Updated: 2023-03-07

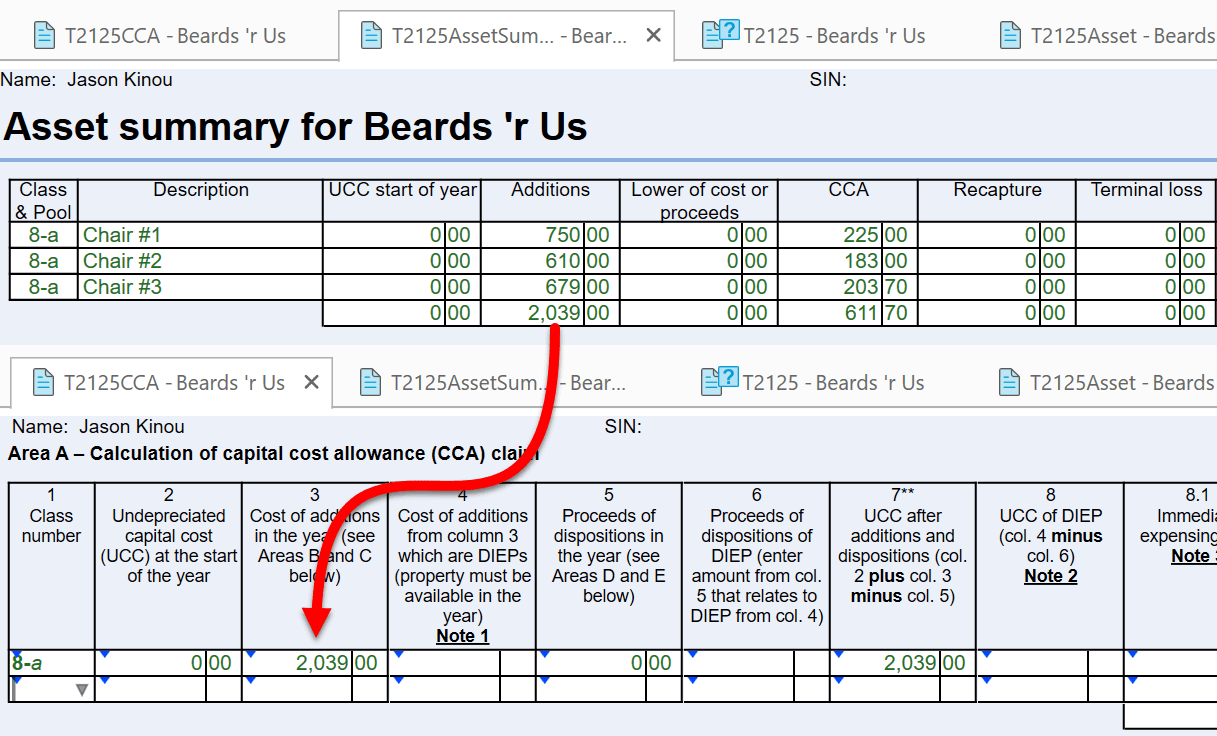

Use the Asset Manager to create and maintain separate CCA records for each capital asset. For example, let’s enter asset records for three office chair purchases, costing $750, $610 and $679 each.

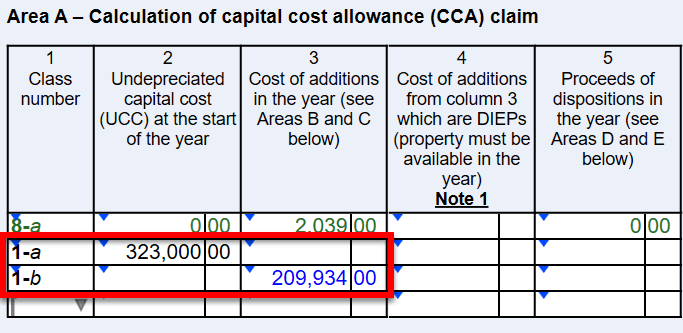

TaxCycle automatically adds a letter to the end of each CCA class. This allows you to create separate CCA classes for capital assets where it is not permitted to pool the cost basis.

For example, each rental property with capital cost of $50,000 or more must be in a separate class 1. In TaxCycle, enter one property as class 1-a and one as class 1-b.

The entries then appear as separate rows on the CCA worksheet and separate records in the Asset Manager.

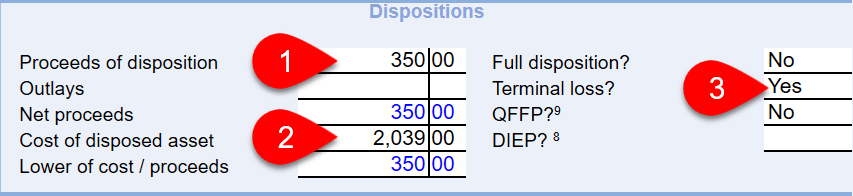

To trigger a terminal loss for all assets under the same class, make one terminal loss entry under one Asset Manager record for that pooled class: