Updated: 2022-03-18

The Québec Relevé 10 (RL-10 slip) does not have an equivalent federal slip. For this reason, in TaxCycle T1/TP1 returns for years 2020 and earlier, you entered information about labour-sponsored fund tax credit on the Credits worksheet.

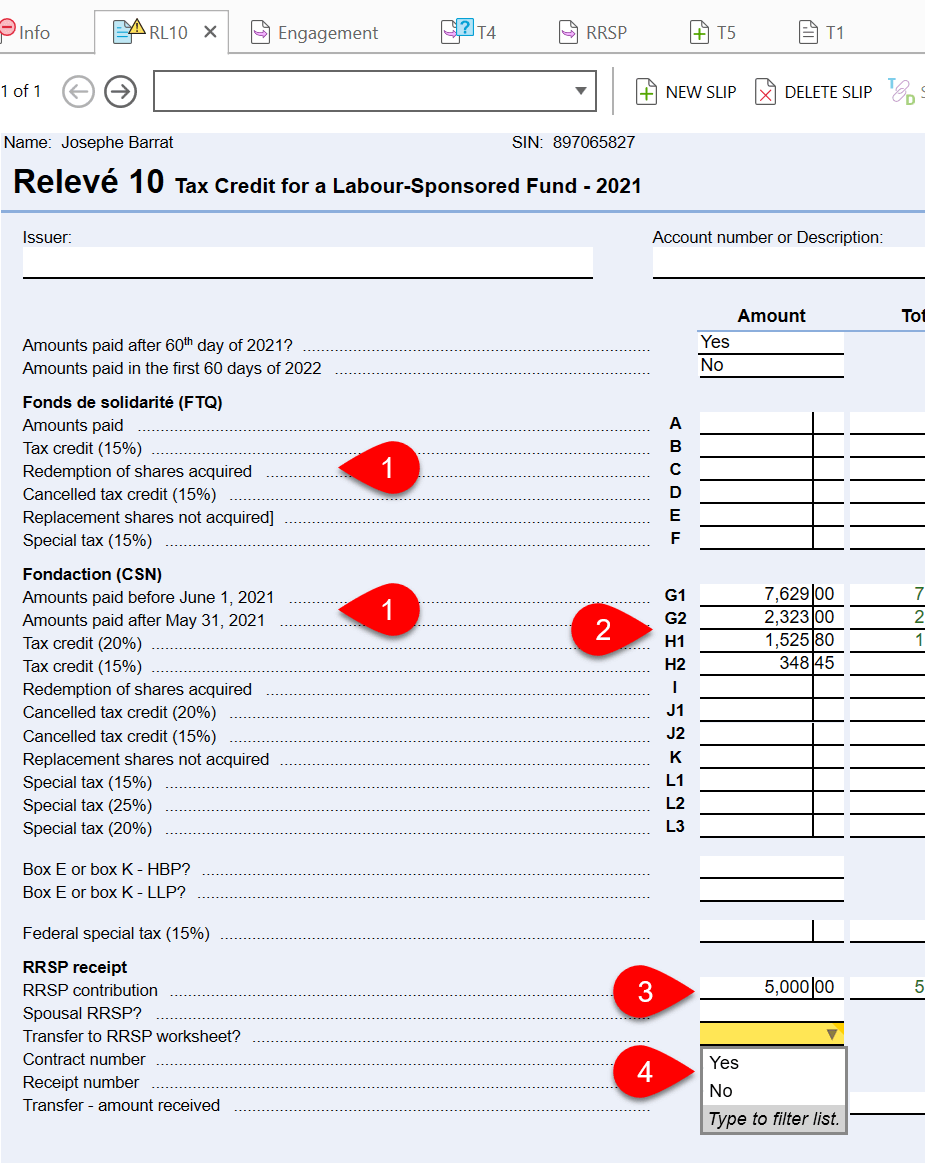

Starting in 2021 tax years, enter information about Québec labour-sponsored funds directly on the RL-10 slip.

The Credits worksheet calculates the credit claimed and the carryforward of any unused amounts. This calculation considers any differences between the Québec and federal rules.

For provinces other than Québec, enter details about labour-sponsored funds directly on the Credits worksheet.