Updated: 2024-12-11

TaxCycle handles slips and summaries differently than most other software packages. Each slip type has its own module in TaxCycle. This means you create individual files for T4/T4A, T5, T5018 and NR4 slips. (Some concepts from preparing slips also apply to other returns that include slips, such as the T5013 and T3 modules.)

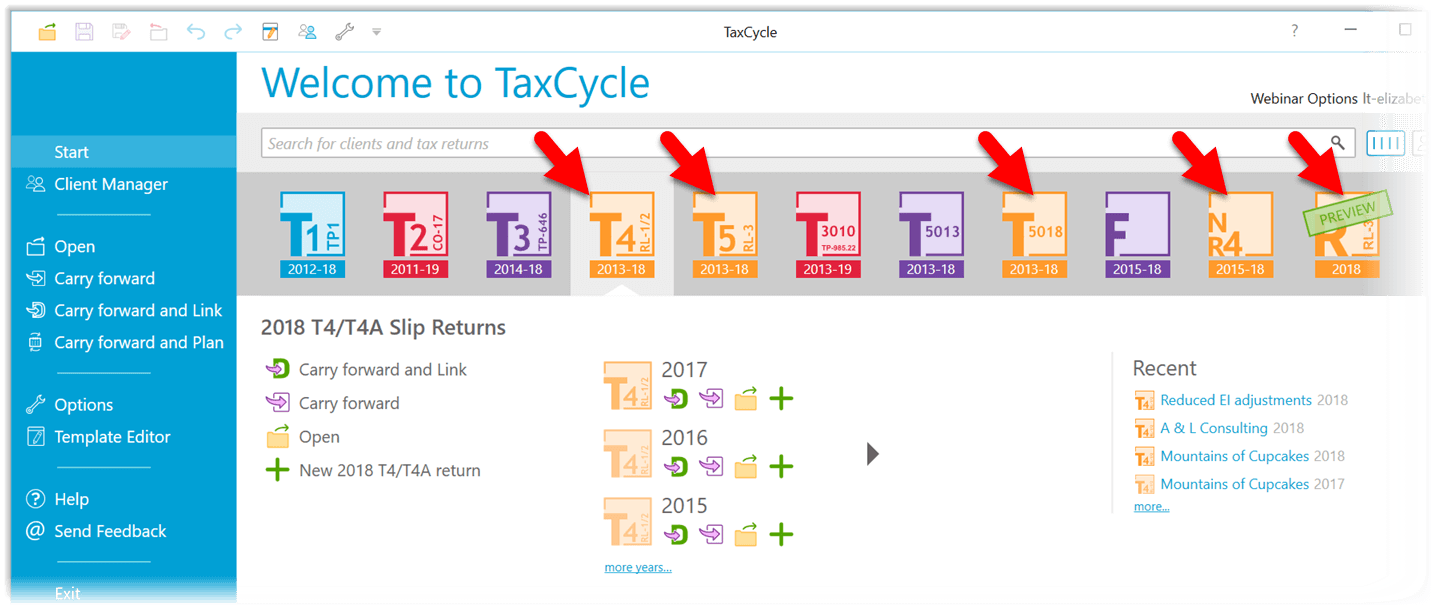

On the TaxCycle Start screen, you will see each slip type listed separately. Slip modules usually have a yellow icon. Click on a slips module to create a new slips return, carry forward from the prior year, or open an existing return.

If you created slips using TaxCycle last year, you can carry forward those slips like you do any other TaxCycle file. See the Carry Forward Returns help topic for more information.

You can also carry forward slips from other software packages, including ProFile® FX, Cantax® FormMaster, or Taxprep® Forms. In these software packages, it is possible to create a single file with multiple types of slips in it. For example, you can include T4, T5, T5018 slips all in one file. Carry forward files from the above packages into TaxCycle in the same way as any other return and TaxCycle will determine what slips files to create. Please read the information related to your prior software package in the Carry Forward Returns help topic to familiarize yourself with what may happen when there is more than one slip type in the source file.

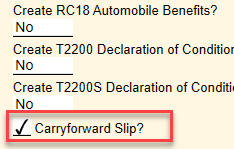

When you create a slip in any of the slips modules, you can choose whether to carry forward a slip to next year.

By default, the Carryforward Slip? box is checked on each slip so that they each carry forward to the following year.

Simply clear this check box if you do not want a slip to carry forward. For example, if you know an employee has left and you will not need to complete their T4 in the following year.