Updated: 2023-04-17

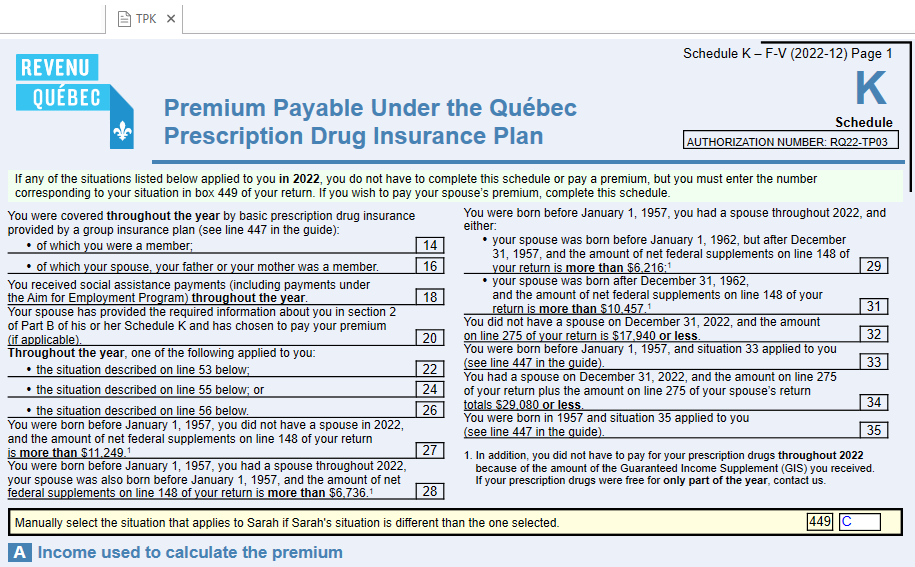

The Québec Schedule K (TPK) calculates the premium payable under the Québec Prescription Drug Insurance Plan and is only required in certain circumstances. The top of the form lists the situations in which the taxpayer is not required to complete the form.

The situation that applies to the taxpayer is indicated on line 449 on the form and determines whether the form is used and printed or transmitted directly to Revenu Québec.

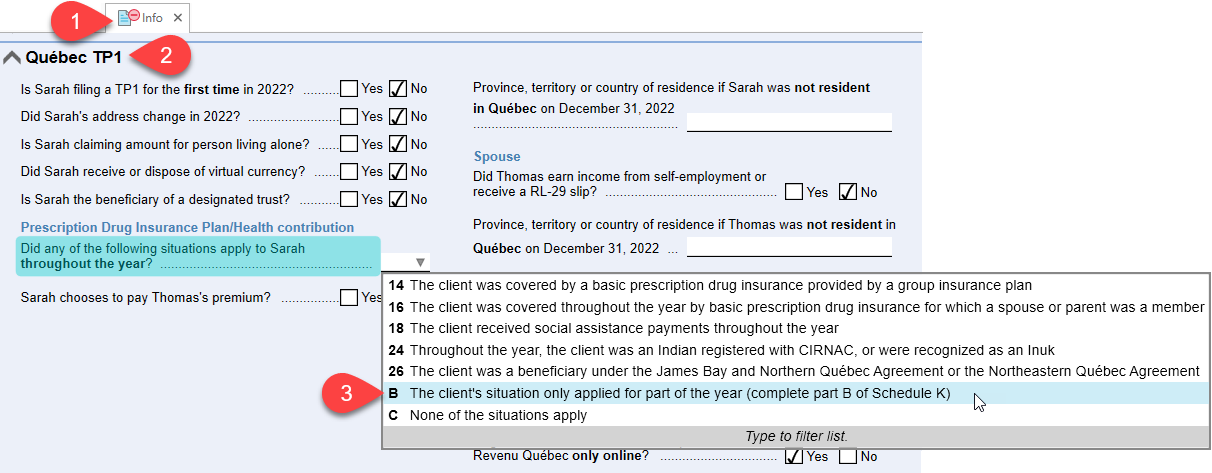

Whenever possible, TaxCycle automatically determines the situation that applies to the taxpayer on line 449, which is why it displays as a calculated field (with the number in blue text).

However, there are a few situations where you will want to manually select a number for line 449. To avoid overriding this field:

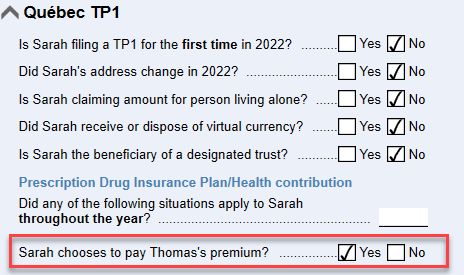

In the Québec TP1 section on the Info worksheet, you can indicate whether the taxpayer pays the spouse's premiums or not. Depending on the answer, TaxCycle completes the calculation on lines 91 to 97 of Schedule K (TPK).