Updated: 2023-01-13

In September 2017, the Ontario government stopped offering a tax credit for provincial tuition and education amounts. Only unused tuition and education amounts from 2017 could be claimed in subsequent years until they were all used, or until the student moved away from Ontario.

In 2021, Ontario changed the rules for years prior to 2022 so that students with an unused credit at the end of 2017, who moved away from Ontario and then returned to Ontario prior to 2022, can claim some or all of that amount.

Students who were a resident in Ontario on December 31, 2017, then moved to a different province or territory then moved back to Ontario in the current year (for example, 2021), may enter whichever of the following amounts is less (on line 1 of ONS11):

If the student is not resident in Ontario after December 31, 2021, their unused Ontario tuition and education amounts balance will be reduced to zero.

These criteria also appear as a note at the top of Ontario Schedule 11 ON(S11) for 2021.

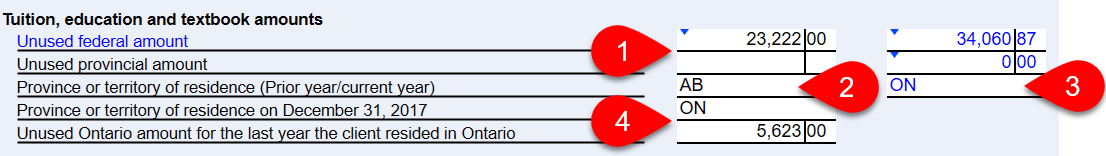

Additional fields on the 2021 Carry Forward Summary (Carry) assist TaxCycle in calculating the appropriate claim according to the rules above. To make a claim:

A taxpayer who meets the criteria was in the situation mentioned where they had left after 2017 and returned in 2021, may be eligible to request an adjustment to applicable prior year returns.

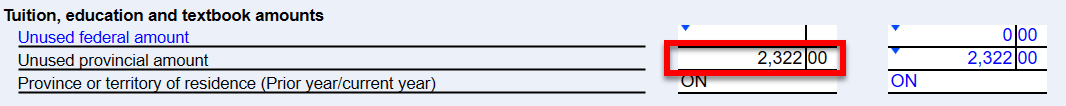

The Carry Forward Summary (Carry) for the years 2019 and 2020 does not include the additional fields. In this case, enter the unused provincial amount from the last year they were resident in Ontario: