Updated: 2024-02-29

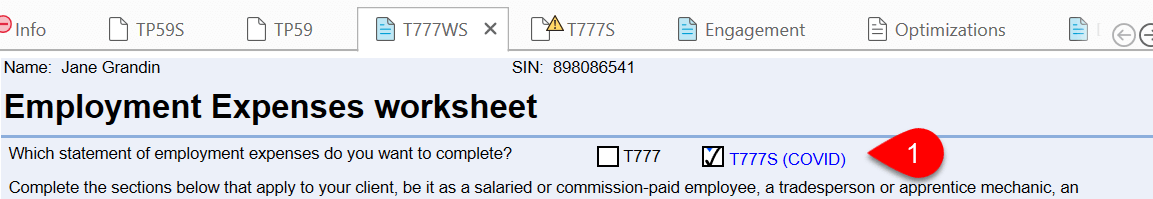

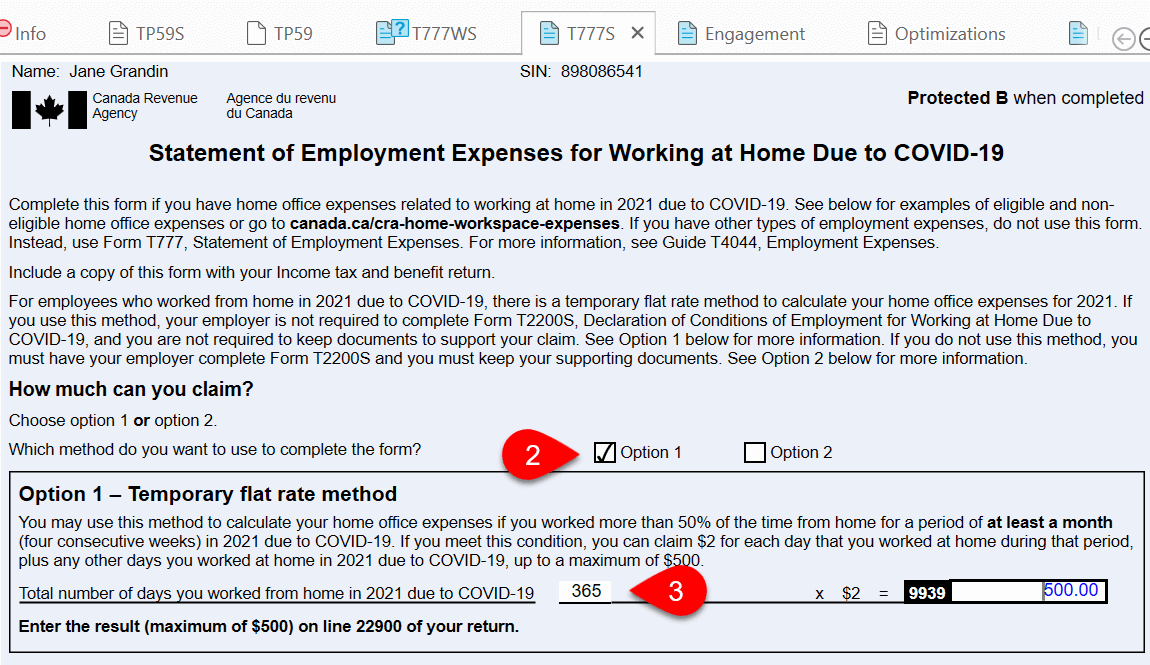

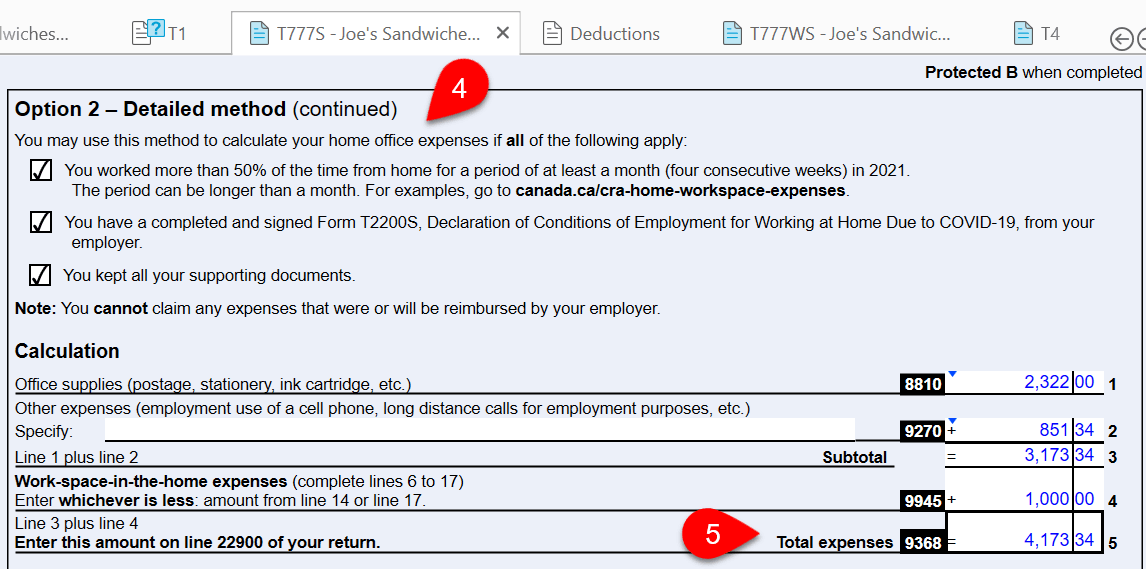

Employees who had to work from home due to COVID-19 between 2020 and 2022 may be eligible to claim home office expenses using form T777S. They can use either the temporary flat rate method or the detailed method to claim office expenses. The detailed method requires them to obtain a signed copy of form T2200S from their employer.

Revenu Québec uses a similar form, TP-59.S-V, Expenses Related to Working Remotely Because of the COVID-19 Pandemic, to calculate the claim on TP1 returns.

To claim employment expenses for salaried and commission employees in TaxCycle T1, see the Employment Expenses (T777 and T777S) help topic.

The employer must complete and sign the T2200S, Declaration of Conditions of Employment for Working at Home Due to COVID-19, if an employee chooses to use the detailed method to calculate their home office expenses (workspace-in-the-home and supplies) while working at home during the pandemic. Claims using the temporary flat rate method do not require a T2200S.

If the employee pays for expenses other than home office expenses, do not use the T2200S. Instead, complete form T2200, Declaration of Conditions of Employment.

If you are filling T4 slips for an organization, you can create T2200 and T2200S forms for their employees along with the T4 slips. See the T2200 Conditions of Employment help topic.

You can also add details from these forms to the return in TaxCycle T1. However, TaxCycle will not use the amounts from these forms in calculating the tax return. Keep the employee’s original form in case the CRA requests it.

To claim expenses for working at home due to COVID-19: