Updated: 2023-03-22

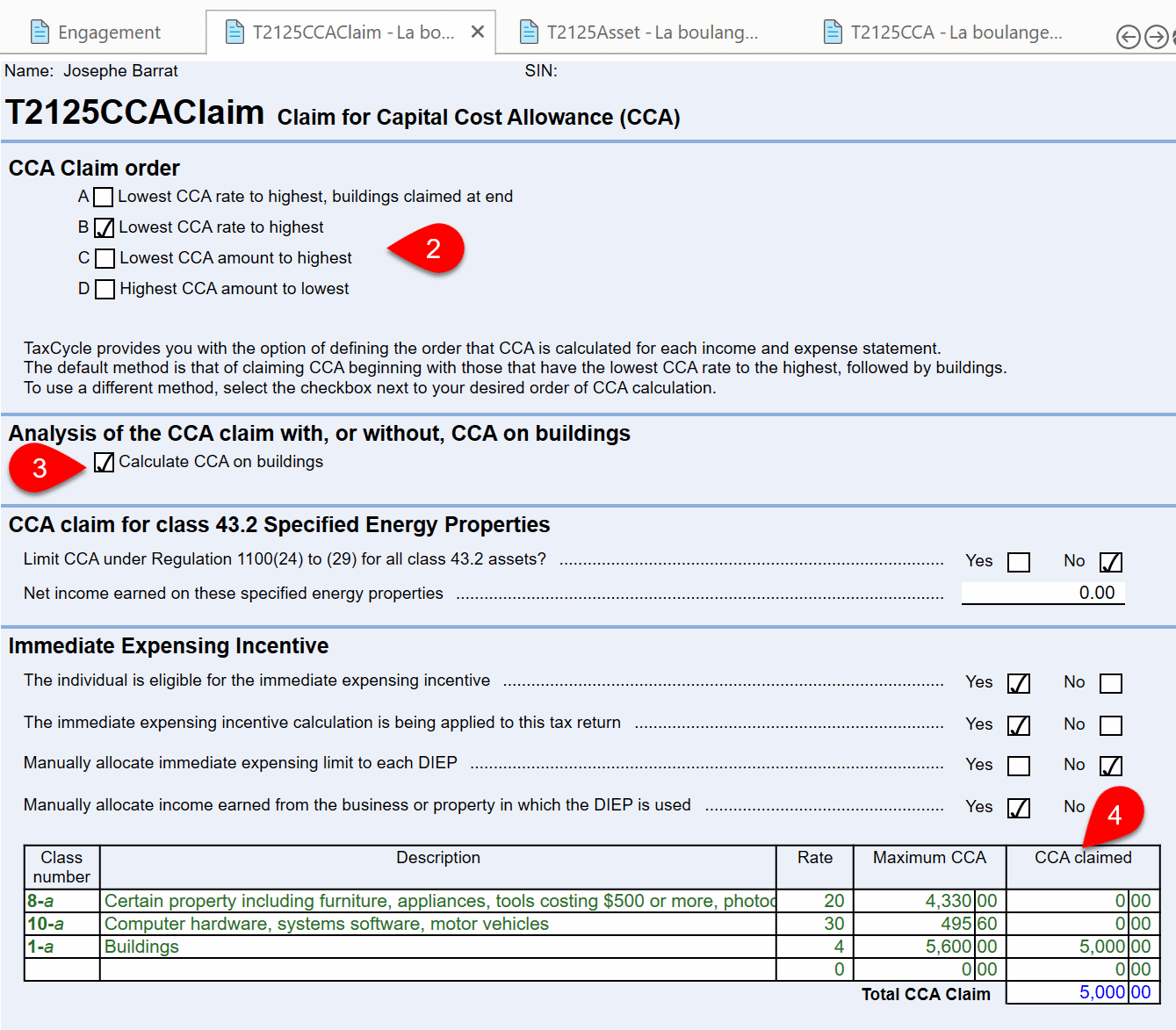

The CCAClaim worksheet contains options for claiming CCA for the related income statement, such as the claim order or settings for specialized classes or measures (like Immediate Expensing).

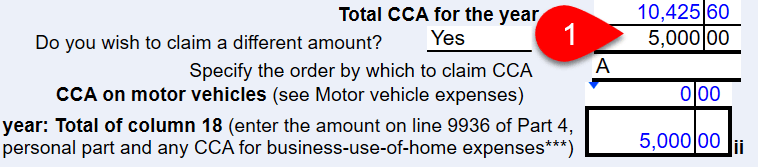

To change the claim order for CCA from different classes:

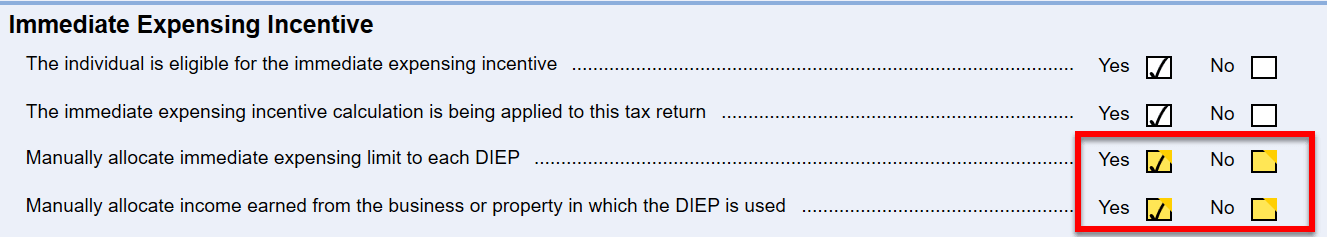

TaxCycle offers two ways of calculating the immediate expensing incentive, depending on how you answer the following questions on the CCA Claim worksheet. You can choose to:

The default for both questions in TaxCycle T1 2022 is Yes, manually allocate the immediate expensing limit and the income earned whether you create a new file or open an existing file. This protects the calculations and CCA claims during the middle of personal tax filing season.

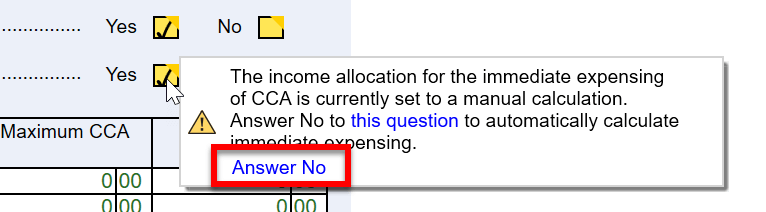

To activate the automatic calculation, answer No to these two questions. You must do this on each income statement in the file. TaxCycle will automatically calculate the immediate expensing claim as you enter capital asset additions on the Asset Manager or the CCA worksheet. TaxCycle will remind you to do this in a review message and you can use the Quick Fix solution to automate the claim.

In the 2023 T1 module, we will set the default to No for these questions, similar to the implementation in T2/T5013.