Updated: 2022-03-02

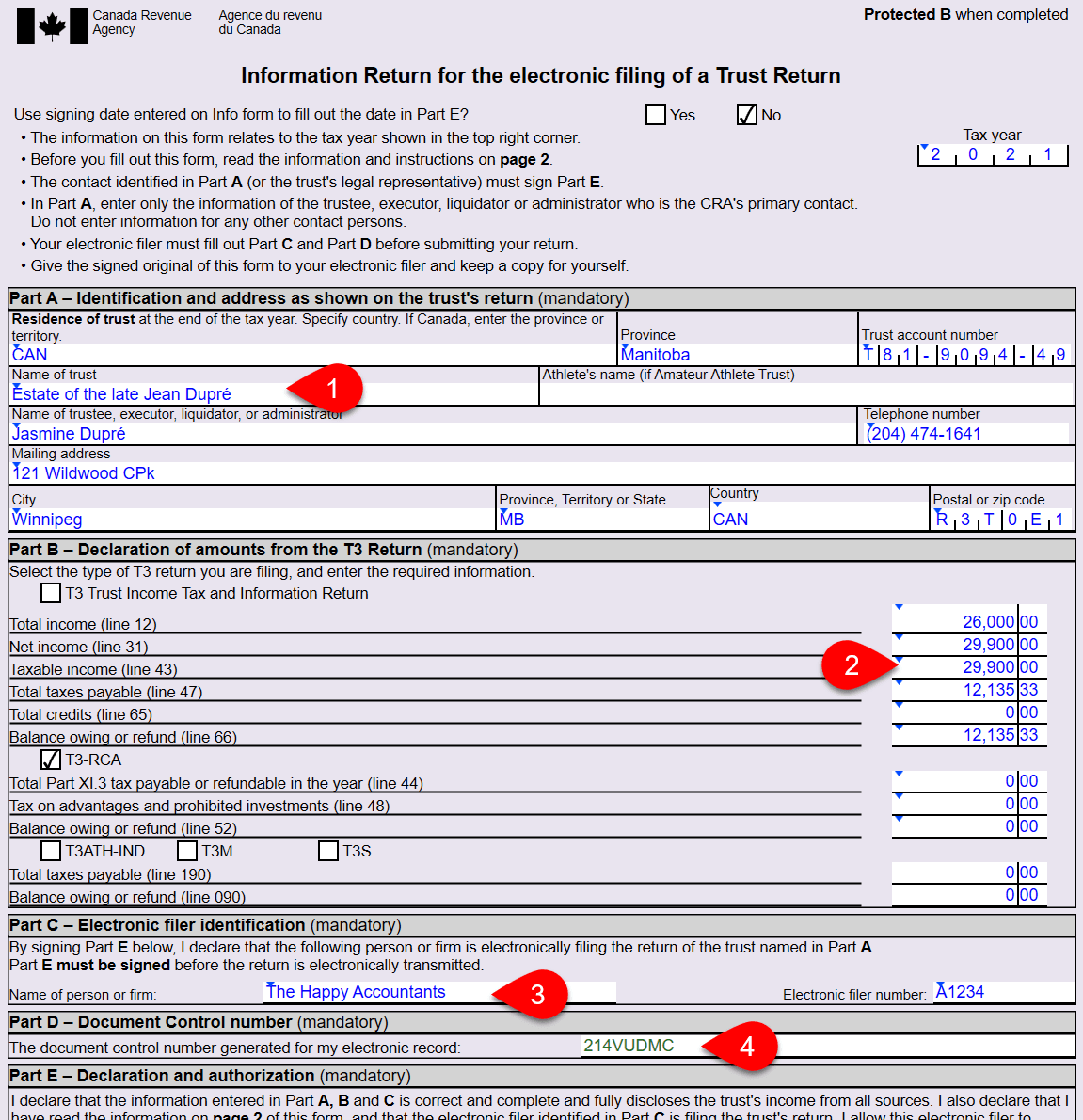

The Canada Revenue Agency (CRA) requires a signed form T183TRUST Information Return for Electronic Filing of a Trust Return before a preparer can electronically file a T3 return.

This form is used to provide authorization to use T3 EFILE. Learn more in the T3 EFILE help topic.

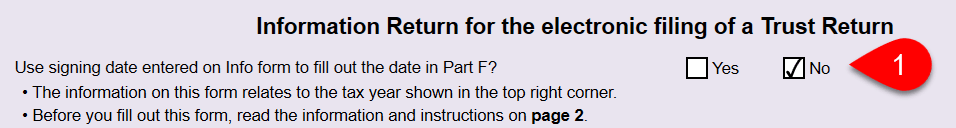

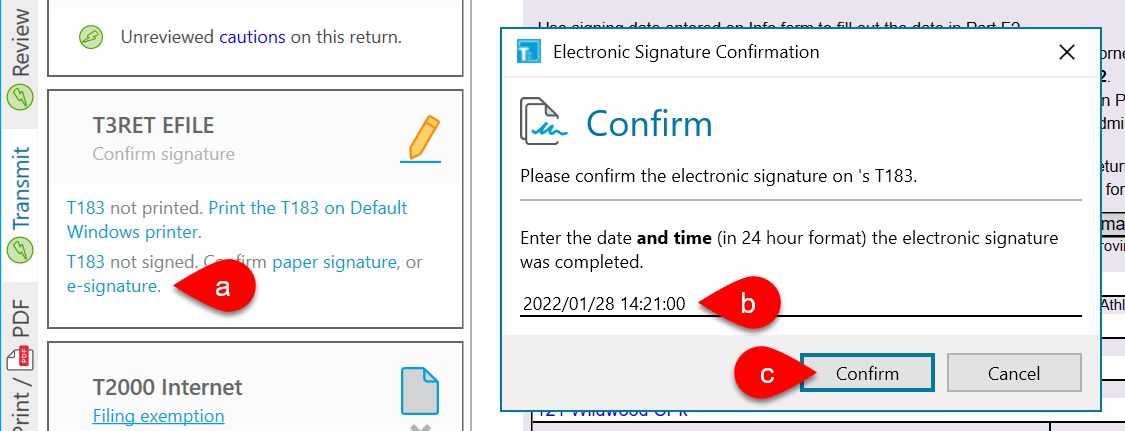

As a temporary measure, the CRA recognizes electronic signatures as having met the signature requirements on the T183TRUST. When collecting an e-signature, the T183TRUST form must report the date and time the form was electronically signed. This information is then transmitted to the CRA. To learn how to send a document for signature, see the Request E-signatures Using TaxFolder and Electronic Signatures With DocuSign® help topics.

It is important that you keep this signed T183TRUST in your files should the CRA ask for it. They regularly check with preparers and request a signed copy.

The information in Parts A and B flows from other areas in the TaxCycle T3 file.

TaxCycle provides several options for entering the signing date on this form:

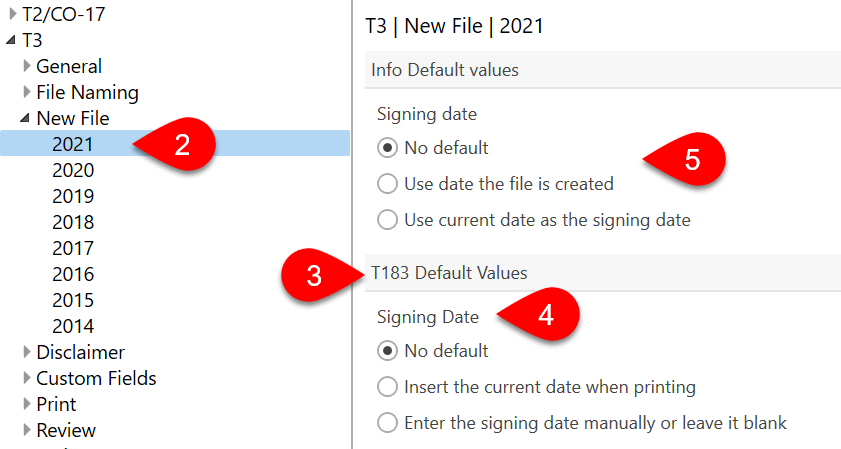

You can set default values for the signing dates in options: