Updated: 2022-08-12

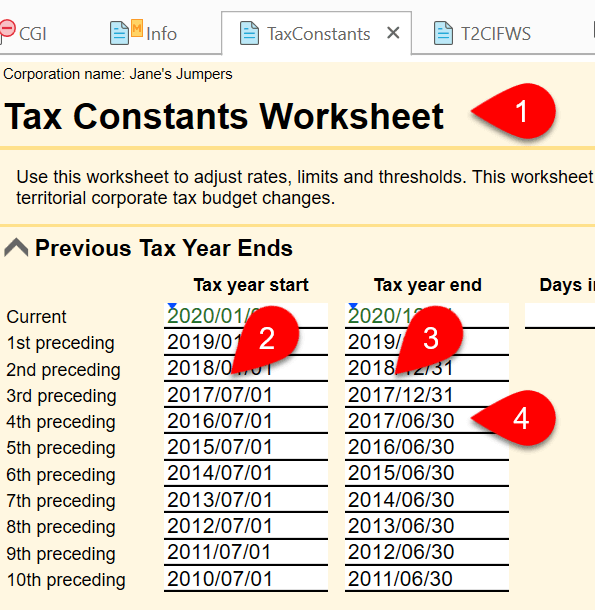

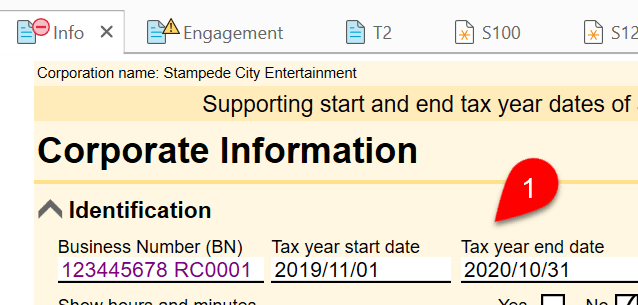

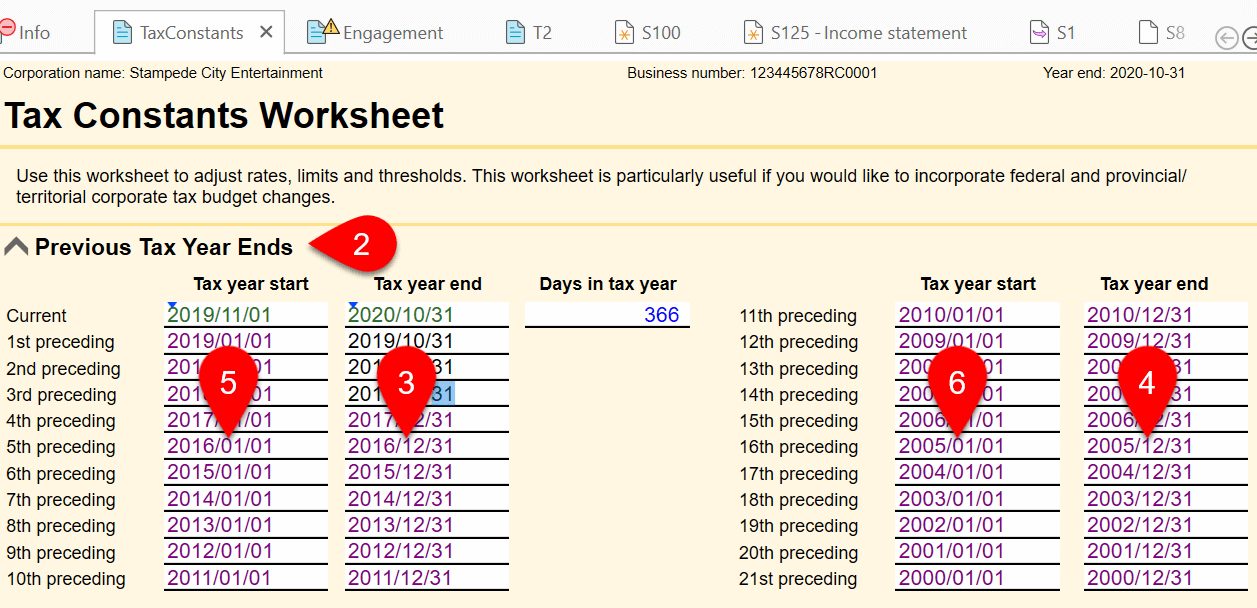

The TaxConstants worksheet contains a list of the Previous Tax Year Ends and uses this information in calculations and review messages in the return. You can edit this list to reflect the corporation’s history. TaxCycle carries forward the data from year to year.

To indicate a previous short year end in the return: