Updated: 2020-05-26

Both the Canada Revenue Agency (CRA) and Revenu Québec require authorization for online access to download and view information about your client, using services like the Auto-fill my return (AFR) and Tax Data Download (TDD). You can also request authorization to change their account on their behalf.

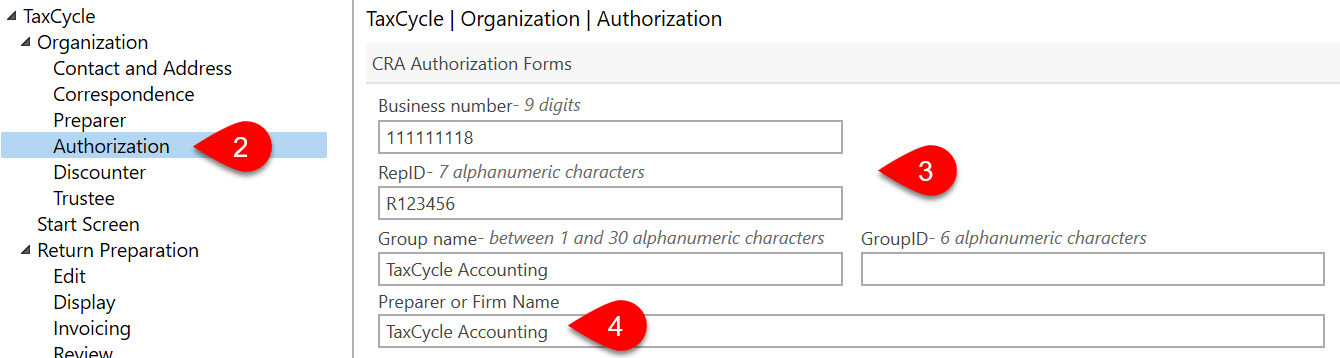

Enter defaults required for the completion of authorization forms in options. To learn more about submitting an authorization request to the CRA, read the Authorization/Cancellation Request (formerly T1013) help topic.

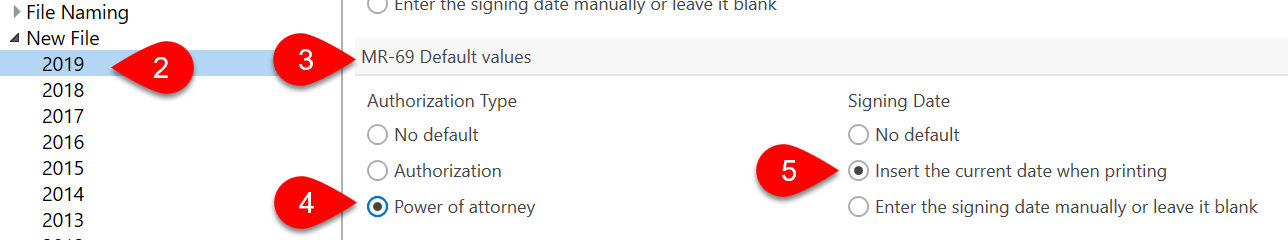

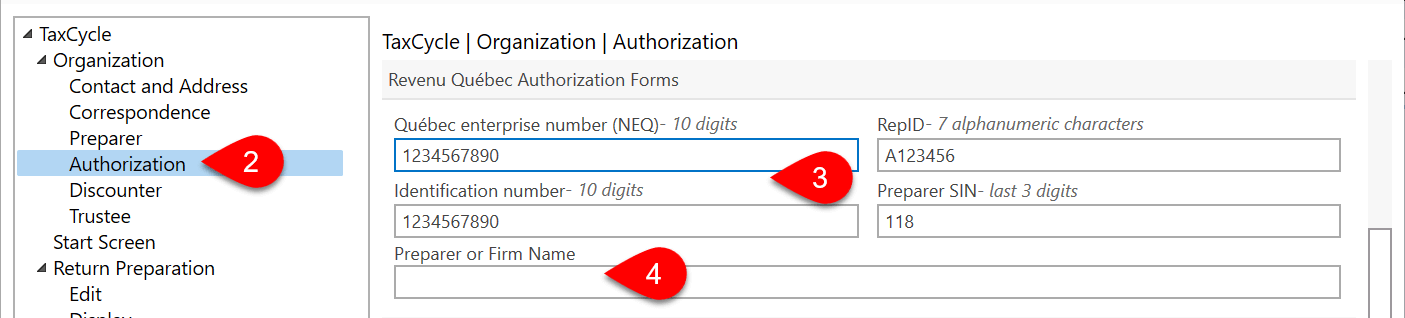

Enter defaults required for the completion of MR-69 in options. To learn more about filing the MR-69 with Revenu Québec, read the MR-69 form and electronic filing help topic.

TaxCycle enters these values on the AuthRep worksheet when you create or carry forward a file. It also triggers a review message if the form doesn’t match the default set in options. To learn more about submitting an authorization request to the CRA, read the Authorization/Cancellation Request (formerly T1013) help topic.

TaxCycle enters these values on the MR-69 form when you create or carry forward a file. It also triggers a review message if the form doesn’t match the default set in options. To learn more about filing the MR-69 with Revenu Québec, read the MR-69 form and electronic filing help topic.