Updated: 2023-06-06

The AgriStability and AgriInvest (ASAI) programs are a joint federal, provincial and territorial business risk management program.

TaxCycle transmits AgriStability or AgriInvest programs to the Canada Revenue Agency (CRA) through EFILE with the T1 return.

AgriStability and AgriInvest forms must include the Participant Identification Number (PIN) for electronic filing. The PIN is a unique identifier that allows the automatic matching of a participant’s information to their prior year records and prevents processing delays.

The PIN appears on the following statements:

Clients participating in AgriStability or AgriInvest for the first time must request a PIN before they can electronically file the forms. To obtain a PIN, participants can complete a PIN Request Form on agriculture.canada.ca:

The PIN will be sent directly to the new participant.

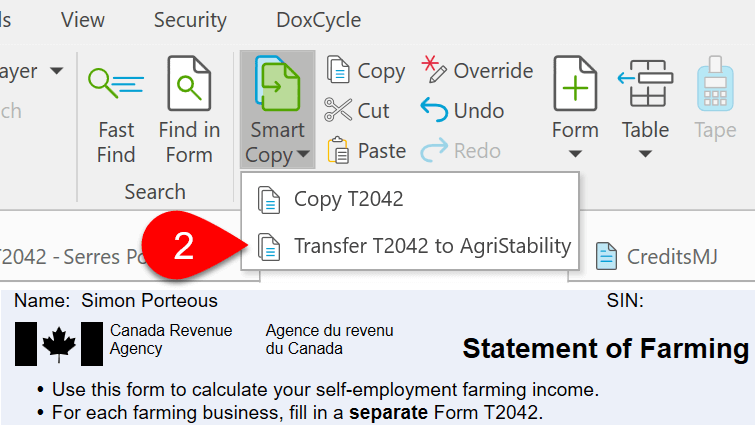

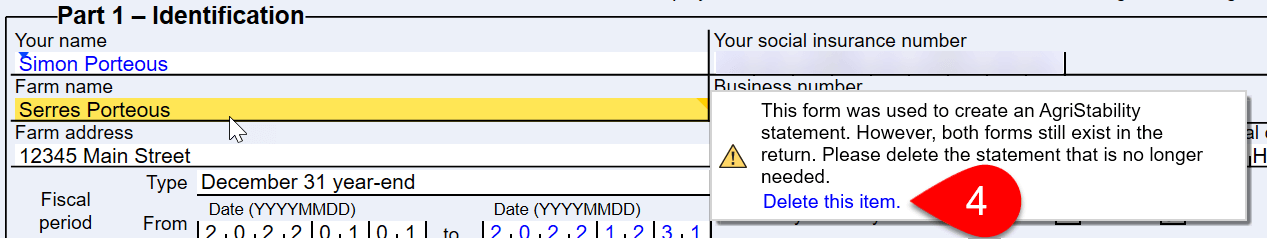

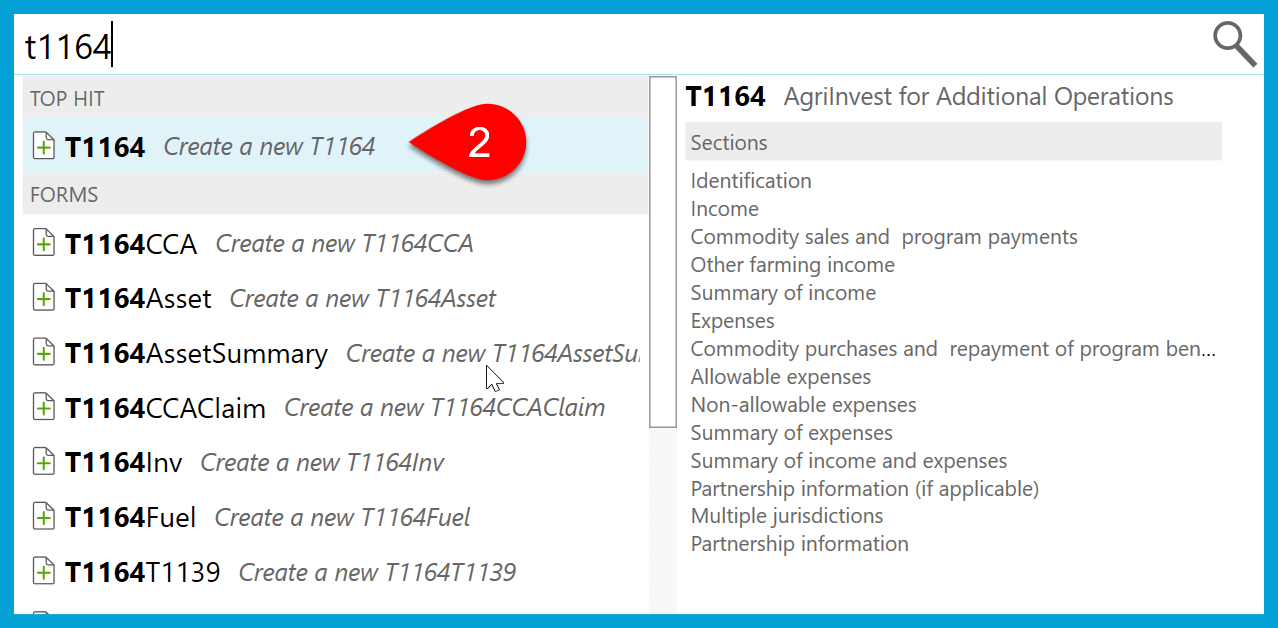

To complete Statement B (T1164 or T1274) for an additional farming operation, start a new AGRI form. The second instance of this form will contain Statement B:

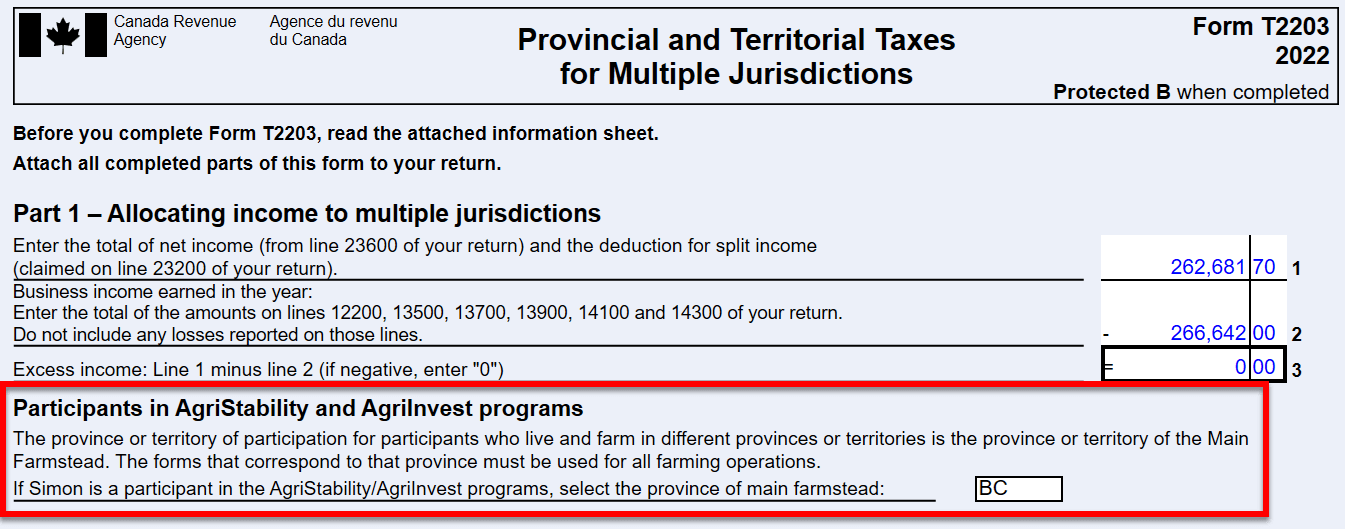

In the case of filing for multiple jurisdictions, if the taxpayer is a resident of Alberta but requires a T1273 for an operation in British Columbia, where the province of main farmstead is in British Columbia, select the province of main farmstead on form T2203. This will allow you to enter data on form T1273/T1274 although the taxpayer is a resident of Alberta.

If a spouse or partner needs to report income for a farming operation where the main farmstead is in a different province than the principal taxpayer, uncouple the returns and calculate them separately.