Updated: 2023-09-19

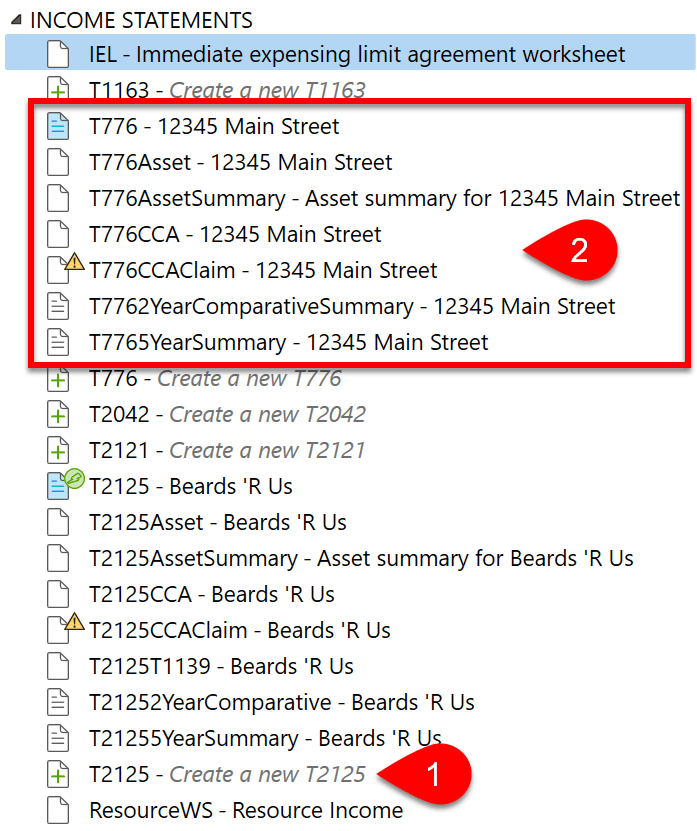

All income statements in TaxCycle are multi-copy forms. This allows you to prepare a separate form if the client has two businesses.

The Prepare sidebar contains a group for Income Statements, including:

When you start working on an income statement, TaxCycle creates a group of related forms that support the statement.

To create a new income statement form set:

TaxCycle also uses information from other forms and worksheets complete income statements, including the motor vehicle expense worksheet and slips that report business or commission income, like contract payments reported on the T5018. The forms are not part of the form set as they can contain information used elsewhere in the file.

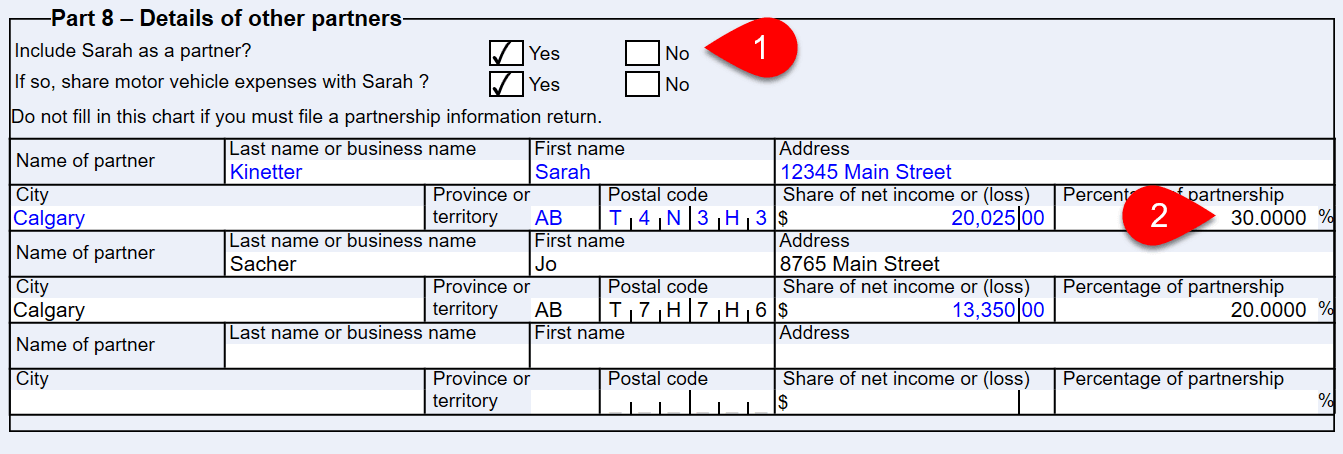

You can share most income statements with a spouse or partner. Look for the section on the statement that allows you to allocate a percentage share to the spouse as a partner or co-owner.

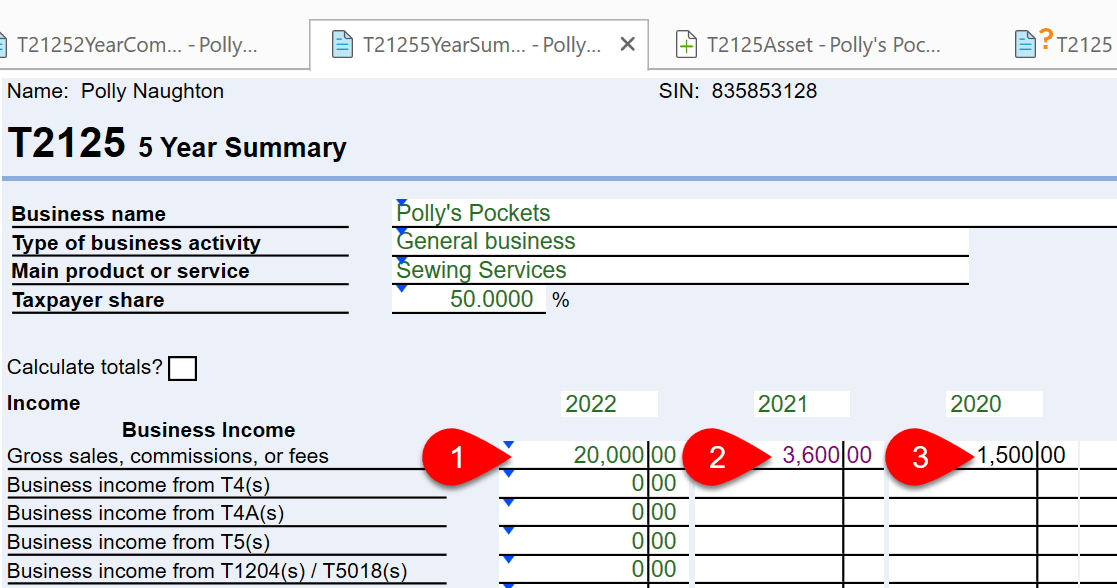

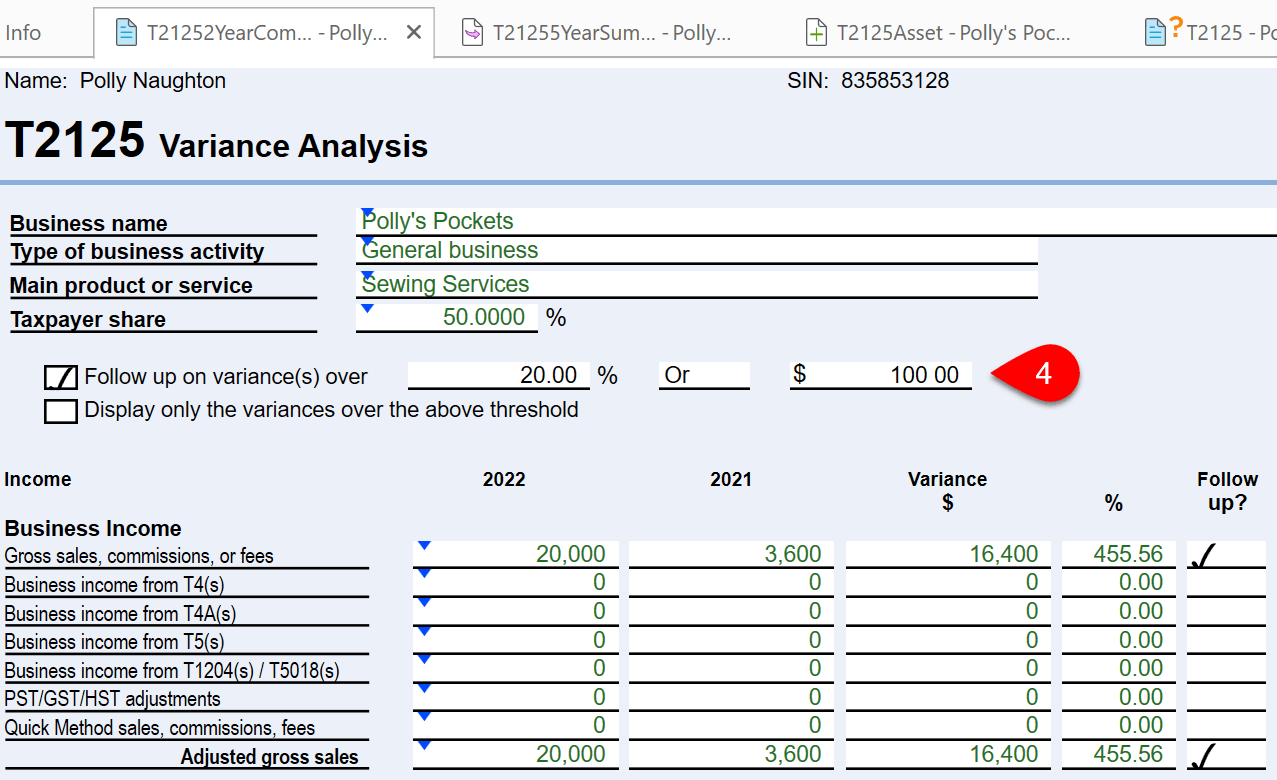

Income statement form sets include two- and five-year summaries. For example, each T2125 form has a related T21252YearSummary and T21255YearSummary summary.