Updated: 2023-08-11

Effective January 1, 2017, the rules governing eligible capital property (ECP) were replaced by the new Class 14.1. Property that was eligible capital property prior to January 1, 2017, is considered depreciable property in the new Class 14.1. Read below to learn about how those changes are handled in TaxCycle T2.

For more details on this change, see the Canada Revenue Agency’s (CRA) Explanatory Notes on Eligible Capital Property.

Common examples of eligible capital property (ECP) are goodwill, customer lists, trademarks, patents, incorporation costs, appraisal costs, legal or accounting costs and farming quotas.

Under the old rule, three quarters of the ECP were included in the cumulative eligible capital (CEC) expenditure pool to be deducted on a declining balance basis at a rate of 7%.

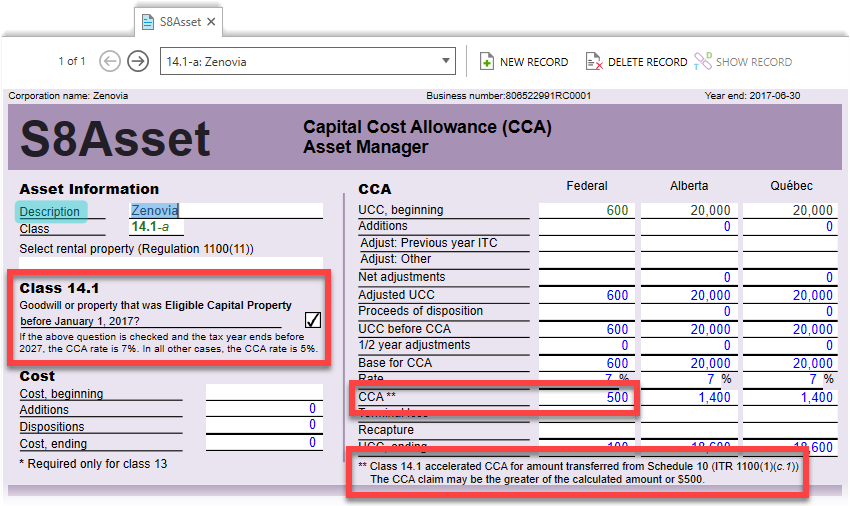

Under the new rule, the cost of acquisition of properties is included in CCA Class 14.1 to be depreciated on a declining balance basis at a rate of 5%. If the property is related to expenditures incurred before January 1, 2017 (for example, CEC balance transferred from Schedule 10 to Schedule 8), the CCA rate becomes 7%.

Under the old rule, expenses incurred for incorporation, reorganization, or amalgamation qualified as ECP.

To simplify the transition for small businesses, a separate business deduction is provided for incorporation expenses incurred after 2016. The first $3,000 of these expenses are treated as a current expense. They are reported on the new line 418 of the Schedule 1. The excess must be included in the new Class 14.1 in Schedule 8.

For further information, please refer to the CRA T2 Corporation—Income Tax Guide.

When you carry forward a prior year’s T2 or T5013 return with a tax year ending on December 31, 2016, the closing balance for CEC on line 300 of the Schedule 10 carries forward to the opening balance in Schedule 8 as the new Class 14.1.

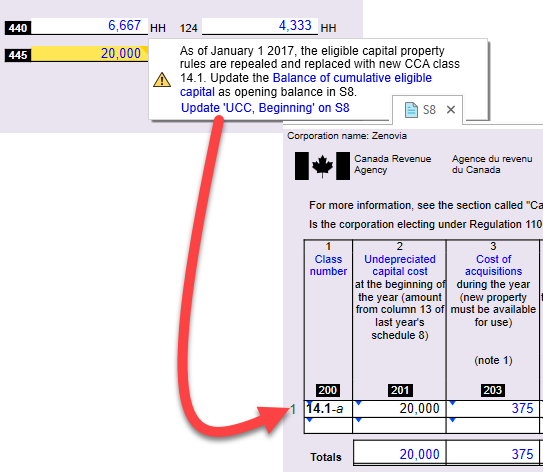

When preparing a T2 or T5013 return with a tax year end that starts in 2016 and ends in 2017—for example, a tax year ending on June 30, 2017—the amount of CEC is recalculated as of January 1, 2017. This calculation occurs in the new Part 3 of the Schedule 10.

A review message then appears on line 445 of the Schedule 10. It prompts you to update this amount to Class 14.1 on Schedule 8. In the review message that appears, click on the Quick Fix link to update the CEC balance on S8.

The capital cost allowance (CCA) for the new Class 14.1 is depreciated using the declining balance method. Generally, the CCA rate for this class is 5%. However, if class 14.1 is created from Schedule 10 due to expenditures incurred before January 1, 2017, the rate becomes 7%, and the annual CCA is calculated as the greater of the following two items:

In TaxCycle T2, you can see the details and explanation of this calculation on the S8Asset:

Under the old rule:

Under the new rule, effective January 17, 2017:

For dispositions of class 14.1 expenditures incurred before 2017—for example, CEC balance transferred from Schedule 10 to Schedule 8—there is a special rule in ITA 13(39) that reduces the recapture upon disposition. When ITA subparagraph 13(39) applies, the recapture is reduced by one quarter of the lesser of proceeds or the capital cost of that property by way of creating an addition in Schedule 8.

If ITA subparagraph 13(39) applies, enter the transaction date, proceeds, cost and check the box at the bottom of S8Asset in TaxCycle:

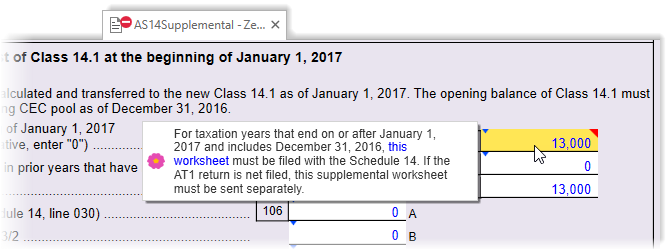

To address these changes in the Alberta AT1, Alberta Finance has introduced a new form: AT1 Schedule 14 Supplemental (AS14Supplemental).

This new form is only for tax years that end on or after January 1, 2017, and that include December 31, 2016.

The AS14Supplemental has two pages that perform the same function as the new pages 3 and 4 of the federal Schedule 10.

If the AT1 return is electronically filed, the AS14Supplemental must be mailed separately to:

Tax and Revenue Administration

Alberta Treasury Board and Finance

9811 – 109 Street

Edmonton, AB T5K 2L5

If the AT1 return is paper filed, attach the AS14Supplemental to the AT1 RSI and mail it to the above address.

TaxCycle will show the following warning if the AS14Supplemental needs to be sent to Alberta Finance: