Updated: 2023-04-21

As of 2016, individuals who sell their principal residence have to report the sale on their tax return. Reporting is required for sales that occurred on or after January 1, 2016.

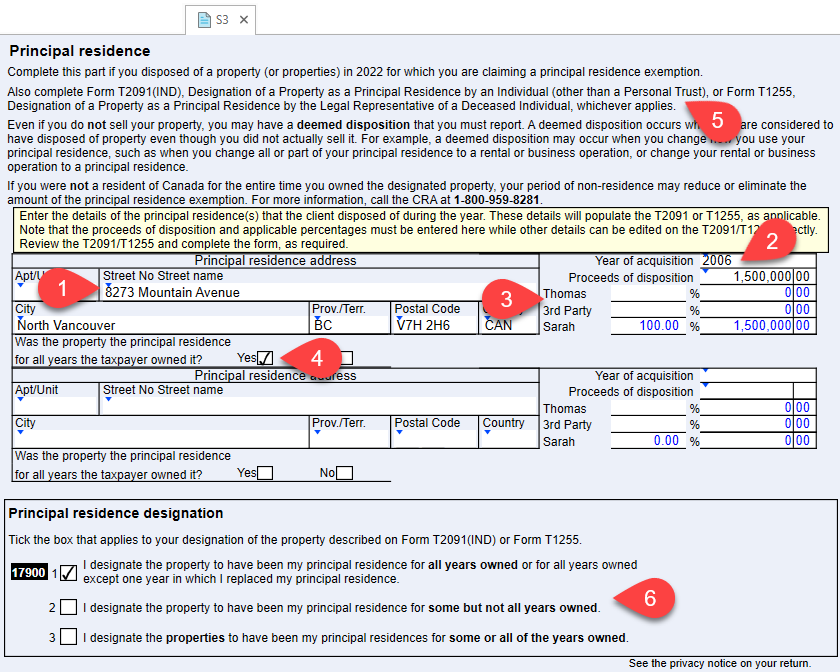

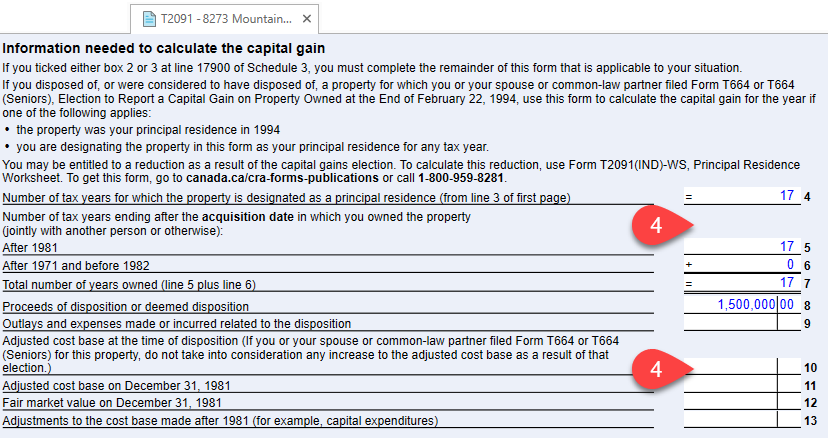

If the property was the individual's principal residence for every year that they owned it, they will make the principal residence designation on Schedule 3 (S3).

There are significant penalties for not reporting this sale. Please see the Canada Revenue Agency's page on Reporting the sale of your principal residence for individuals (other than trusts) for the latest information.

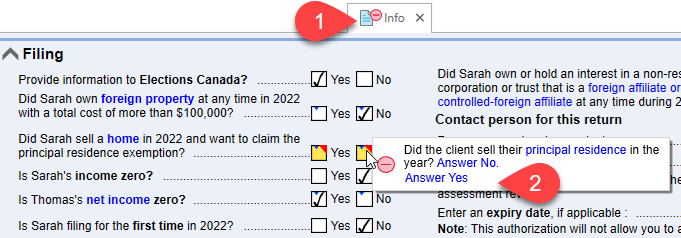

Each taxpayer is required to answer a question on the sale of principal residence in TaxCycle T1.

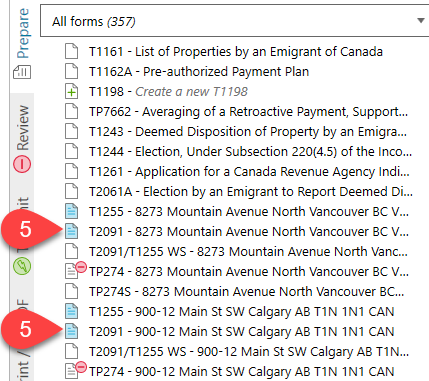

Once you answer Yes to the question on the Info worksheet, you are required to complete the Principal residence section on page 3 of the Schedule 3 (S3):