Updated: 2023-07-13

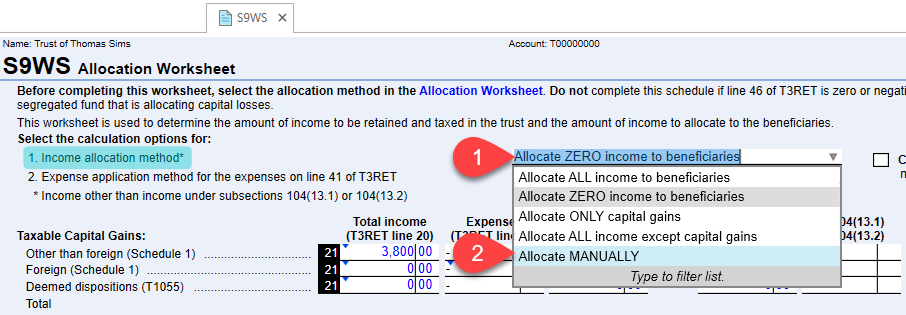

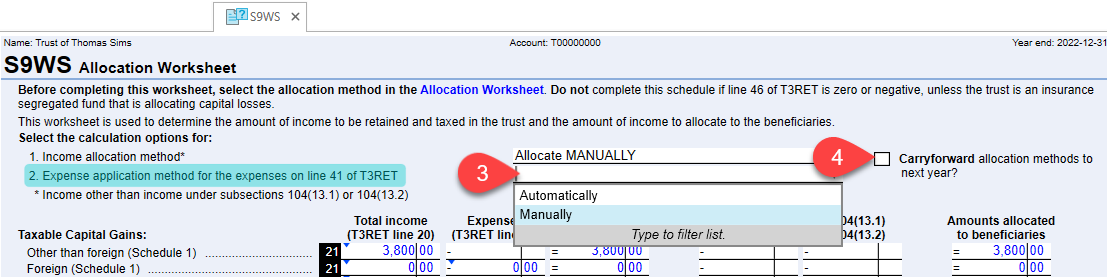

The S9WS determines the amount of income that is retained and taxed in the trust, and the amount of income to allocate to the beneficiaries. At the top of the S9WS, select the calculation options for the income and expense allocation method: