Updated: 2023-06-12

The S8RecWS worksheet shows changes to capital assets made over the tax year and reconciles the amounts calculated for accounting and tax purposes.

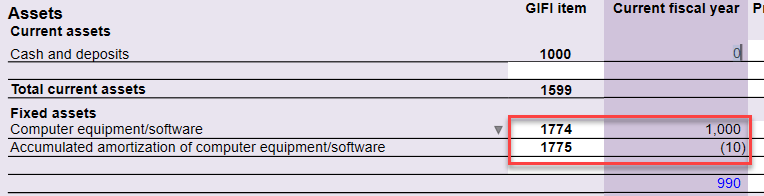

For example, if a corporation purchases $1,000 computer equipment during a tax year, this increase is reflected on the S100 Balance Sheet.

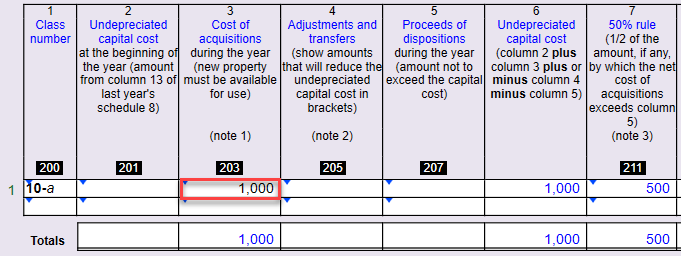

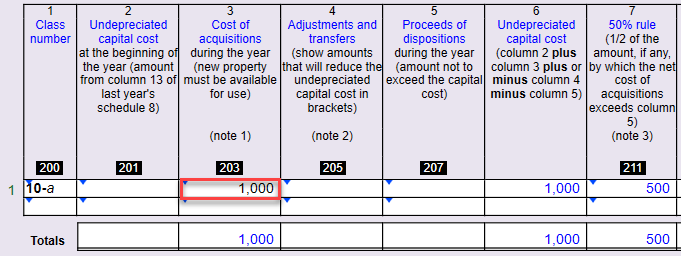

The same $1,000 purchase is recorded on the S8 as an addition.

The $1,000 increase (net of amortization) on the S100 should then correspond to the same increase on the S8. This is the basis of the S8RecWS in TaxCycle.

Sample Files

We include two sample files when you install TaxCycle to help show you how this works. Find them in:

C:\Program Files (x86)\Trilogy Software\TaxCycle\Samples

Year 1

- Tax year ending on December 31, 2016

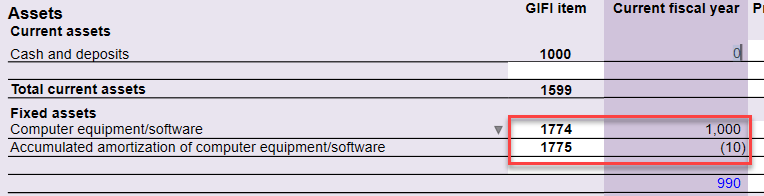

- Computer equipment purchase: $1,000 (S100 GIFI 1774)

- Computer equipment accumulated amortization: $10 (S100 GIFI 1775)

- Computer equipment amortization: $10 (S125 GIFI 8670)

See sample file S8Rec Example Year 1.2017T2

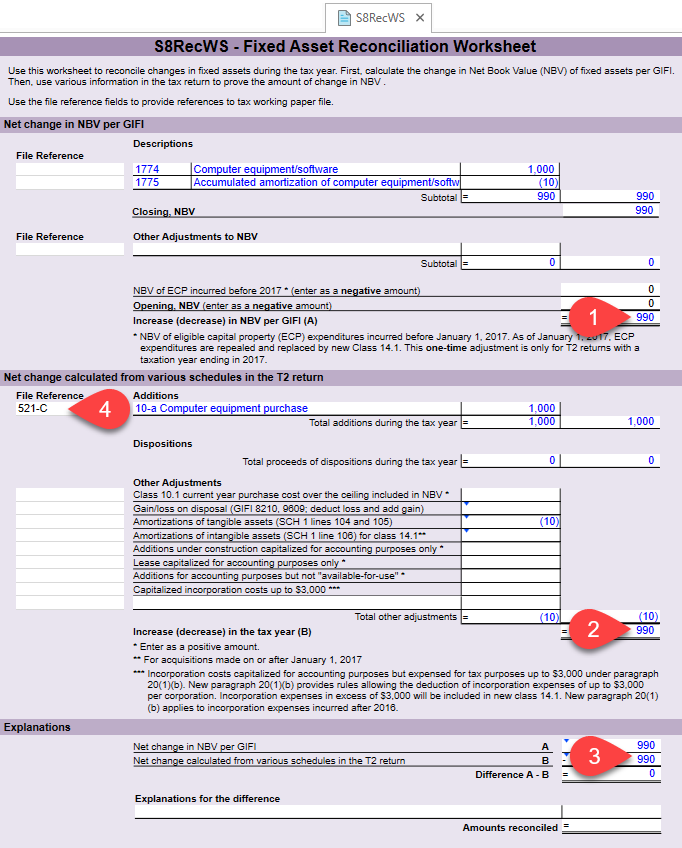

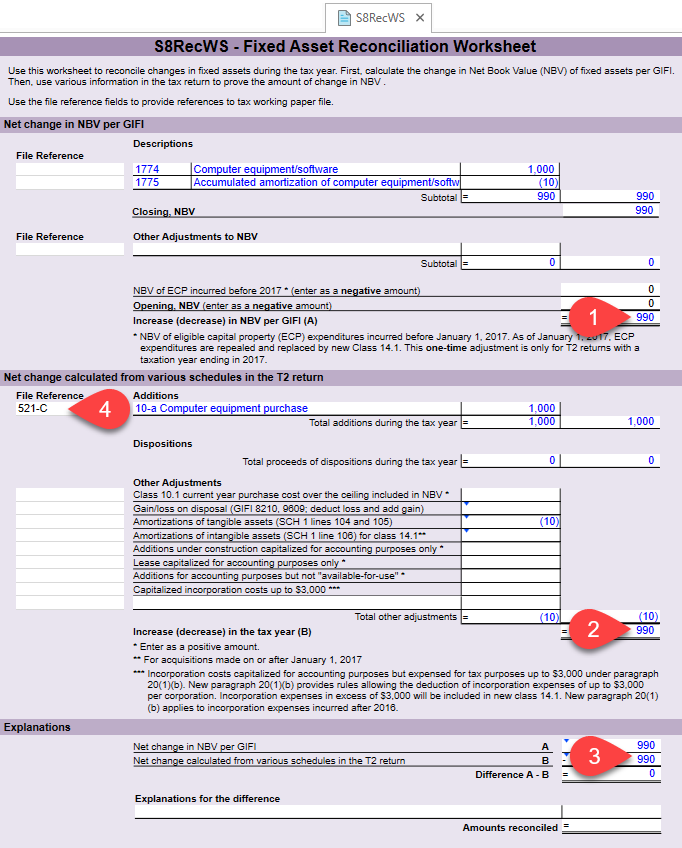

- On S8RecWS, in the Net change in NBV per GIFI section, the net book value (NBV) in the financial statements has increased by $990 net of accumulated depreciation ($1,000−$10).

- The middle section, Net change calculated from various schedules in the T2 return, shows that $1,000 is recorded on the S8 and shows a net increase (net of annual amortization expenses) of $990.

- Since the amounts from both sections match, the worksheet provides assurance that the capital assets increase in the financial statements match the increase on S8 in the T2 return.

- You can use the File Reference column on the left of the worksheet to record references to the tax working paper file.

Year 2

- Tax year ending on December 31, 2017

- Proceeds of disposition: $600

- Accounting loss on disposition: $390 ($600 proceeds−$990 net book value; S125 GIFI 8210)

Let’s take the previous example one step further. The same corporation begins its second year of operations. Assume that all computer equipment is sold for proceeds equal to $600, creating an accounting loss of $390 in the income statement (S125 GIFI 8210).

See sample file S8Rec Example Year 2.2017T2

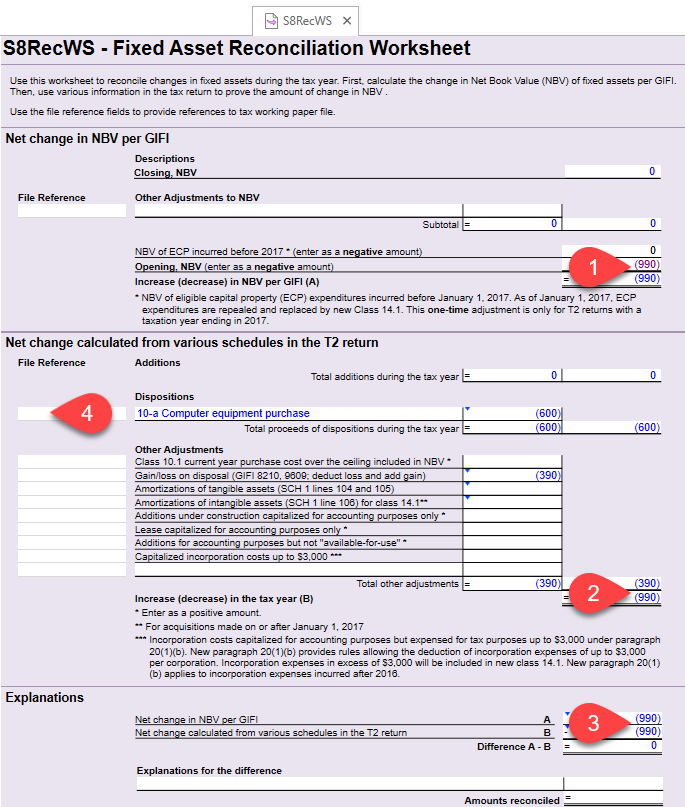

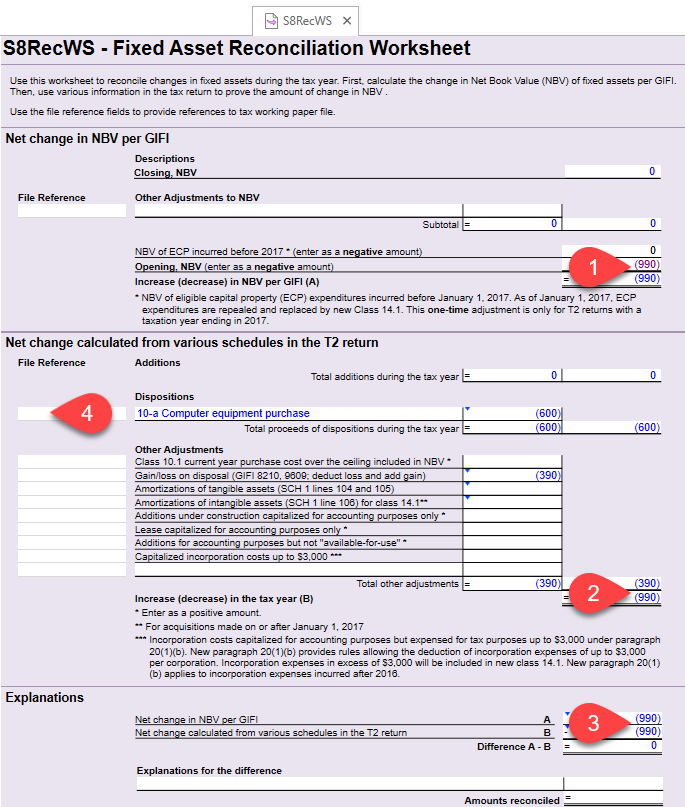

- The Net change in NBV per GIFI section shows that the NBV in the financial statements has decreased by $990 of NBV.

- The Net change calculated from various schedules in the T2 return shows the loss of $390 along with $600, which is the lower of cost or proceeds, resulting in a corresponding decrease of $990.

- Since the amounts from both sections match, the worksheet provides assurance that the capital assets decrease in the financial statements match the decrease in S8 in the T2 return.

- You can use the File Reference column on the left of the worksheet to record references to the tax working paper file.