Updated: 2021-05-18

AT1 Schedule 29 (AS29) calculates the Alberta Innovation Employment Grant tax credit. This tax credit applies to eligible expenditures incurred as of January 1, 2021.

For more information on this tax credit, see the following:

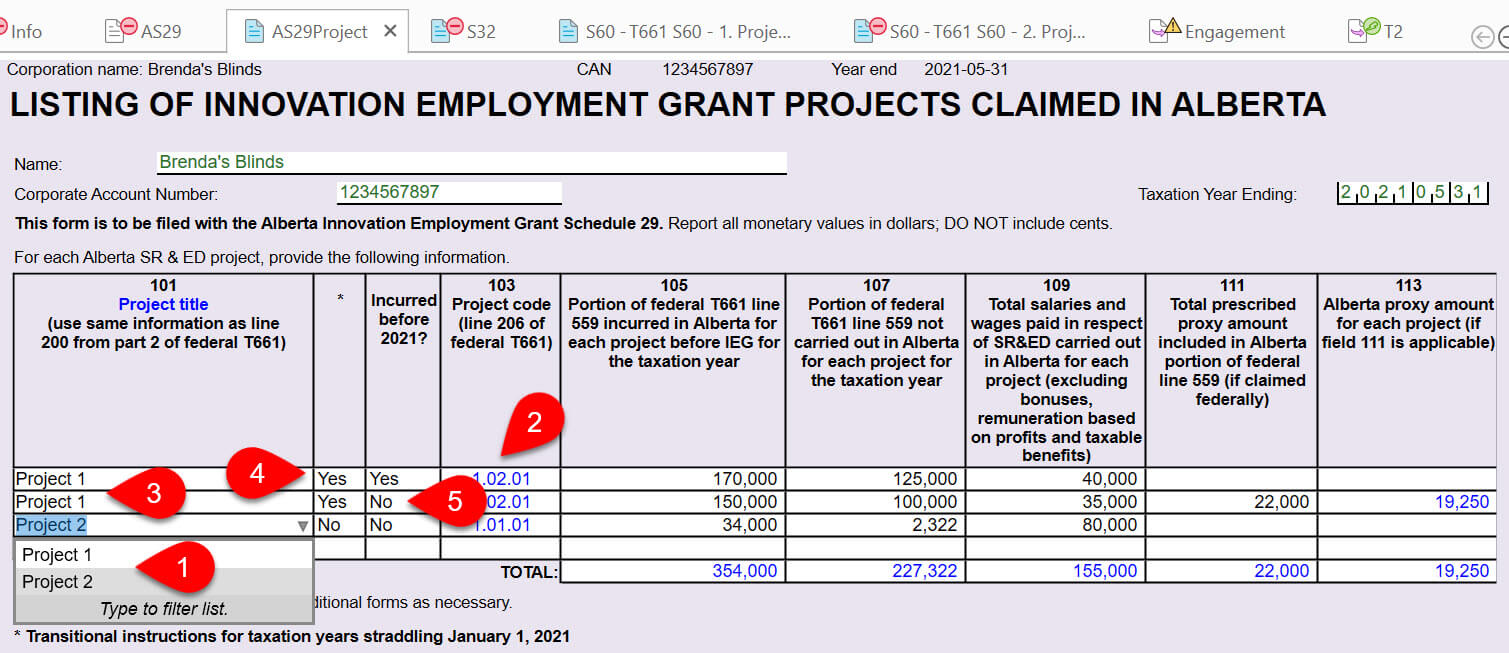

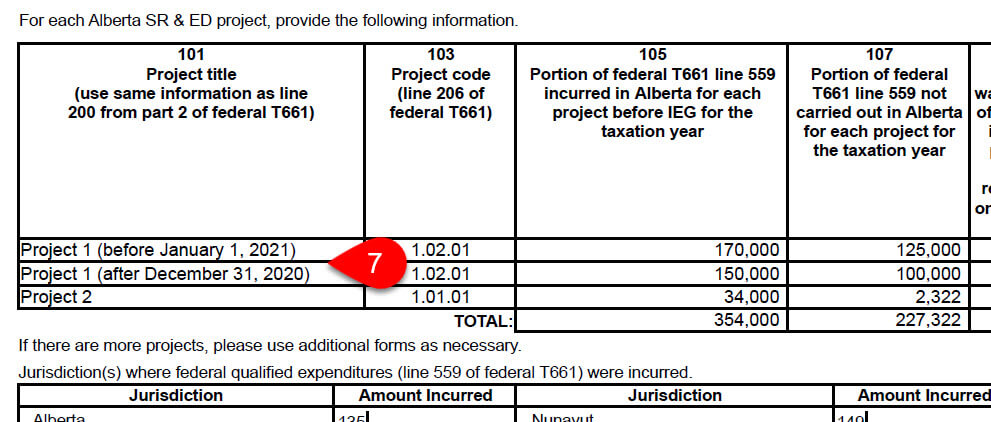

To calculate and claim the credit, enter eligible expenditures in the project table on the AS29Project worksheet (AT4970), then complete the two-step process on the AS29Step worksheet. The refundable tax credit then flows from the AS29 to line 129 on the AT1 jacket.