Updated: 2023-11-13

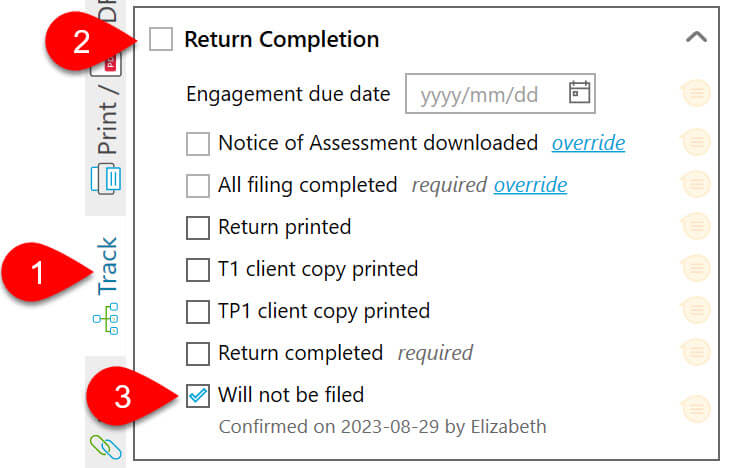

If you do not intend to file a return for the client, mark it as “Will not be filed.” This makes it easy to exclude the file from the search results in the Client Manager.

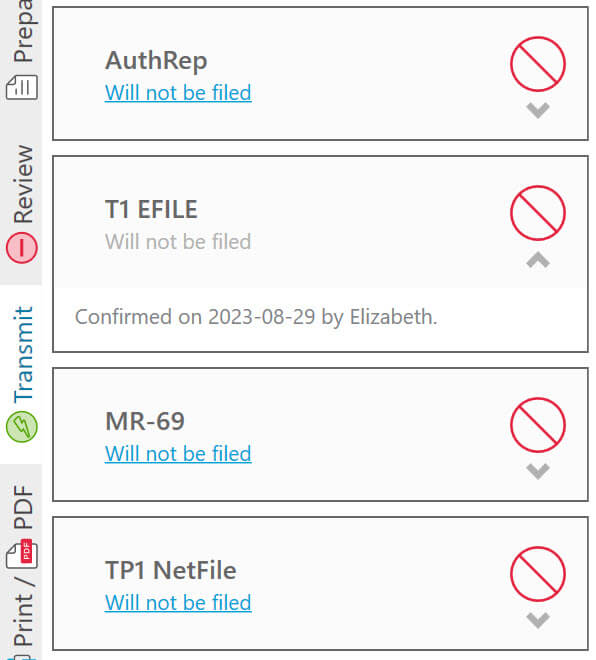

After you set the return to “Will not be filed” status, all electronic filing statuses change to a “do not enter” symbol and you cannot file the return.