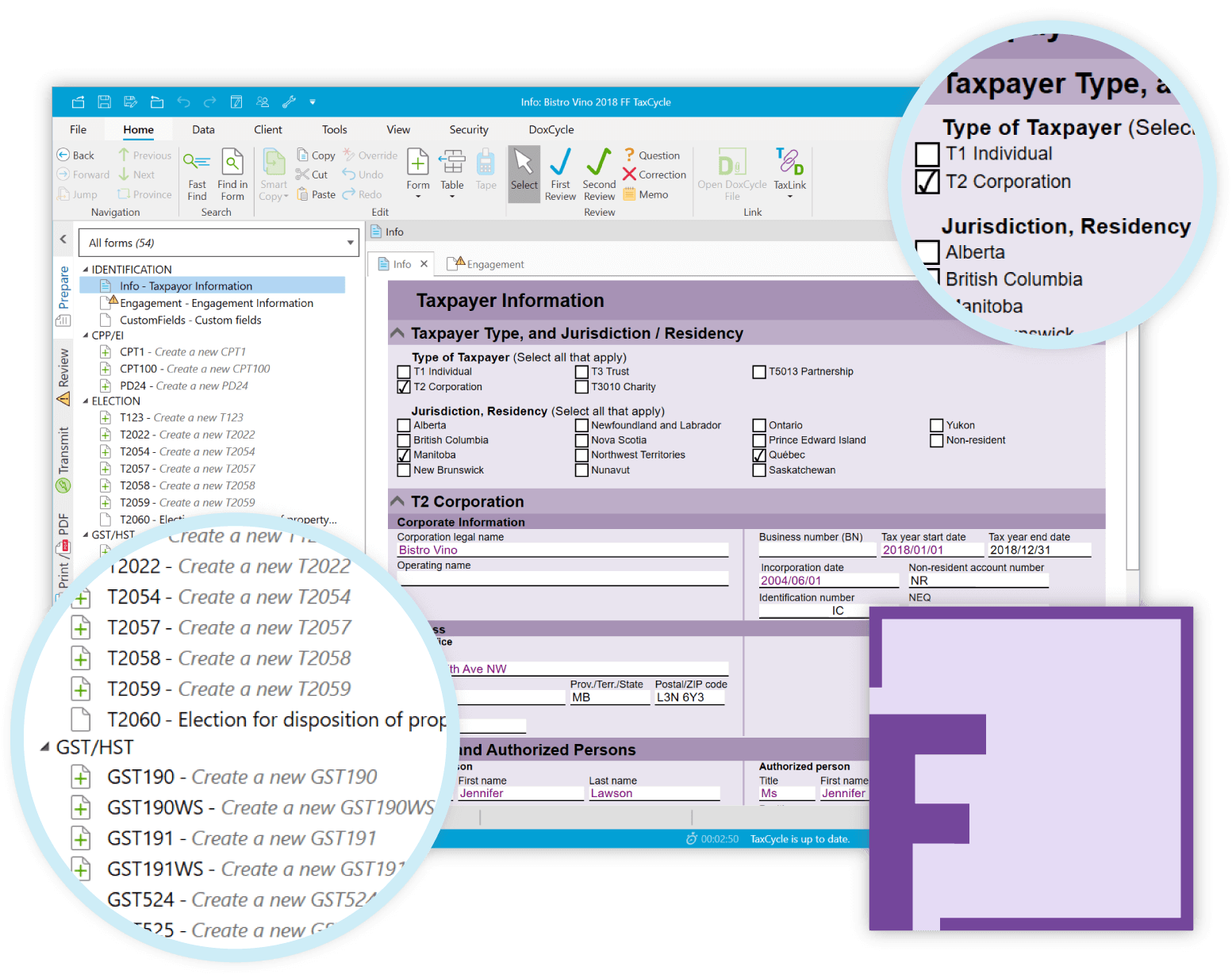

The TaxCycle Forms module allows you to prepare a variety of government forms for your clients.

Choose the type of taxpayer (individual, corporation, etc.) and jurisdiction on the Info worksheet, then prepare unlimited forms. Or, create a Forms file from another TaxCycle module.

TaxCycle Forms is included in the Complete Paperless Tax Suite and is also available as a stand-alone module.

Find out for yourself why thousands of tax preparers have already switched. Get up and running in just 10 minutes with your free trial of the TaxCycle Suite. Seamlessly carry forward returns from DT Max®, Cantax®, Taxprep® and ProFile® software.

| FILES | |

|---|---|

| Number of files | Unlimited |

| Years | 2015 onward |

| CARRYFORWARDS | |

| TaxCycle Forms | |

| IDENTIFICATION | |

| Info — Taxpayer information | |

| Engagement — Engagement information | |

| Workflow — Workflow summary | |

| CustomFields — Custom fields | |

| AUTHORIZATION FORMS | |

| AUT01 — Authorize a representative for access by phone and mail | |

| AUT01X — Cancel authorization for a representative | |

| SERs — Special Elections and Returns transmission service | |

| SERsSupport — Special Elections and Returns, and Submit E-documents web services | |

| SERsDeclaration — Special Elections and Returns (SERs) terms and conditions | |

| CPP/EI FORMS | |

| CPT1 — Request for a ruling as to the status of a worker under the Canada Pension Plan and/or Employment Insurance Act | |

| CPT100 — Appeal of a ruling under the Canada Pension Plan and/or Employment Insurance Act | |

| PD24 — Application for a refund of overdeducted CPP contributions or EI premiums | |

| ELECTION | |

| T123 — Election on disposition of Canadian securities | |

| T1521 — Election for a Pertinent Loan or Indebtedness (PLOI) under Subsection 15(2.11) | |

| T2022 — Election in Respect of the Sale of Debts Receivable | |

| T2027 — Election to Deem Amount of Settlement of a Debt or Obligation on the Winding-Up of a Subsidiary | |

| T2054 — Election for a Capital Dividend Under Subsection 83(2) | |

| T2055 — Election in Respect of a Capital Gains Dividend Under Subsection 131(1) | |

| T2057 — Election on Disposition of Property by a Taxpayer to a Taxable Canadian Corporation | |

| T2058 — Election on Disposition of Property by a Partnership to a Taxable Canadian Corporation | |

| T2059 — Election for Disposition of Property by a Taxpayer to a Canadian Partnership | |

| T2060 — Election for Disposition of Property Upon Cessation of Partnership | |

| T2060SA — Schedule A - Election on Disposition of Property by a Taxpayer to a Canadian Partnership | |

| T2066 — Election for Immediate or Gradual Intergenerational Business Transfer | |

| T2123 — Dividend Substitution Election Under Subsection 212.3(3) | |

| T2183 — Information Return for Electronic Filing of Special Elections | |

| T2311 — Election for Pertinent Loan or Indebtedness (PLOI) under Subsection 212.3(11) | |

| UHT183 — Authorization to Electronically File the Underused Housing Tax Return and Election Form | |

| UHT-2900 — Underused Housing Tax Return and Election Form | |

| GST/HST FORMS | |

| GST20 — Election for GST/HST Reporting Period | |

| GST44 — Election Concerning the Acquisition of a Business or Part of a Business | |

| GST60 — GST/HST Return for Acquisition of Real Property | |

| GST66 — Application for GST/HST Public Service Bodies' Rebate and GST Self-Government Refund | |

| GST70 — Election or Revocation of an Election to Change a GST/HST Fiscal Year | |

| GST71 — Notification of Accounting Periods | |

| GST74 — Election and Revocation of an Election to Use the Quick Method of Accounting | |

| GST159 — Notice of Objection | |

| GST190 — GST/HST New Housing Rebate application for houses purchased from a builder | |

| GST190A — GST/HST New Housing Rebate, appendix A | |

| GST190NovaScotia — GST190 Nova Scotia rebate schedule | |

| GST190Ontario — GST190 Ontario rebate schedule | |

| GST190WS — GST190 calculation worksheet | |

| GST191 — GST/HST New Housing Rebate application for owner-built houses | |

| GST191Ontario — RC7191-ON, Ontario New Housing Rebate schedule | |

| GST191WS — GST191 Construction summary worksheet | |

| GST524 — GST/HST New residential rental property rebate application | |

| GST524Ontario — GST524 Ontario rebate schedule | |

| GST525 — GST525 Supplement to the new residential rental property rebate application (co-op and multiple units) | |

| RC4616 — Election or Revocation of an Election for Closely Related Corporations and/or Canadian Partnerships to Treat Certain Taxable Supplies as Having Been Made for Nil Consideration for GST / HST Purposes (formerly GST25) | |

| RC7066 — Provincial schedule - GST/HST public service bodies' rebate | |

| NON-RESIDENT | |

| NR6 — Undertaking to file an income tax return by a non-resident receiving rent from a real or immovable property or receiving a timber royalty | |

| NR73 — Determination of Residency Status (Leaving Canada) | |

| NR7-R — Application for Refund of Part XIII Tax Withheld | |

| NR301 — Declaration of eligibility for benefits (reduced tax) under a tax treaty for a non-resident person | |

| NR302 — Declaration of eligibility for benefits (reduced tax) under a tax treaty for a partnership with non-resident partners | |

| NR302WorksheetA — Part XIII effective rate of withholding | |

| NR302WorksheetB — Exempt income worksheet | |

| NR303 — Declaration of eligibility for benefits (reduced tax) under a tax treaty for a hybrid entity | |

| NR303WorksheetA — Part XIII effective rate of withholding | |

| NR303WorksheetB — Exempt income worksheet | |

| R102-R — Regulation 102 waiver application | |

| R105 — Regulation 105 waiver application | |

| R105-S — Regulation 105 Simplified Waiver Application for Non-resident Artists and Athletes Earning No More Than CAN $15,000 | |

| RC473 — Non-resident employer certification | |

| Rental worksheet | |

| T106 — Information return of non-arm's length transactions between non-residents (slip) | |

| T016S — Information return of non-arm's length transactions between non-residents (summary) | |

| T1261 — Application for a Canada Revenue Agency individual tax number (ITN) for non-residents | |

| T2062 — Request by a non-resident of Canada for a certification of compliance related to the disposition of taxable Canadian property | |

| T2062A — Request by a non-resident of Canada for a certificate of compliance related to the disposition of taxable Canadian property | |

| T2062A Schedule 1 — Disposition of Canadian resource property by non-residents | |

| OTHER FILING | |

| RC1 — Request for a business number and certain program accounts | |

| RC65 — Marital Status Change | |

| RC66 — Canada Child Benefits Application | |

| RC66SCH — Status in Canada / Statement of Income for the Canada Child Benefits Application | |

| RC145 — Request to Close Business Number Program Accounts | |

| RC199 — Voluntary disclosures program (VDP) taxpayer agreement | |

| RC243 — Tax-Free Savings Account (TFSA) Return | |

| RC312 — Reportable Transaction and Notifiable Transaction Information Return | |

| RC681 — Request to Activate Paper Mail for My Business | |

| T400A — Objection to a notice of assessment or a notice of determination | |

| T1134 — Information return relating to controlled and not-controlled foreign affiliates | |

| T1134Sup — Information return relating to controlled and not-controlled foreign affiliates worksheet | |

| T1141 — Information return in respect of contributions to non-resident trusts, arrangement or entities (2007 or later taxation years) | |

| T1141Sup — Information return in respect of contributions to non-resident trusts, arrangement or entities (2007 or later taxation years) worksheet | |

| T1142 — Information return in respect of distributions from indebtedness to a non-resident trust | |

| T1142Sup — Information return in respect of distributions from indebtedness to a non-resident trust worksheet | |

| T1158 — Registration of Family Support Payments | |

| UHT0001 — Objection – Underused Housing Tax Act | |

| BRITISH COLUMBIA | |

| FIN146 — Authorization or cancellation of a representative | |

| FIN196 — Application for a refund of logging tax | |

| FIN542P — Logging return of income for processors | |

| FIN542S — Logging tax return of income | |

| QUÉBEC | |

| CO-502 — Election in respect of a dividend paid out of a capital dividend account | |

| FP-2074 — Election or revocation of election respecting the quick method of accounting | |

| LM-1.A-V — Request for Cancellation or Variation of Registration | |

| TP-518 — Transfer of property by a taxpayer to a taxable Canadian corporation | |

| TP-529 — Transfer of property by a partnership to a taxable Canadian corporation | |

| TP-614 — Transfer of property to a Canadian partnership | |

| TP-1097 — Notice of disposition or proposed disposition | |

| TP-1086.R.23.12 — Costs incurred for work on an immovable | |

| SUMMARIES | |

| Memos — Memo summary | |

| Tapes — Tape summary | |