Updated: 2023-03-03

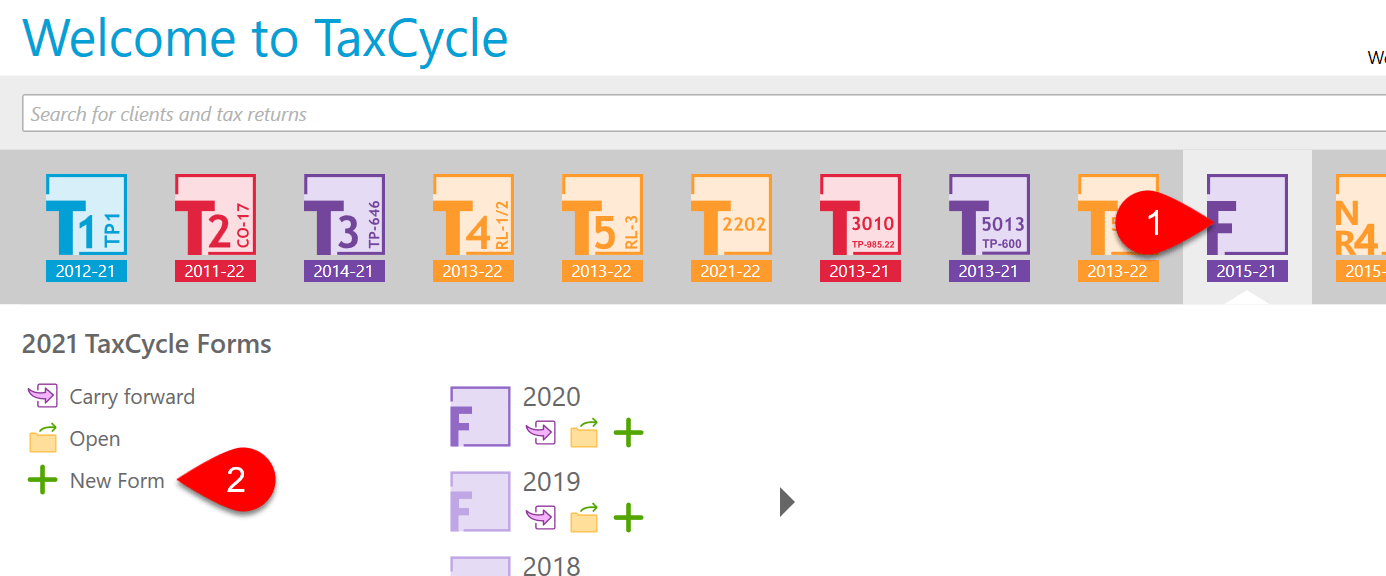

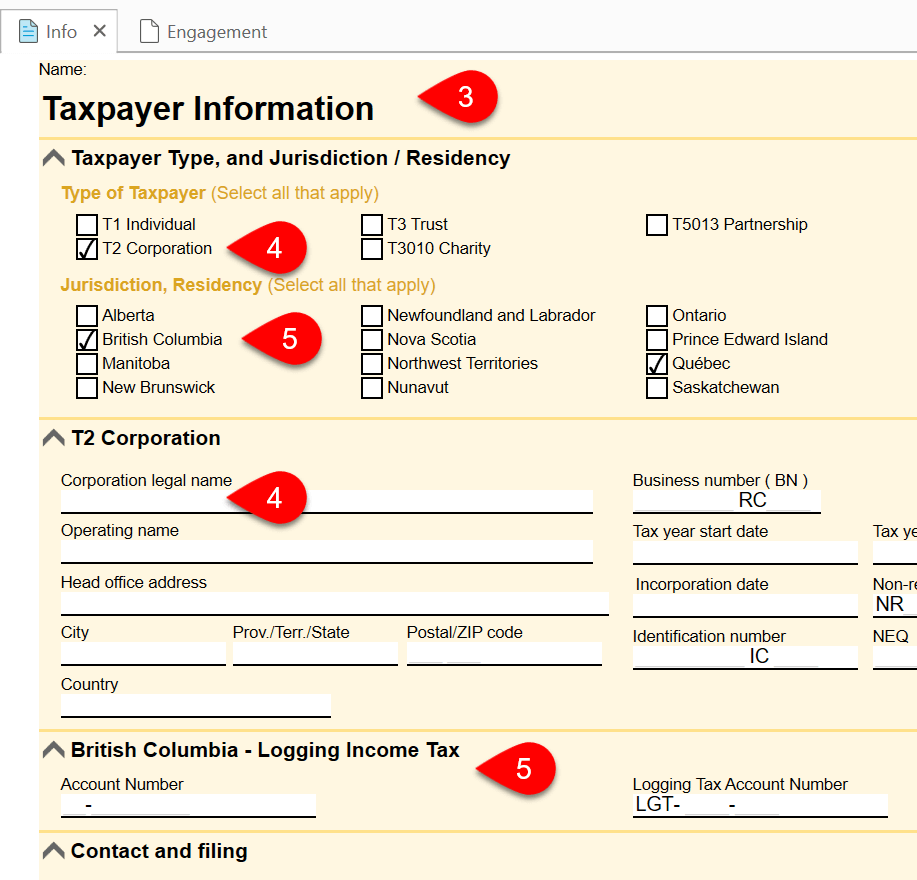

TaxCycle Forms module helps you prepare a variety of government forms for your clients. Use these forms for individuals, corporations, trusts, charities or partnerships. For a list of the forms included in this module, see the TaxCycle Forms Collection page.

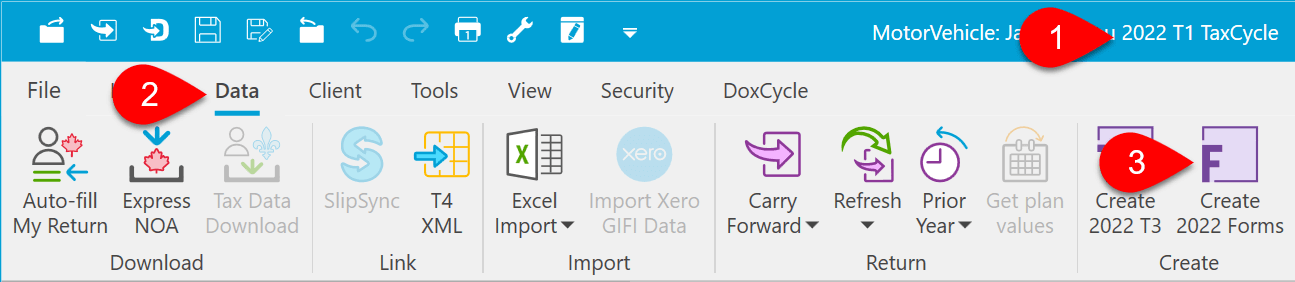

You can create a Forms file from another TaxCycle to carry taxpayer information directly into the return.