Updated: 2024-02-22

The Canada Revenue Agency (CRA) requires that a taxpayer sign the appropriate sections on the T183 Information Return for Electronic Filing of an Individual’s Income Tax and Benefit Return before a preparer can electronically file on their behalf. For T2 corporate tax returns, the equivalent form is the T183CORP.

This form is used to:

- Provide authorization to use T1 EFILE. Learn more in the T1 EFILE help topic.

- Register taxpayers for online mail.

- Request a notice of assessment or notice of reassessment through download into TaxCycle. Learn more in the Express NOA help topic.

You can send this form for electronic signature from TaxCycle, using TaxFolder or DocuSign®. It is important that you keep this signed T183 in your files should the CRA ask for it. They regularly check with preparers and request a signed copy.

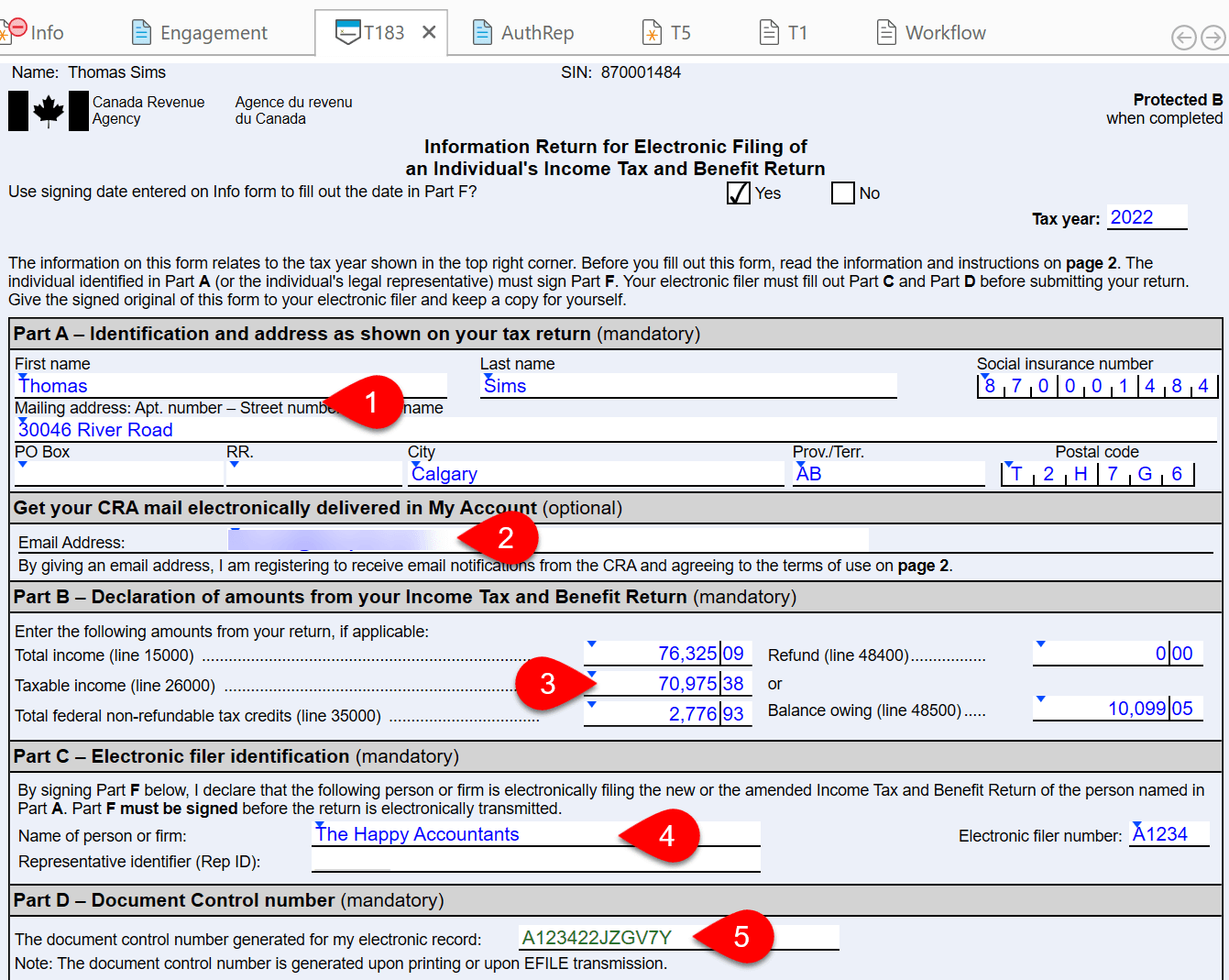

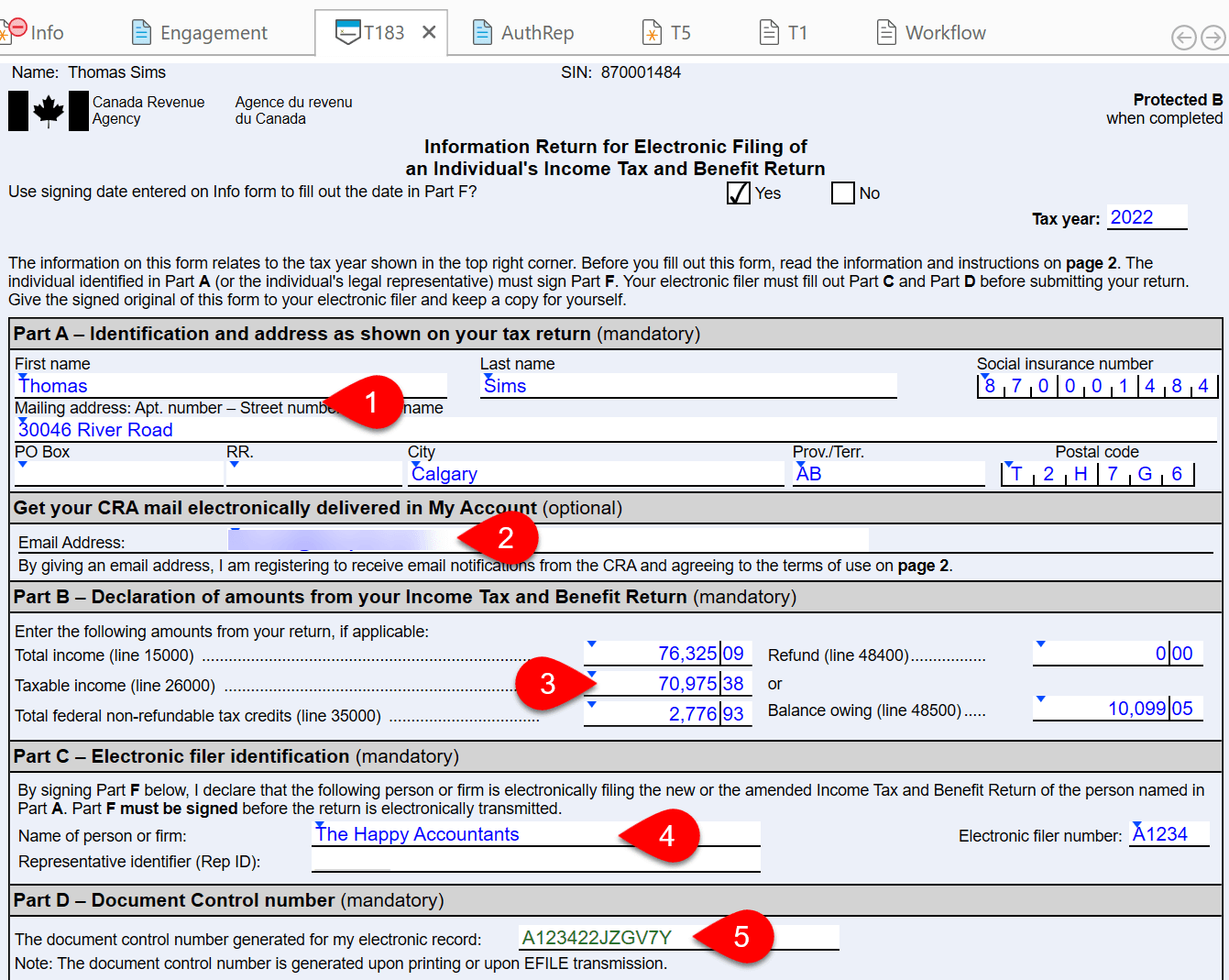

Parts A, B, C and D

The information in Parts A and B flows from other areas in the TaxCycle T1 return.

- If you need to make changes to the contact information in Part A, return to the Info worksheet.

- If your client is registering for CRA online mail or updating their email address, their email address shows on the T183. (See the section on Part E, below.)

- Most of the amounts in Part B flow from the T1 Jacket. To drill down to see the source of amounts, double click on the field.

- Part C shows the information about the electronic filer. The Name of person or firm, Rep ID and the Electronic filer number fields flow from the Engagement worksheet. See the T1 EFILE help topic and the Preparer and Firm Options help topic to learn how to set these options.

- Part D shows the Document Control Number. TaxCycle generates this unique number when you print the form or when you transmit the form using T1 EFILE. The CRA uses it for reference.

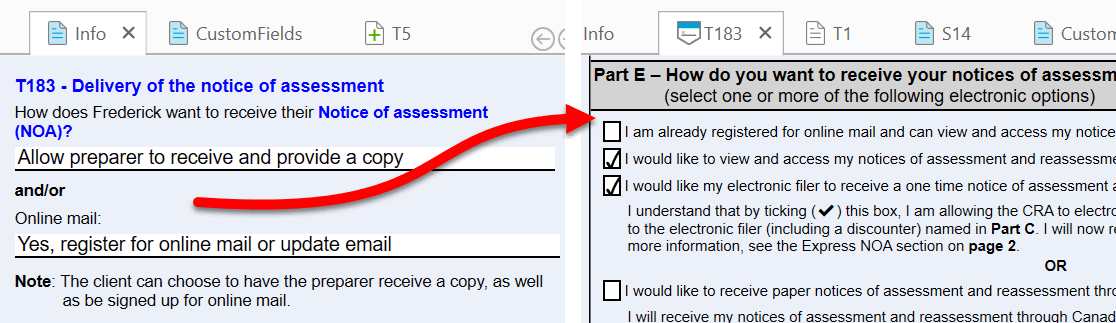

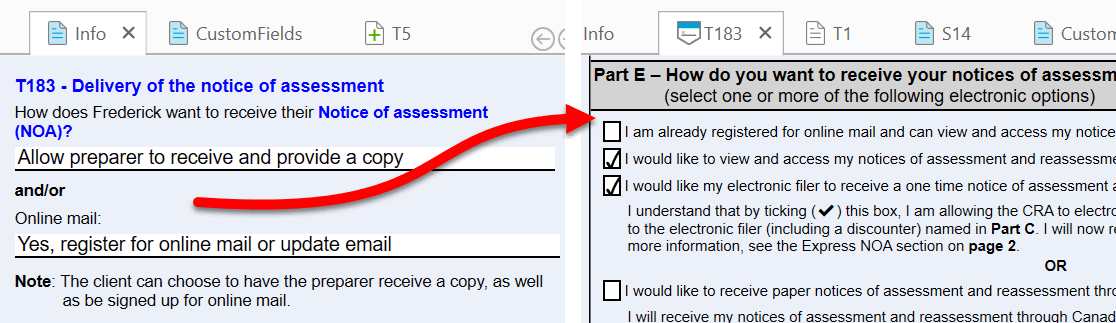

Part E—Online Mail and Notice of Assessment

Part E of the T183 allows taxpayers to indicate how they wish to receive their notices of assessment and reassessment, and to register for online mail.

The questions in Part E share their responses with those in the Filing section of the Info worksheet. Changing the selections on the Info worksheet also changes the T183, and vice versa:

You must make at least one selection from the following options:

- If the taxpayer is already registered for online mail, their notice of re/assessment, and any future correspondence eligible for online delivery are currently not printed and mailed to them. Auto-fill my return (AFR) data includes a flag to indicate whether a taxpayer is registered for online mail. You cannot choose to “already registered for online mail” and “receive paper copies by Canada Post.” Selecting both triggers a review message in TaxCycle.

- Sign up to receive online mail flows the taxpayer’s email address the Info worksheet to the T183 form (see the section on Part A, B, C and D above). They will receive an email when mail is waiting for them—such as their notice of assessment—and will then need to log in to the CRA My Account for Individuals to view it. They will no longer receive their notice of re/assessment, and any future correspondence eligible for online delivery by paper mail. You cannot sign a taxpayer up for online mail and check the box for them to receive paper copies by Canada Post. TaxCycle will show a warning message if you do so.

- Authorize the electronic filer/preparer to collect the taxpayer’s notice of assessment via download from the CRA using the Express NOA service. See the Express NOA help topic to learn how to do this through TaxCycle. (To receive notices of assessment on behalf of your clients, you must have valid authorization on file with the CRA. Read the AuthRep Authorization/Cancellation Request help topic to learn how to obtain this authorization.) If a taxpayer chooses Express NOA:

- The CRA will not send the taxpayer a paper copy of the notice of assessment or reassessment.

- If the taxpayer is registered to receive online mail, the notice of assessment is made available electronically to the electronic filer and the taxpayer will receive an email notification to inform them that online mail is available to view in My Account. (We recommend the taxpayer be registered for online mail if you make this selection.)

- If the taxpayer is getting a tax refund and he/she has not signed up for direct deposit, the notice is made available to the electronic filer and the refund cheque will be mailed to the taxpayer. (If the return is being discounted, the refund and notice of assessment will be sent to the discounter.)

- This authorization is valid for current tax year assessments and reassessments only, and will not affect all other correspondence.

- Receive paper copies by letter mail. You cannot select this option if the taxpayer is registered or registering for online mail. TaxCycle will show a warning message if you do so.

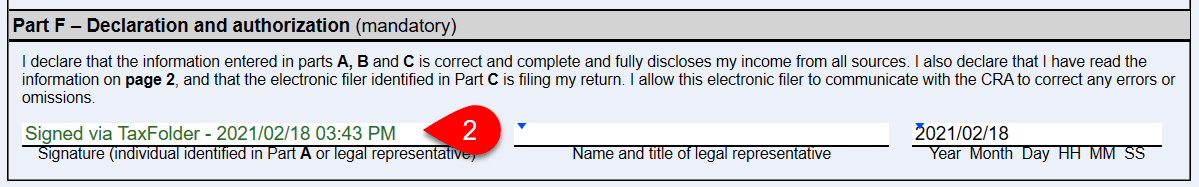

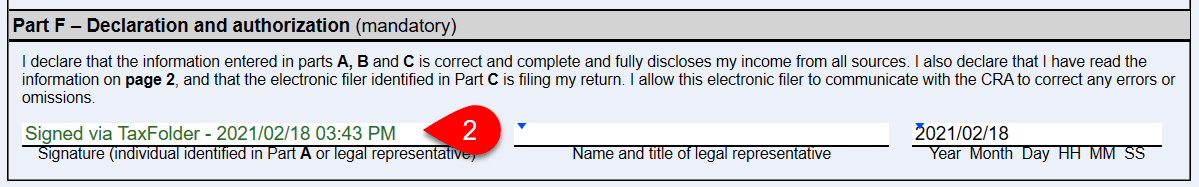

Part F—Declaration and Authorization

The taxpayer must sign the T183 before you can transmit the return using T1 EFILE.

As a temporary measure, the CRA permits electronic signatures on this form. When collecting an e-signature, the T183 form must report the date and time the form was electronically signed. This information is then transmitted to the CRA through T1 EFILE. To learn how to send a document for signature, see the Request E-signatures Using TaxFolder and Electronic Signatures With DocuSign® help topics.

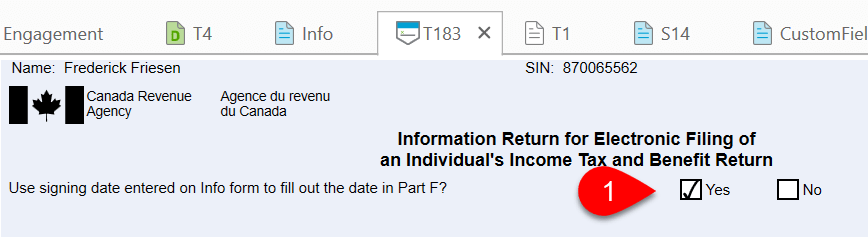

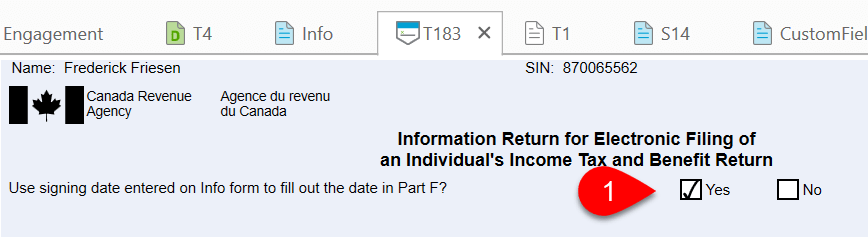

Record the Signing Date

TaxCycle provides several options for entering the signing date on this form:

- Answer Yes to the question at the top of the T183 to insert the current date when printing the form and TaxCycle will insert the date when printing the form. This is most useful when you have a client in your office to sign documents. If you answer No to the question at the top of the T183, you must type the date into the field on the form.

- If you send the form for electronic signature through TaxFolder or DocuSign®, TaxCycle automatically records the signing date and time when the document was signed.

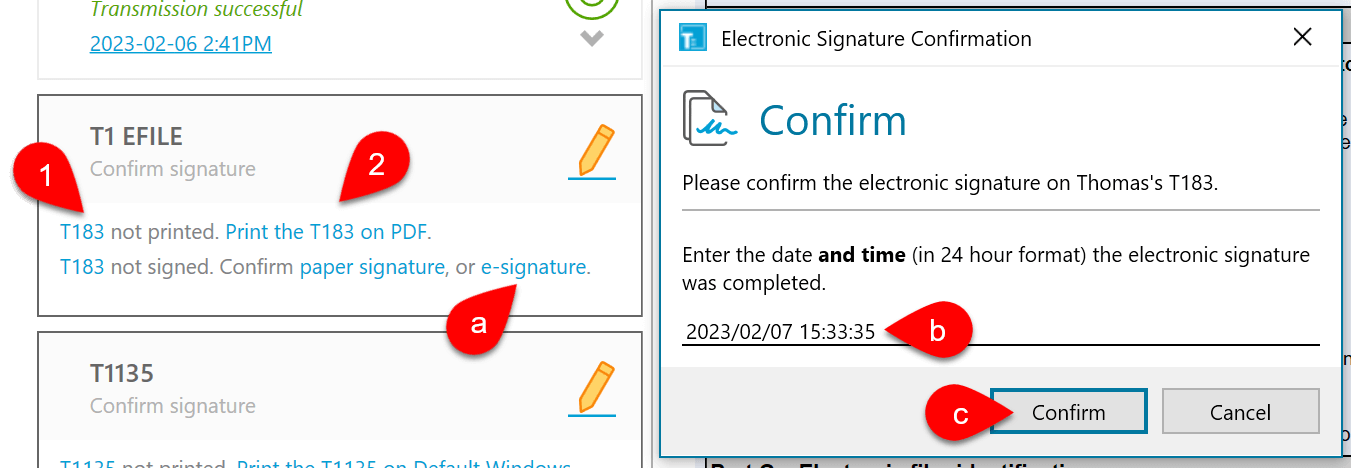

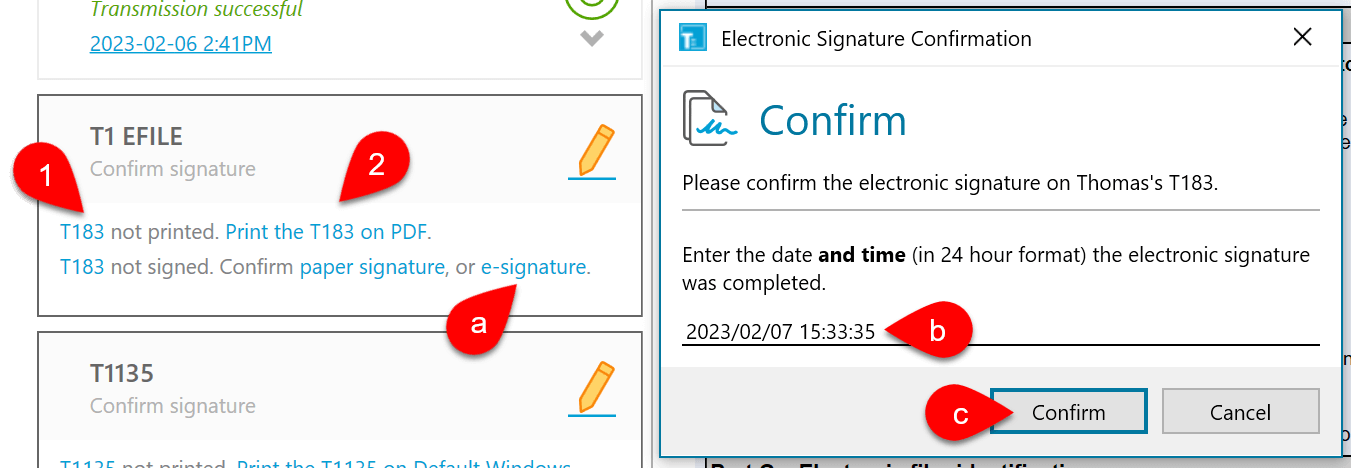

- If you collect an electronic signature by any other method (such as collecting a scanned copy or using Adobe® Reader), TaxCycle does not record the date and time the document was signed. Instead, you must enter this information when confirming the signature before T1 EFILE transmission:

- Click the e-signature link to confirm receipt of the signature.

- TaxCycle automatically enters the current date and time using the 24-hour format.

- Adjust the date and time if required and click the Confirm button to save.

When to Ask Your Client to Sign the Form Again…

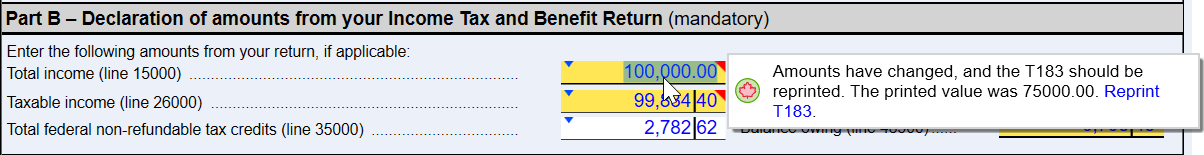

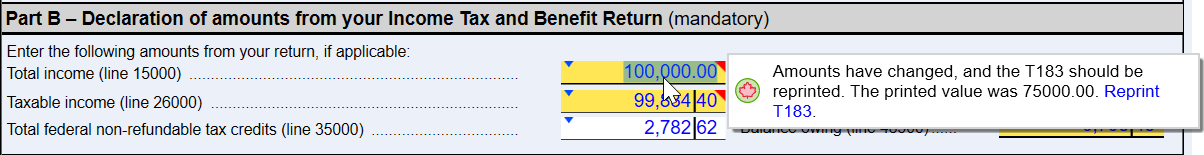

If your client signed a T183 early in the season, and you later need to change the return before filing, you don’t always need to reprint the form and have your client sign it again before you can transmit the return. The instructions on the back of the form state that as long as the refund or balance owing shown in Part B does not change by more than $300, you have authorization to transmit or retransmit the return.

If changes to the return require that your client sign a new copy of the form, TaxCycle will display a review message to alert you to reprint the form. Note this only applies to the original EFILE transmission. If the return is accepted and then later needs to be adjusted, a new T183 needs to be signed. See the ReFILE and T1-ADJ help topic.

Default Options for T183, Online Mail and Notice of Assessment

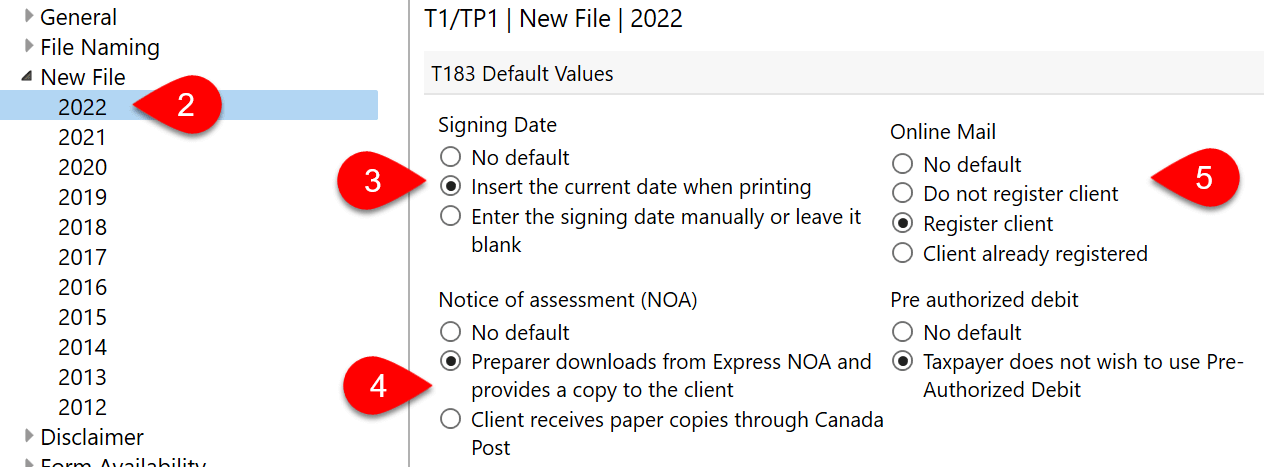

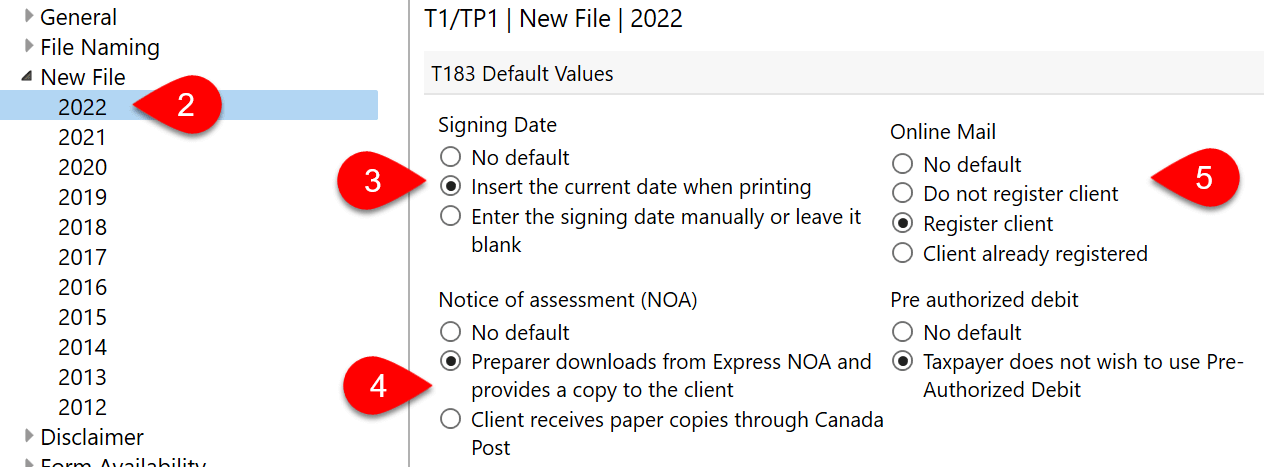

You can set a default values for these fields in New File options:

- To open options, go to the File menu, then Options. Or, if you are on the Start screen, click Options in the blue bar on the left.

