Updated: 2023-02-28

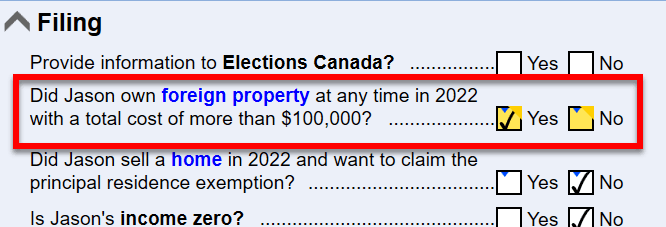

When your client confirms they have foreign property worth more than $100,000, you must complete the T1135 for the client.

Review messages and transmission functions for the T1135 form appear when you answer Yes to the foreign property question in the Filing section of the Info worksheet.

Note: The CRA requires that the full social insurance number (SIN) or business number (BN) appear on the T1135 when filing a paper copy. TaxCycle will ignore the print option to mask these numbers unless the form was already electronically filed. Please use caution when sending this form to your clients in PDF format.

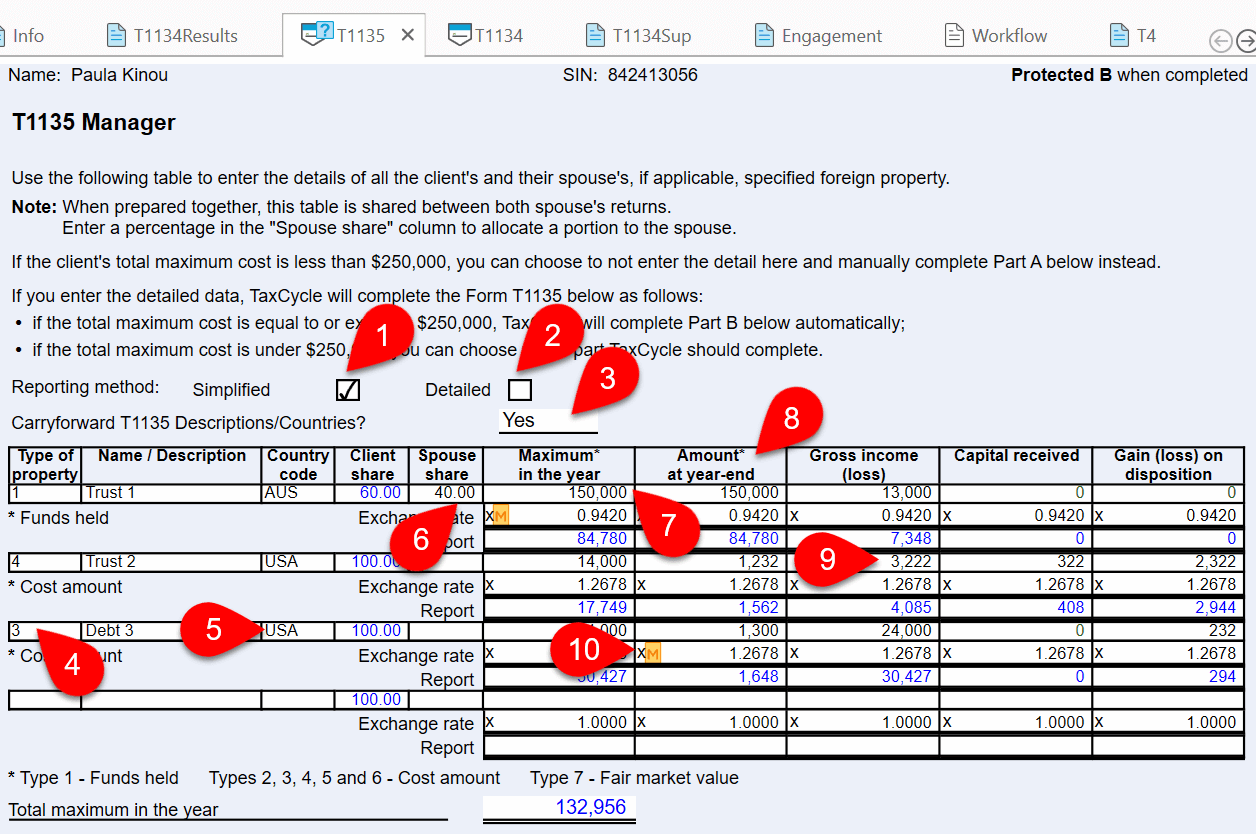

At the top of the T1135, the T1135 Manager allows for splitting and sharing of foreign investments between spouses, while retaining the applied foreign exchange rates.

When entering the amounts in the table, choose a reporting method. If you choose not to enter amounts in the T1135 Manager table, you may still complete Part A manually using the simplified reporting method.