Updated: 2023-04-18

In TaxCycle T1/TP1, you can prepare returns for taxpayers and/or spouses who immigrated or emigrated from Canada during the tax year, as well as for a non-resident spouse.

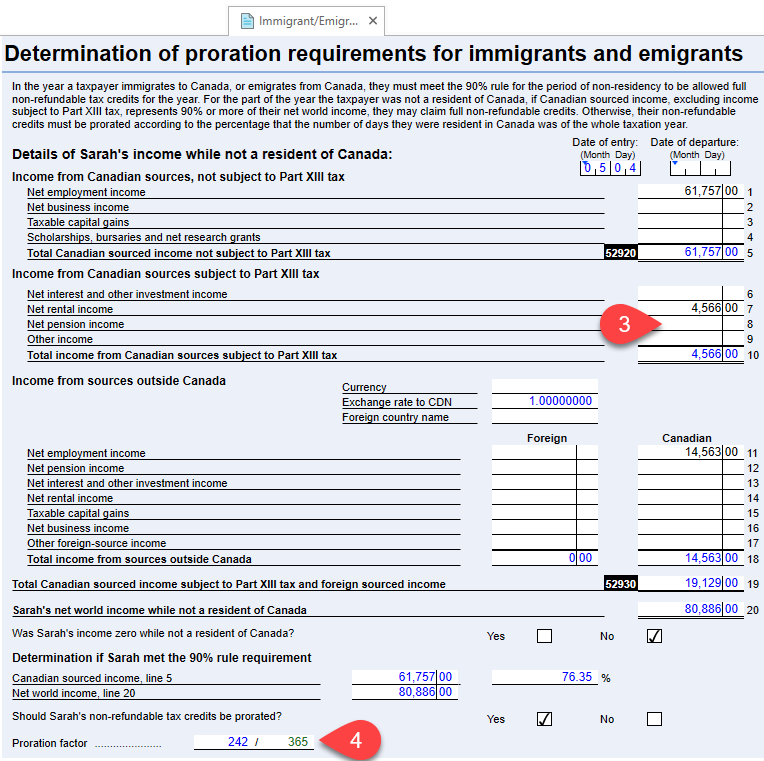

The 90% Rule

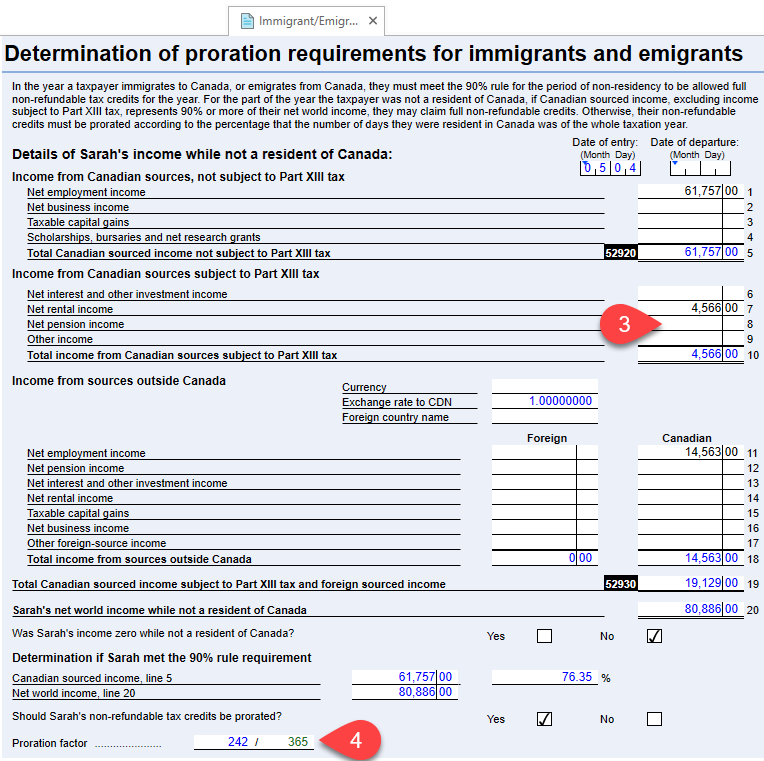

In order for an immigrant/emigrant to be allowed full non-refundable tax credits in the year of arriving or leaving Canada, the taxpayer must meet the 90% rule for the period of non-residency.

If a taxpayer does not meet the 90% rule, non-refundable tax credits are prorated based on the entry or exit date.

A taxpayer meets the 90% rule if:

The Canadian-source income reported by the taxpayer for the part of the year that they were not a resident of Canada is 90% or more of their net world income for that part of the year. Or,

- They had no foreign or Canadian-source income in the period when they were not a resident of Canada.

- A newcomer to Canada may be limited in the amount they can claim for the non-refundable tax credits in the year of immigration.

For more information on eligibility for the 90% rule, consult the CRA website for information for Newcomers to Canada.

Part-Year Resident

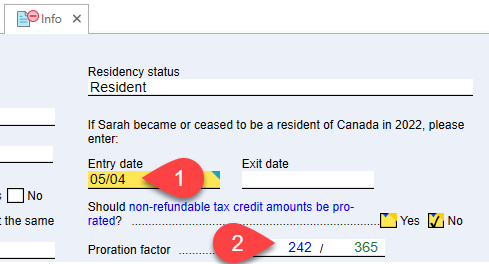

If the taxpayer arrived in or departed from Canada during the year:

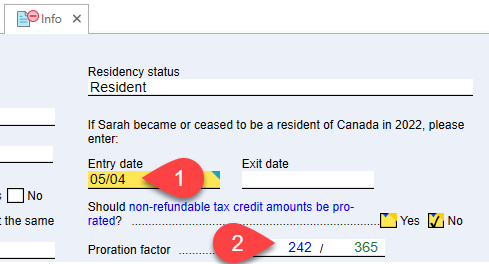

- Enter the Entry date or Exit date for the taxpayer in the Residency section on the Info worksheet.

- TaxCycle determines the Proration factor by calculating the number of days that the taxpayer was a resident.

- Complete the Immigrant/Emigrant worksheet to determine whether the taxpayer is eligible to prorate non-refundable tax credits.

- TaxCycle automatically prorates credits when the taxpayer is eligible. Leave the worksheet blank to claim 100% of the credits.

When to Couple Returns for a Part-Year Resident or Non-Resident Spouse?

Do not couple the returns if the principal taxpayer was a resident for the full year and the spouse was a non-resident for the full year. Both taxpayers must have the same residency to have a coupled return.

Only complete a return for a non-resident spouse if he/she earned income that was taxable in Canada and that was not already subject to withholding taxes. Examples include employment income, self-employment income, or capital gains. Dividends, interest and rental income would already have been subject to withholding taxes.

You may couple returns if the spouse arrived in or left Canada during the year. Add the entry or exit date on the spouse’s Info worksheet and use the spouse’s Immigrant/Emigrant worksheet to enter the details of the income earned before/after entering/exiting Canada and determine whether the spouse’s non-refundable tax credits can be prorated.

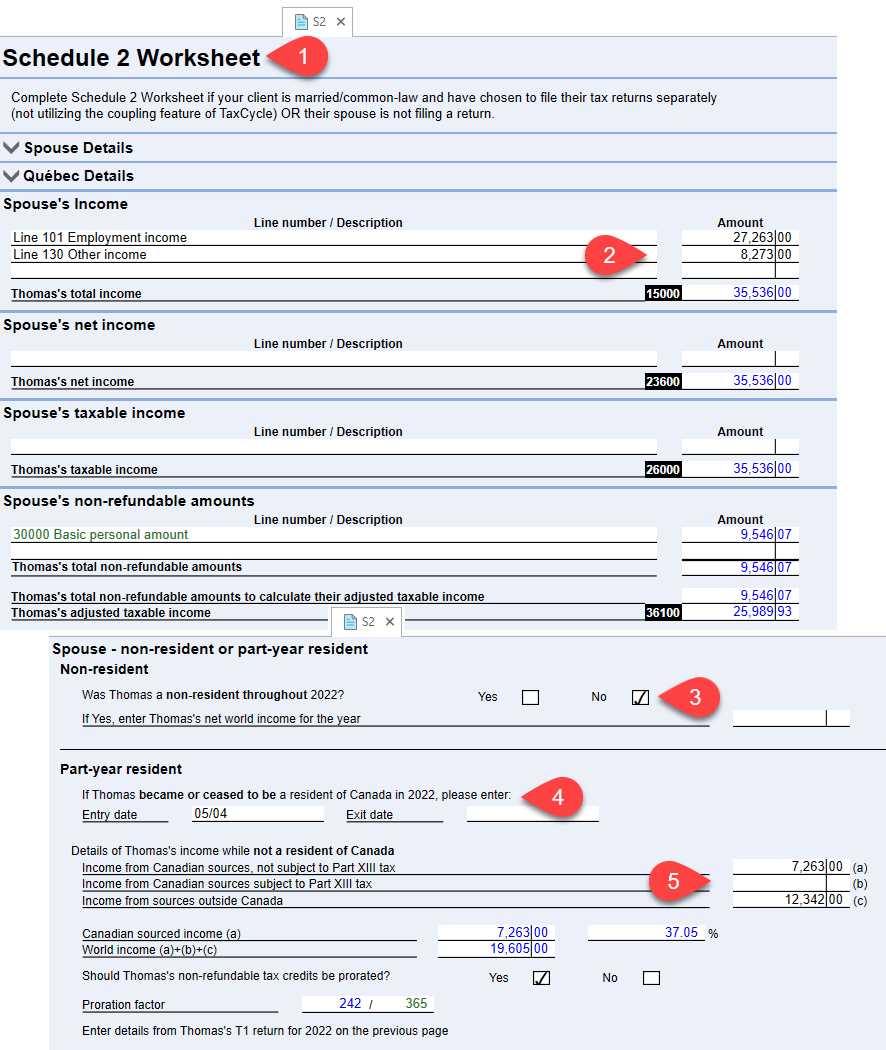

Part-Year Resident Spouse

If the spouse arrived in or departed from Canada during the tax year and you are not completing their tax return:

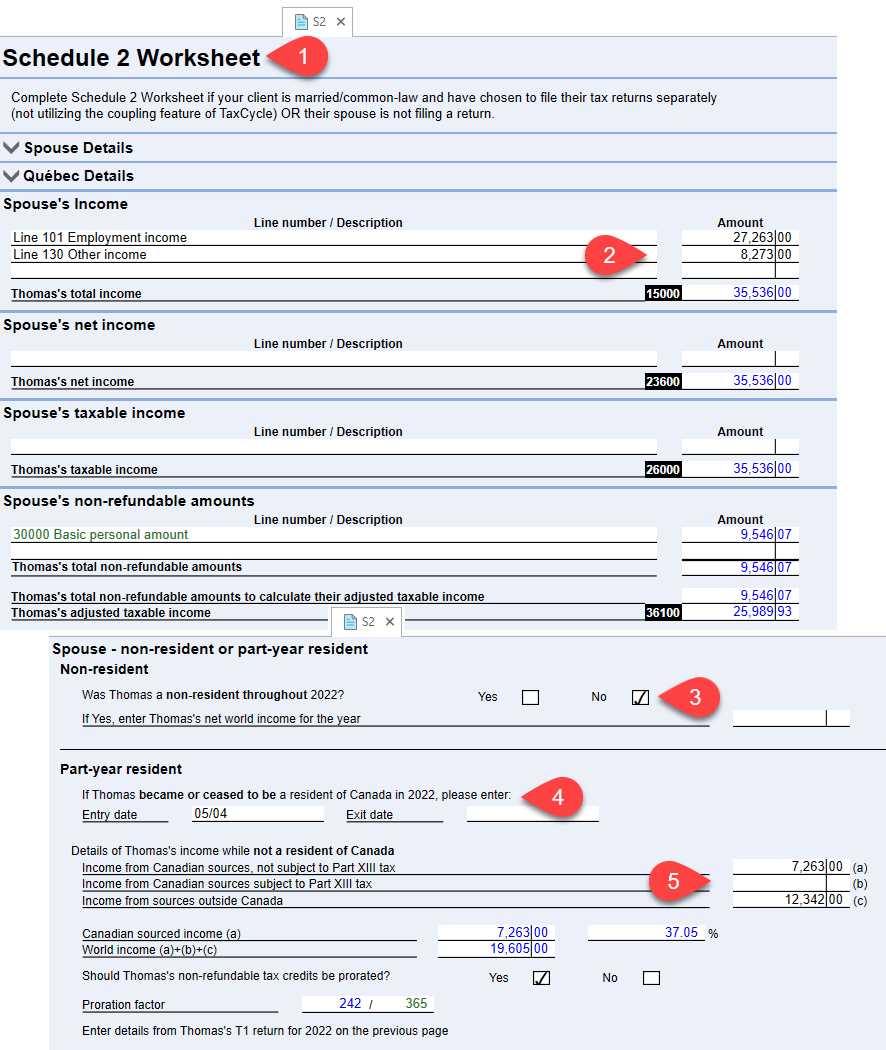

- Open Schedule 2 (S2) and scroll to the Schedule 2 Worksheet page.

- Enter the details from the spouse’s Canadian tax return (lines 101 to 260, plus the non-refundable credits).

- Answer No to the residency question in the Spouse - non-resident or part-year resident section on page 3.

- Enter the spouse’s Entry date into Canada or Exit date from Canada.

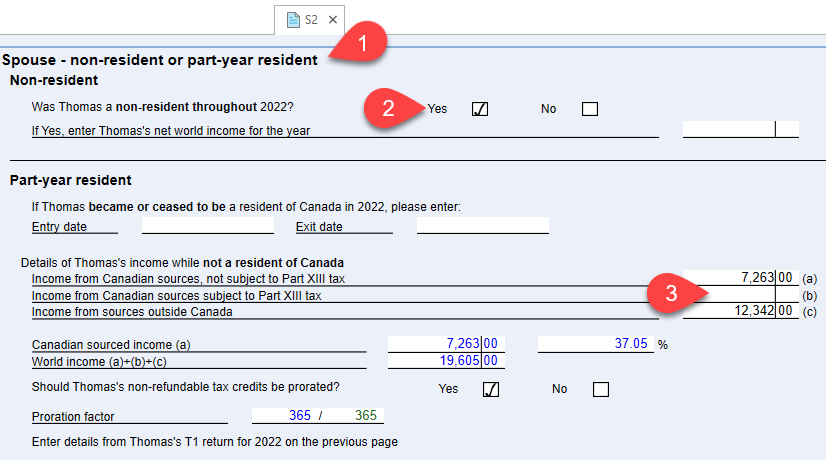

- Enter the details of the spouse’s income while not a resident of Canada, from Canadian and other sources. TaxCycle determines whether to prorate the spouse’s non-refundable tax credits.

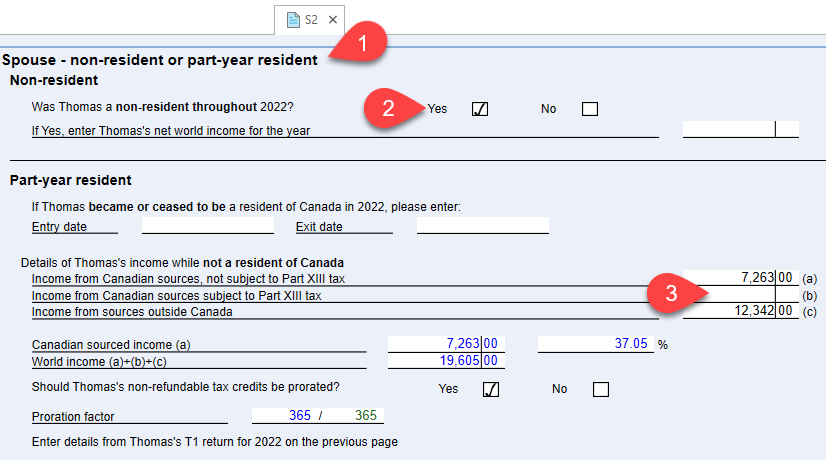

Non-Resident Spouse (Full Year)

Use Schedule 2 (S2) to prepare a return for a resident of Canada whose spouse/partner did not reside in Canada for the full year. For example, someone who has married a U.S. resident but hasn’t yet emigrated to the U.S.

Step 1: Complete the Info Worksheet for the Principal Taxpayer

- Choose the Marital status of the principal taxpayer.

- Enter the principal taxpayer’s address.

- Enter the spouse’s name and contact information in the Spouse section of the Info worksheet.

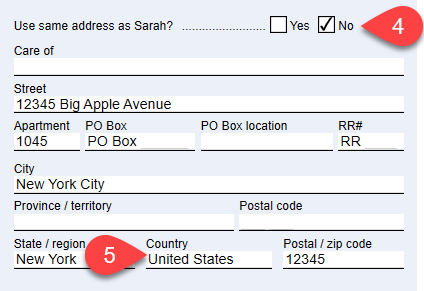

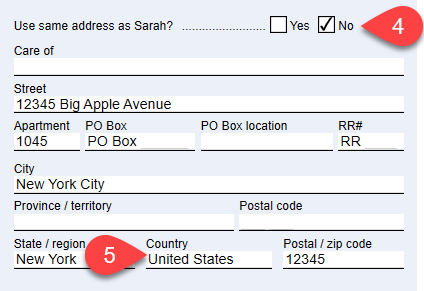

- To enter an address for the spouse outside of Canada, answer No to the question Use same address as the principal taxpayer?

- Then, enter an address using the State/region, Country, and Postal/zip code fields.

Step 2: Do Not Couple the Returns

Do not prepare the return for the spouse. Instead, use the Schedule 2 worksheet to report information about the spouse’s tax situation.

Step 3: Complete the Schedule 2 Worksheet

- Open Schedule 2 (S2) and scroll to the Spouse - non-resident or part-year resident on page 3. This is part of the Schedule 2 worksheet.

- Answer Yes to the first question to indicate that the spouse was non-resident throughout the year. (This ensures TaxCycle does not claim the amounts for the spouse for the GST credit and other provincial credits.)

- Enter the spouse’s net world income for the year (foreign or Canadian). Amounts calculated here appear on the first page of the principal taxpayer’s T1 jacket and also figure into the calculation of credits that are based on family income (such as a possible GST credit for the principal taxpayer).