- On the left, expand T1/TP1 and click on New File to apply the settings to all years. To set different options for a specific year, expand the section and click on a year. On the right, scroll down to the T183 Default Values section.

- Choose how to set the Signing Date on form T183.

- Choose No default to leave the check boxes at the top of the T183 blank and manually enter the signing date on the Info worksheet.

- Choose Insert the current date when printing to select Yes at the top of the T183 to make TaxCycle insert the current date into the field on the Info worksheet upon printing the form.

- Choose Enter signing date manually or leave it blank to select No at the top of the T183. You can either manually enter the date on the T183 or leave it blank. Nothing flows from the Info worksheet and you must enter the signing date manually or when confirming receipt of the signature.

- Under Notice of assessment (NOA), choose whether the preparer will download the notice of assessment or whether the client will receive the paper copy from Canada Post. If you choose No default, you must make this selection in each file.

- Under Online Mail, choose whether to register the client, do not register the client, or whether to mark the client as already registered. If you choose No default, you must make this selection in each file.

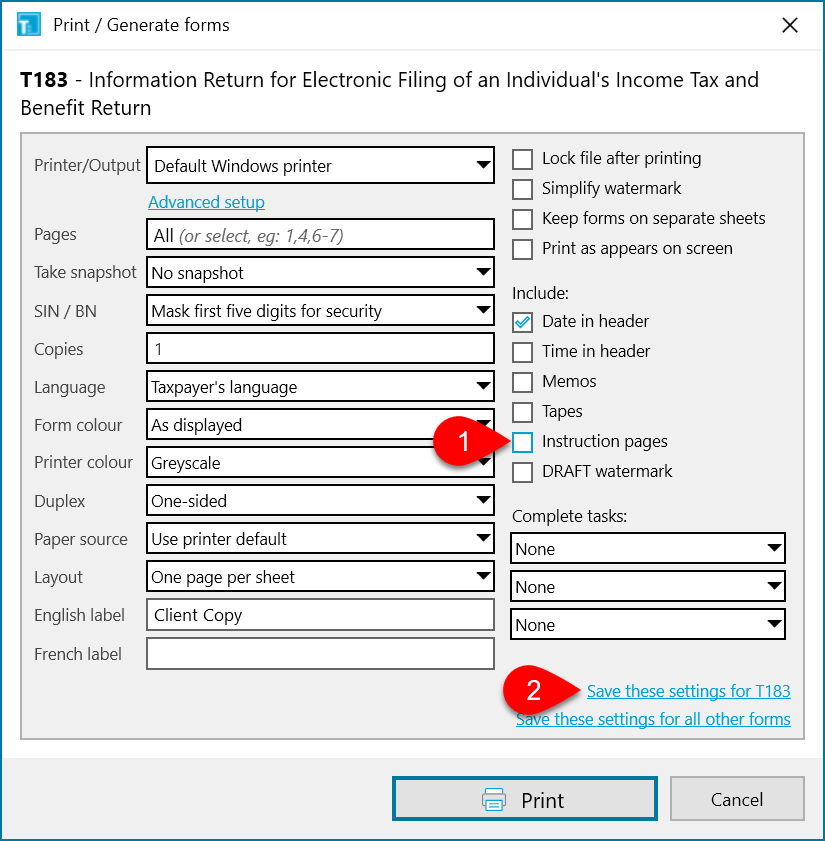

Skip Second Page when Printing

The second page of the T183 contains instructions for the form. Many preparers prefer not to print this second page.

Regardless of how or when you choose to print the T183 (as part of a print set, as a single form, etc.), you can easily exclude this second page from printing when configuring your printer/output. For example, on this single form print box:

- Clear the Instructions pages check box.

- Click the Save these settings for T183 link to have them available next time you print.

TaxCycle will only print the first page of the T183.